After a turbulent month for the crypto industry in March, Bitcoin’s (BTC) price went sideways in April despite some volatility. The meteoric rise of memecoins, such as PEPE, made headlines, and First Republic, another mid-sized United States bank, went under. However, on the basis of current market sentiment is a standoff between markets and policymakers: While the U.S. Securities and Exchange Commission Chairman Jerome Powell publicly states that interest rates are unlikely to come down this year, the markets for risk-on assets like crypto have firmly priced in a pivot in the coming months.

In times like these, it is wise to drill deeper into the fundamentals that will shape future market movements. With an uncertain macro environment and a looming regulatory crackdown in the U.S., there are other notable developments that are easily drowned out by these dominant news items.

The report is available for free on the Cointelegraph Research Terminal.

For those keen to gain a deeper understanding of the crypto space’s various sectors, Cointelegraph Research publishes a monthly Investors Insights Report that dives into venture capital, derivatives, decentralized finance (DeFi), regulation and much more. Compiled by leading experts on these various topics, the monthly reports are an invaluable tool to quickly get a sense of the current state of the blockchain industry.

NFT hype fades as memecoins take over

Nonfungible token (NFT) collectibles are one of the few sectors that took a major hit this month. Memecoins, such as PEPE, may be partially responsible for this, as they absorbed the attention, printing eye-watering gains. BRC-20 tokens, a new abstraction created on the Bitcoin Ordinals protocol, may also compete for cash inflow from traditional NFT collectibles traders. Sellers have started to persistently outnumber buyers on NFT marketplaces recently, and this trend is likely to continue.

There are concerns about the NFT market going into free fall, as all important metrics, such as volume and active wallets, have been on a steep decline. NonFungible reported only 49,200 active wallets and a sales volume of $80,500 this month. The NFT marketplace wars, combined with diminishing excitement around NFTs, are other driving factors behind this long-term development.

Despite the overall NFT market slump, a niche NFT sector that is picking up steam is the NFT lending market. Since the start of 2022, this sector has witnessed double-digit growth every month, and this continued in April with a 16.13% increase in new users.

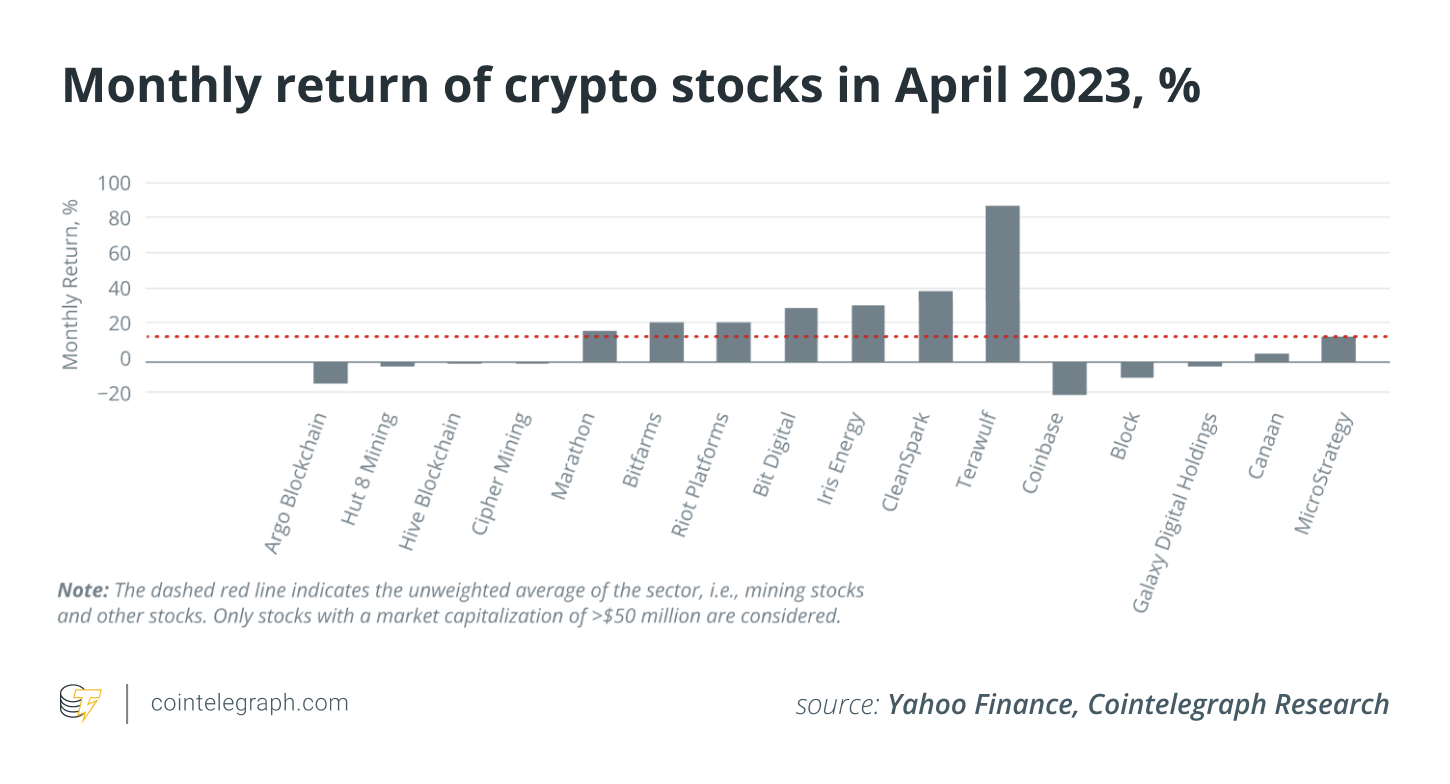

Mining stocks outperform BTC

Every Cointelegraph Research Monthly Trends Report includes coverage of mining economics and crypto stocks. For investors interested in increasing their exposure to BTC, mining stocks have historically been a popular option. While idiosyncratic factors have negatively impacted individual stocks this month, the sector as a whole seems to have exited from the 2022 bear market.

The highest returns were again recorded by TeraWulf, which continued its rally with another 85% rise in evaluation. CleanSpark, IrisEnergy and BitDigital were other strong gainers. Notably, the stocks in April outperformed BTC on aggregate after lagging behind in the previous month. Where Bitcoin only posted a 2.8% close, the largest crypto stocks, dominated by mining, recorded 12.9%

Of course, increased evaluations in the mining industry are highly sensitive to BTC’s price action. For those with confidence in improving macroeconomic conditions for risk-on assets, these stocks may offer good entries as they were previously battered by the bear market. The stocks section of the monthly report tracks the fundamentals of major companies in the industry and thus amends our regular analysis of Bitcoin mining economics.

The Cointelegraph Research team

Cointelegraph’s Research department comprises some of the best talents in the blockchain industry. Bringing together academic rigor and filtered through practical, hard-won experience, the researchers on the team are committed to bringing the most accurate, insightful content available on the market.

Demelza Hays, Ph.D., is the director of research at Cointelegraph. Hays has compiled a team of subject matter experts from finance, economics and technology to bring the premier source for industry reports and insightful analysis to the market. The team utilizes APIs from various sources to provide accurate, useful information and analyses.

With decades of combined experience in traditional finance, business, engineering, technology and research, the Cointelegraph Research team is perfectly positioned to put its combined talents to proper use with the latest Investor Insights Report.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Be the first to comment