BitMEX and Kraken crypto exchanges received highest scores for their proof of reserves attestations.

Binance ranked lower for its ‘incomplete’ PoR among other metrics.

Nic Carter says the PoR momentum is good for crypto and a “silver lining” out of the FTX chaos.

BitMEX and Kraken score highly in an assessment of proof-of-reserves attestations by major crypto exchanges.

That’s according Nic Carter, one of the most popular Bitcoin advocates out there.

In a Medium article highlighting the score list and rankings of some of the leading crypto trading platforms, Carter points out the latest PoR results and offers insight into why some of the exchanges just getting to publish their cryptographic proof of reserves may still have a lot of work to offer the assurances the market seeks.

While Kraken and BitMEX rank highest, the world’s largest crypto platform Binance posts a relatively low score. But according to the crypto analyst, the move to have PoRs is undeniably one in the right direction. He sees the momentum as a good signal for cryptocurrencies, terming it “a genuine silver lining from the FTX debacle.”

“We may well yet emerge from this crisis with a major step forward in exchange credibility,” he wrote in his ‘The Status of Proof of Reserve as of Year End 2022’.

BitMEX, Kraken rank higher on various metrics

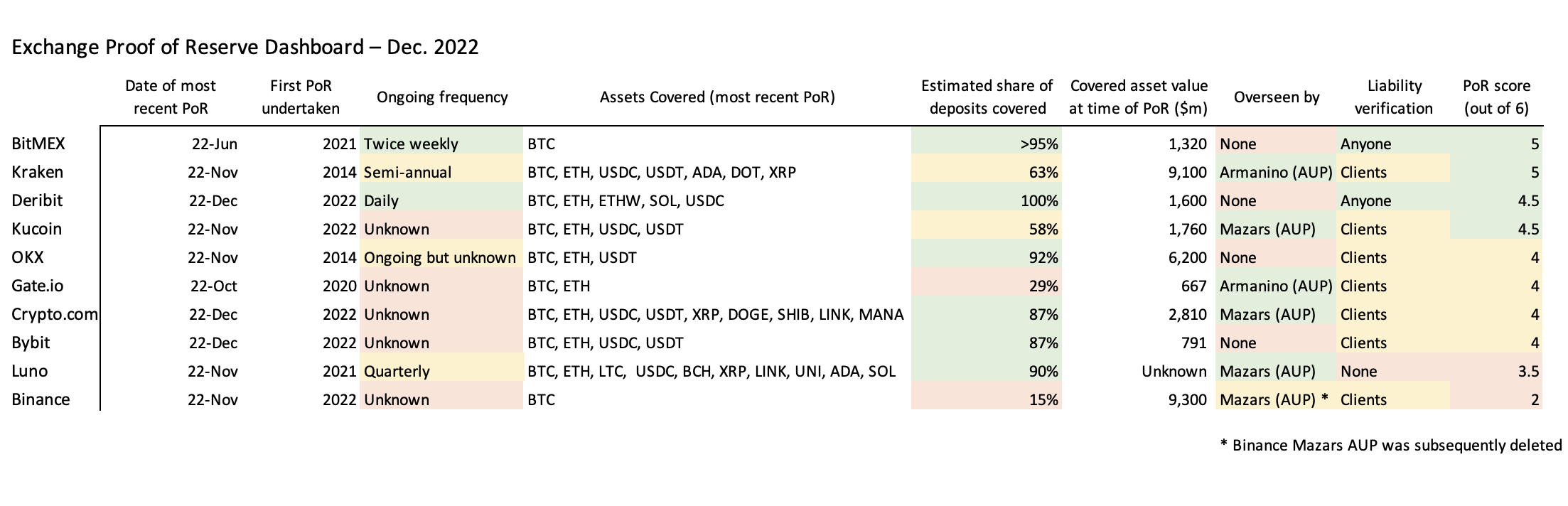

Looking at crypto exchange reserves attestations via metrics such as assets for which the platform provided the attestation, estimates of deposits covered and disclosure of liabilities, BitMEX scored the highest with 5 out of 6.

Crypto platform Kraken was second, while Deribit, KuCoin and OKX ranked third to fifth in that order.

Exchange proof of reserves scores and ranking. Source: Nic Carter on MediumWhile some platforms scored highly Binance’s proof of reserves was mostly ‘incomplete’ and thus the exchange scored poorly. In a comment on this, Carter wrote:

Exchange proof of reserves scores and ranking. Source: Nic Carter on MediumWhile some platforms scored highly Binance’s proof of reserves was mostly ‘incomplete’ and thus the exchange scored poorly. In a comment on this, Carter wrote:

“Binance’s first PoR doesn’t grant strong assurances. It only covers Bitcoin, which only represents 16.5% of their client assets. It does allow individual users to verify their inclusion in the liability set but does not contain the entire liability list, making it hard for a third party to verify the procedure.”

Be the first to comment