Render token has made a blistering start to Q2 2023 with a 53% price surge in April. A critical look at the on-chain data suggests that despite increased whale investment, RNDR could still be undervalued at current prices. Can the bulls push for $3?

Render (RNDR) is an ERC-20 utility token that enables artists and content creators to connect with node operators and GPU capability providers.

RNDR grabbed media attention after making a 400% tear in January. But, after a major retracement below $1 in March, bearish investors feared further correction toward the previous local low of $0.4. However, on-chain data now suggests that RNDR looks poised to ride its current rally to a new year-to-date high.

Crypto Whales Have Been Buying RNDR

A significant cohort of whales appears to be driving the current RNDR price rally, according to data analytics platform, Santiment. After a curtailed outlook in March, whales with balances of 1 million to 10 million RNDR tokens have started buying again.

The chart below shows how they increased their holdings from 198 million to 206 million tokens between April 1 and April 18. The newly added tokens are worth nearly $16 million at current market prices of around $2.1.

Crypto whales often significantly influence a token’s price prospects due to their disproportionately high buying power. Hence, as observed above, the whale accumulation wave poses a bullish signal to other investors and network participants.

Notably, the cohort mentioned above holds the largest share of RNDR tokens compared to other whale clusters on the network. If they continue to buy, Render could experience more upside in the coming days.

Similarly, Render’s Network Value to Transaction Volume (NVT) ratio is another critical on-chain metric currently flashing bullish.

Since the recent high on April 8, RNDR NVT ratio has declined from 765.53 to 25.38 as of April 18.

Typically, the NVT ratio measures the valuation of a cryptocurrency network relative to the volume of the underlying transactions. A declining NVT ratio indicates that a Render network is undervalued relative to its current transaction volumes.

In summary, the rising whale accumulation wave and low NVT ratio suggest that Render Network could garner more price momentum in the coming days.

RNDR Price Prediction: The Next Breakout Target is $3

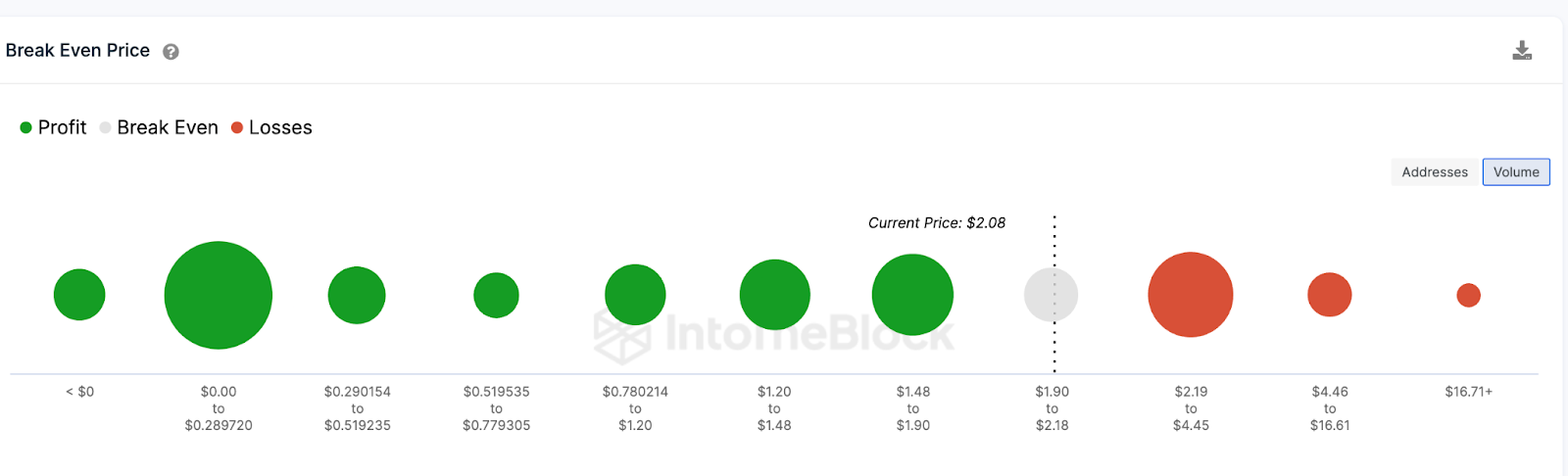

The Break-Even price distribution provided by IntoTheBlock depicts that Render token will likely push the current bull rally toward $3.

The chart below shows that RNDR could face minimal challenges until it breaks out of the $2.20 resistance zone. But profit-taking from 998 addresses that bought 21 million Render tokens for an average price of $2.03 could prevent this.

However, if it can breach that resistance, the rally could garner momentum to reach $3. However, the 3,600 addresses that paid an average of $3.13 to acquire 91.7 million tokens could mount a significant roadblock.

Although the positive narrative holds, the bears could overturn it if Render loses its current price support level of $1.90. However, there is a possibility that the drop may be prevented by a portion of the 998 addresses that hold 21 million tokens.

If the support level of $1.90 is not held, there could be a further drop in the RNDR price towards $1.33. In such a scenario, a more substantial support of 4,000 addresses holding 54 million tokens may step in to intervene.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment