The Ethereum network’s planned Shanghai hard fork is nearly here. Planned for April 12, this is the first major upgrade since The Merge in September 2022. The “Shapella” upgrade (a combination of the two major proposals Shanghai and Capella), includes EIP-4895 which enables validators to withdraw staked ETH from the Beacon chain (Consensus layer) to the EVM (execution layer). The execution layer is the fun and friendly Ethereum users have come to know and love.

Why is this a big deal? With just over 18 million ETH currently staked (valued at just over $33 billion at the time of writing), some of which has been locked up for years, the possibility of these tokens flooding an already teetering market is enough to get some holders ready to sell the news once withdrawals are enabled.

For holders who are both long and short ETH post-withdrawals, it’s likely to be a significant event, and on-chain activity suggests many feel the same: activity around liquid staking derivatives (LSDs) can be a useful gauge for what the market might do post-unlock.

Liquid Staking Derivatives could exert influence over Beacon Chain unlocks

What are liquid staking derivatives? They are a relatively new financial instrument born of DeFi that function like bearer instruments for staked ETH. Similar to how borrowing and lending protocols give users a share token to represent locked collateral (think Aave’s a-tokens), staking ETH generates a wrapped asset used to claim the equivalent amount of Ethereum from the staking platform. When a staker deposits ETH with major platforms like Lido, Rocketpool, Frax, Stakewise and now Coinbase, they receive a platform-specific flavor of LSD. Because staked tokens are illiquid, these wrapped assets allow stakers to continue earning rewards while securing the network without completely giving up the opportunity to participate in other activities within DeFi.

Liquid staking derivatives aim to solve these problems by allowing staked assets to be traded on secondary markets. This means that stakers could access the value of their staked ETH before the Shanghai upgrade enables withdrawals or, in the future, while maintaining their staked position. For example, a staker could use their wrapped ETH as collateral on another platform, or cover an unexpected expense by selling their LSD on a secondary market.

RocketPool, Lido, Coinbase and Frax

Though the markets have seen what seems to be an increasing string of green days, with Ethereum rapidly catching up to Bitcoin’s year-to-date performance, ETH’s gains are set against a backdrop of volatility among LSDs and staking tokens.

Lido’s LDO hasn’t recaptured its high from early March and has maintained a resistance at $2.75. The largest staking protocol by nearly an order of magnitude, Lido currently offers some of the highest staking rewards among major providers with an average APY around 10%. The high rewards are no surprise: Lido took in nearly 50 million ETH in fees and 5 million in revenue in March, with April on track to meet or exceed those numbers.

RocketPool’s RPL fared much better with a 25% increase over the last thirty days. The wrapped asset issued by the number three staking provider by TVL, rETH, has historically traded at a premium to ETH and other LSDs, likely a result of the provider’s reputation as the most decentralized staking solution available to holders today, making rETH a desirable LSD to hold.

Over the last thirty days, RocketPool has seen over $46 million in inflows, with many likely hoping to cash in on rETH’s premium when withdrawals are enabled. RocketPool’s average APY according to DeFi Llama is around 3.65% which isn’t as high as other providers, but with over 1,800 active RocketPool nodes, the decentralized nature of the protocol is attractive. Addresses holding RPL have been steadily increasing as well.

