US critics deride it as the “Biden coin”, Europeans worry their privacy is at risk, while in China few are prepared to ditch tried-and-tested payment apps for the state-backed equivalent.

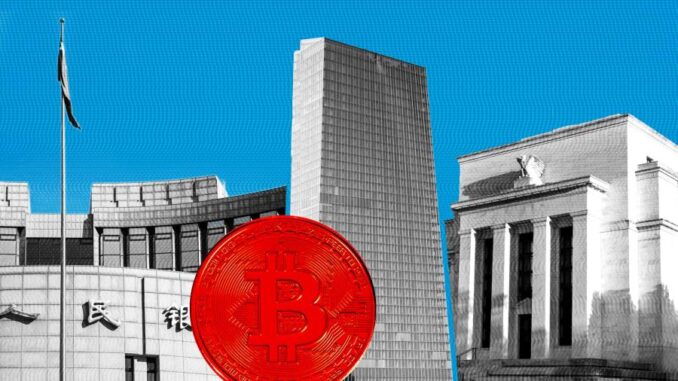

About 85 central banks are engaged in projects to create digital currencies, according to figures from the Bank for International Settlements. Among them is the Bank of England, which said last month it was “likely” that the UK would eventually need one.

Cheaper and faster payments, more financial inclusion and the crowding out of cryptocurrencies and Big Tech are the aims. Yet governments’ enthusiasm is not matched by the citizens they represent, many of whom view central bank digital currencies, or CBDCs, as an encroachment into their private lives and are unsure what benefits the projects are supposed to deliver.

“Central banks are putting the technical preparations in place,” said Eswar Prasad, professor of international trade policy at Cornell University. “But they have realised there is more broad public and political support needed before moving forward.”

A CBDC could also have radical implications for private lenders, which would face liquidity shortages if a flood of money were shifted into state coffers. Policymakers could impose holding limits — or offer limited or no interest on deposits — to stop that happening, but that would impede take-up of CBDCs.

“It would be an embarrassing failure if [a CBDC] is not used,” said Harald Uhlig, economics professor at the University of Chicago. “But if you make it too attractive you’re eating the banks’ lunch.”

In countries where CBDCs have been launched, adoption has been piecemeal. In Nigeria — one of four jurisdictions to launch a digital currency for the public alongside the Bahamas, the Eastern Caribbean, and Jamaica — less than 0.5 per cent of citizens used the eNaira more than a year on from its October 2021 launch.

Mosope Arubayi, a Nigerian economist, said a lack of trust between citizens and the government had reduced take-up. “People are sceptical about it and afraid of their money disappearing without anyone to hold accountable,” said Arubayi.

The idea is also yet to take off in China, which launched a pilot programme in selected cities in 2020 to challenge the dominance of digital payments apps Alipay and WeChat.

Transactions using private digital systems for the third quarter of 2022 were valued at Rmb87.5tn ($12.5tn) — those using the digital renminbi were just a fraction of that at Rmb100bn ($14.5bn).

Former People’s Bank of China official Xie Ping in December acknowledged the results of the pilot were “not ideal”.

However, other officials point out forms of money do not have to be widely used to have value. “I don’t think Swedish krona banknotes are a lesser form of money than Japanese yen banknotes just because the Swedish notes in circulation are equivalent to about 1 per cent of GDP and the Japanese ones are over 20 per cent,” said Cecilia Skingsley, head of the innovation hub at the Bank for International Settlements.

Yet competition is a driving factor behind governments’ enthusiasm for CBDCs.

Despite its failings, the Facebook-led Libra project, launched in June 2019 and quietly killed off in January 2022, highlighted a threat to central banks’ near-monopoly power to issue base money. In the eurozone, the dominance of US payments giants Visa and Mastercard has led the European Central Bank to push for a digital euro.

However, a 2021 ECB consultation found that European citizens were deeply concerned about the implications for privacy of a CBDC. At the start of February, hundreds of people marched through central Amsterdam in protest, complaining a digital euro would allow the authorities to monitor and restrict their spending options.

“European history has traumatic examples of the misuse of central authority over citizens’ information,” said Marina Niforos, affiliate professor at HEC Paris. “For many Europeans, [data privacy] is an acquired right that needs to be respected by any new project.”

Central banks are concerned that too much anonymity could allow users to break their own strict anti-money laundering and anti-terrorism rules. Fabio Panetta, the ECB executive overseeing the project, tried to offer a compromise last month, saying the central bank would not be able to access people’s personal payments data. The ECB has also suggested lower value transactions could be processed with less scrutiny.

Analysts are sceptical that such reassurances will be enough. “They’ll have to tie their hands behind their backs to prove they don’t have the data,” said Darrell Duffie, professor of management and finance at Stanford university.

Officials in the US are also brushing up against popular resistance.

At a time when the government is under fire for high inflation, digital dollars, dubbed “Biden bucks” and “Biden coin”, have become the subject of online misinformation campaigns, which claim the US president has already signed an executive order to get rid of cash.

“CBDCs are being sold as being better, faster and cheaper, but it will be weaponised to profile and identify political enemies,” said economist and lawyer Jim Rickards.

While the Boston and New York Federal Reserve Banks have carried out experiments on the concept of a US digital currency, some finance officials are far from keen on the idea. Fed governor Christopher Waller said in October he was “not a big fan”. Nellie Liang, under-secretary for domestic finance at the Treasury, said in December that the need for one did not currently exist — though this month she said the Treasury, the Fed, and White House would soon begin discussions on a US CBDC.

Advocates say a digital dollar could cut payments costs for lower-income households. The 4.5 per cent of US households that do not have a bank account can be charged as much as $12.99 to pay a $100 bill using cash, according to the Kansas City Fed.

“CBDCs should be there to cater for a certain part of the public’s preferences,” said Skingsley. “Not to become the dominant form of money.”

However, it is not clear whether those without bank accounts would be able to access CBDCs. The BoE, which has said a final decision on the adoption of “Britcoin” would be made in 2025, has already faced scepticism from lawmakers, who have said there were “more straightforward and targeted” ways to increase access to the banking system.

The House of Lords economic affairs committee also said in 2022 that a digital pound would pose “significant risks” such as state surveillance and could be exploited by hostile states and criminals.

In the US, House majority whip Tom Emmer introduced a CBDC anti-surveillance state bill in late February, which aimed to “halt efforts of unelected bureaucrats in Washington from issuing a CBDC that strips Americans of their right to financial privacy”. The legislation would prevent the Fed from offering a digital dollar directly to individuals.

“In the current political climate, the notion of a CBDC is inducing conspiratorial questions,” said Prasad. “If the Fed were to make this a priority, it wouldn’t fly well.”

Additional reporting by Aanu Adeoye in Lagos and Martin Arnold in Frankfurt

Be the first to comment