Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When Thorstein Veblen invented the notion of “conspicuous consumption” he was not thinking of a crypto tycoon paying $6.2mn for a banana and consuming it. Or a digital asset with no fundamental value changing hands for almost $100,000. But the 19th-century sociologist would recognise his theories in both events. Bitcoin and bananas are now Veblen goods.

That label describes assets that defy normal market forces, by getting more desirable as they get more expensive. Classically, it includes indulgences such as luxury cars, fine wines and occasionally designer sneakers. These items show one’s elevated place in the world, but are inherently, to Veblen’s mind, “a patent waste of time”. The more useless and costly the bauble, the more precious.

Bitcoin has almost been a Veblen good for years, but not quite. Purchases of the digital currency have been driven not by status, but by the prospect of selling to a greater fool at a higher price. The pursuit of investment returns is generally not a factor for wealthy buyers of Hermes Birkin bags, Patek Philippe watches or Tesla trucks. Conversely, even the most absurd meme stock has utility if it can be flipped at a profit.

This week, though, bitcoin really entered its Veblen era, because it now functions as a badge of the elite. President Donald Trump has conferred legitimacy on the digital token, considering appointing a bitcoin tsar. His new commerce secretary Howard Lutnick has said he is a fan and an owner. A friendly US administration will probably mean more opportunities to invest in bitcoin, but also more status for those who hold it.

Then there’s Tesla boss Elon Musk, a dogged crypto-supporter who now heads a government anti-waste initiative named after a joke currency called Dogecoin. Horseriding, knowledge of heraldry or ownership of fine art used to show membership of the elite class. But now it’s tech moguls and bitcoin boosters who rule the world. Buying crypto brings the holder psychologically closer to their circle.

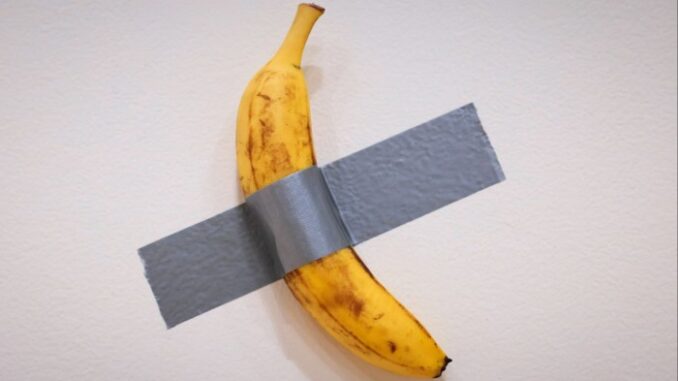

Into this new pecking order arrives Sotheby’s $6.2mn banana. The buyer of the artwork “Comedian” — actually a certificate granting the right to tape a banana to a wall — is the founder of a crypto token called Tron. Justin Sun says that conspicuously consuming the banana will make him part of a “unique artistic experience”. Veblen couldn’t have described it better.

All of this is glum news for old-world Veblen goods. LVMH has faltered and Gucci owner Kering suffered lately, because demand for their trinkets is falling. Extravagant luxury clothing is falling out of favour. If luxury moguls want to retain their cachet, they might want to diversify their high-end conglomerates from bags to bitcoin — even if it is all slightly bananas.

john.foley@ft.com

Be the first to comment