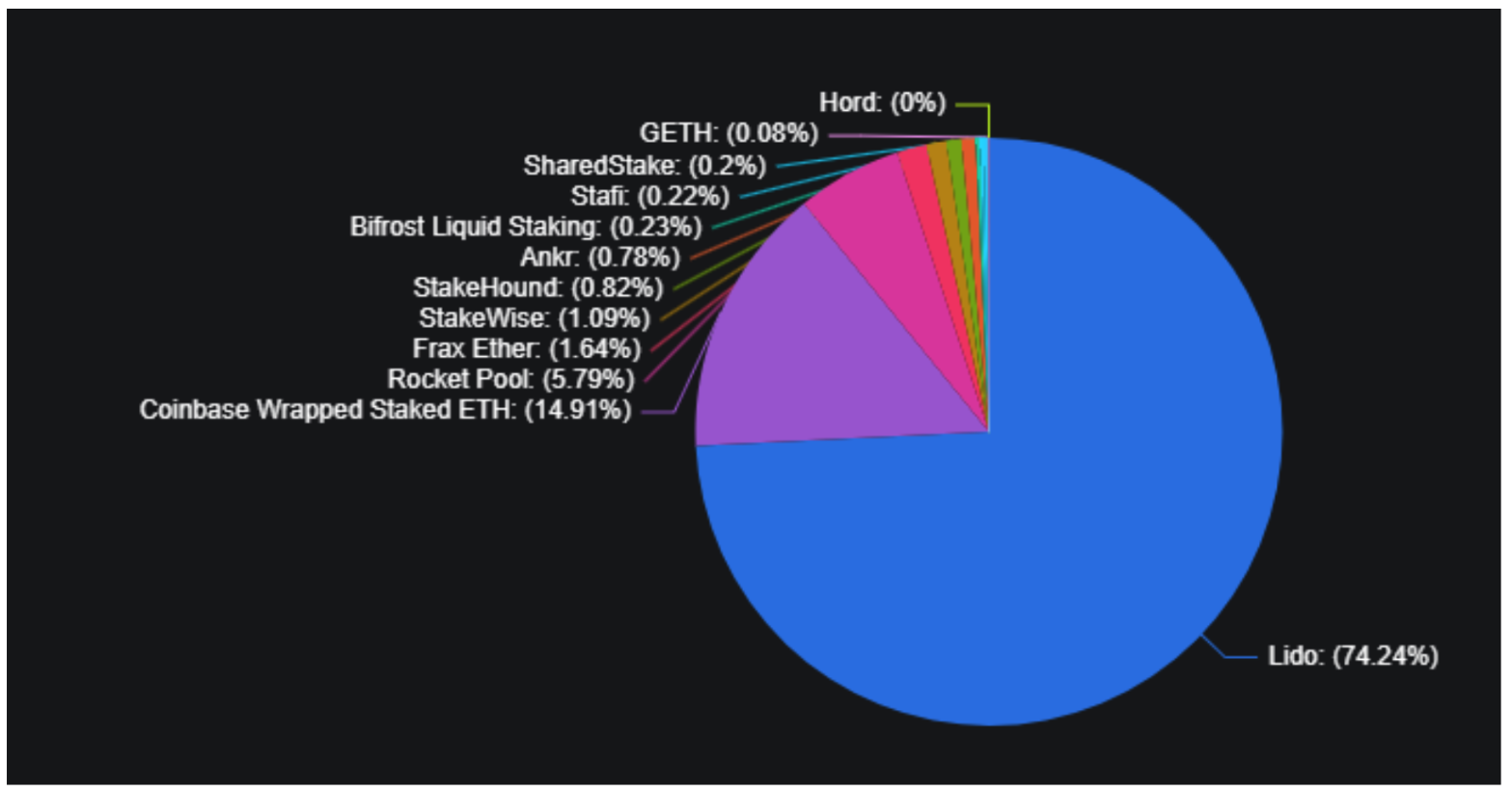

Conversely, LSDs from the two top staking providers, Lido and Coinbase both trade at a discount to spot ETH. Together representing nearly 90% of all staked ETH, it’s unsurprising that Lido and Coinbase have both come under scrutiny as centralizing entities given their concentration of staked ETH.

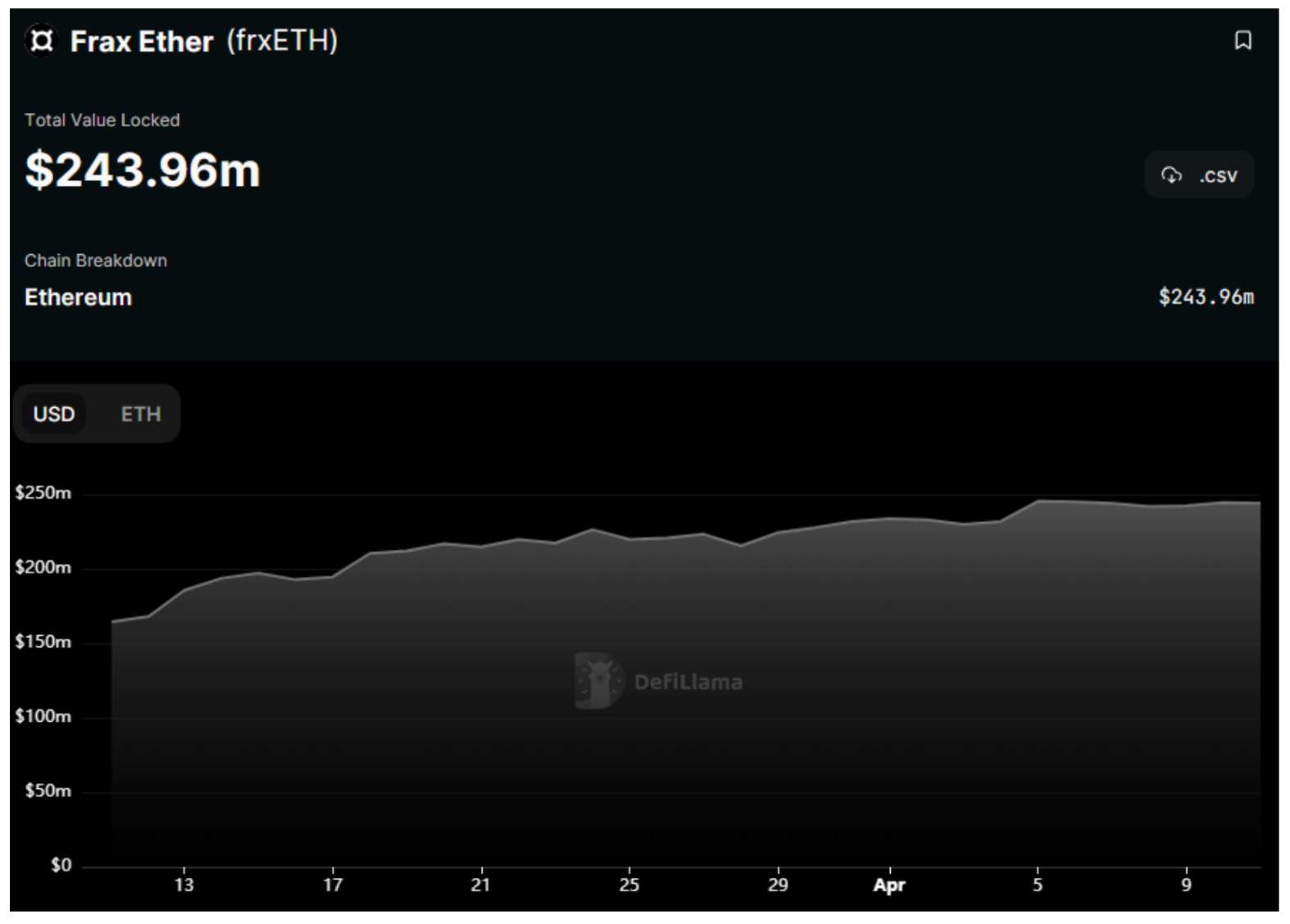

Despite RPL’s impressive performance and StakeWise’s native token SWISE’s 15% gain, Frax seems to have come out the winner.

Frax Ether has seen the most significant jump in total value locked over the last 30 days compared to the other top ten staking providers at 14% growth for a $244 million valuation. Despite the increase in TVL, Frax totaled only $3.1 million in inflow over thirty days, putting the protocol just above StakeWise’s $2.6 million.

Liquid staking derivatives like the wrapped Ether offered by staking providers is an important part of the Ethereum ecosystem much like plasma is an essential part of human blood. DeFi, NFT trading and GameFi are all interlinked, sometimes more subtly than others.

LSDs perform an important function of maintaining liquidity within the Ethereum ecosystem. Currently, over 15% of all Ether that exists is staked with a Beacon chain validator (meaning this doesn’t include any ETH being used as collateral on borrowing/lending platforms).

Considering that a non-trivial amount of that ETH has been locked for years, through one of the toughest bear markets on top of that, indefinitely freezing this much capital (worth over $33 billion at the time of writing) would have a lasting and noticeable effect on the entire ecosystem.

Over the last 30 days though, trying to hedge against the chaos post-Shapella by holding unstaked ETH didn’t perform much better than holding an LSD: ETH is up 31% compared to stETH’s 30%, rETH’s 30%, while Coinbase’s cbETH is up 32% and Frax’s LSD is up 34%.

Overall, liquid staking derivatives are an important development in the staking ecosystem, as they help to address some of the challenges associated with staking, while also expanding the pool of potential participants in the ecosystem.

Related: Ethereum traders show uncertainty ahead of Apr 12’s Shapella hard fork: Report

Withdrawals being enabled for staked Ethereum on the Beacon chain means that proof-of-stake Ethereum has reached a point of sufficient stability and security, and the stakers who participated in securing the network will be able to retrieve their staked funds.

Regardless of the immediate impact of enabled withdrawals, proof-of-stake Ethereum’s continued success relies on incentivizing ETH holders to validate the network, and liquid staking derivatives have proven to be an effective mechanism to do so.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Be the first to comment