For the past 17 days, the Bitcoin price has been trading within a narrow 8.5% range, from $27,250 to $29,550, causing the 40-day volatility metric to drop below 40%. This wasn’t restricted to cryptocurrencies, as the S&P 500 index’s historical volatility reached 17%, its lowest level since December 2021.

But will $28,000 become the new resistance? Not according to the latest Bitcoin (BTC) futures and options data. Nevertheless, macroeconomic conditions remain the main driver for risk markets’ price fluctuations in the near to medium terms.

BTC price flattens as investors lose risk appetite

A myriad of reasons could be given to explain the relatively small price oscillations in risk markets, including the expectation of a recession, investors unwilling to place new bets until the United States Federal Reserve ends its rate hikes, or increased demand (and focus) on fixed-income trades.

The problem is that no one can prove what has been causing investors to restrict their risk appetite and drive Bitcoin’s price sideways. Many — including Warren Buffett, the multi-billionaire fund manager — fear that commercial real estate is a growing concern, which could trigger major turbulence ahead.

While some believe that the U.S. debt ceiling discussion and the banking crisis could further cement the U.S. dollar’s weakening, Buffett does not foresee alternatives. The finance mogul is a long-term critic of the precious metal gold, as his investment thesis prioritizes yield-providing assets.

The debt ceiling drama has caused Treasury Secretary Janet Yellen to warn that a “steep economic downturn” would follow if Congress fails to act in the next few weeks.

On the one hand, the government is facing pressure to sustain economic activity and contain the banking crisis. Ultimately, increasing the debt limit would add liquidity to the markets, further triggering inflation.

This complex environment of inflation risks, an economic downturn and a weakening U.S. dollar might have caused investors to lose interest in risk assets and concentrate their bets on fixed-income trades as interest rates have moved above 5% per year.

For Bitcoin, an alarming sign would be a negative futures contract premium or increased costs for hedging using options. That’s why investors should closely track those BTC derivatives metrics.

Bitcoin futures display weak demand from longs

Bitcoin quarterly futures are popular among whales and arbitrage desks. However, these fixed-month contracts typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement.

As a result, BTC futures contracts in healthy markets should trade at a 5 to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

Bitcoin traders have been extremely cautious in the past two weeks. Even during the recent rally toward $29,850 on May 6, there was no surge in demand for leverage longs. Moreover, the subsequent 6.8% correction down to $27,800 has brought the BTC futures premium to its lowest level in two months at 1.5%.

Bitcoin options risk metric stood neutral

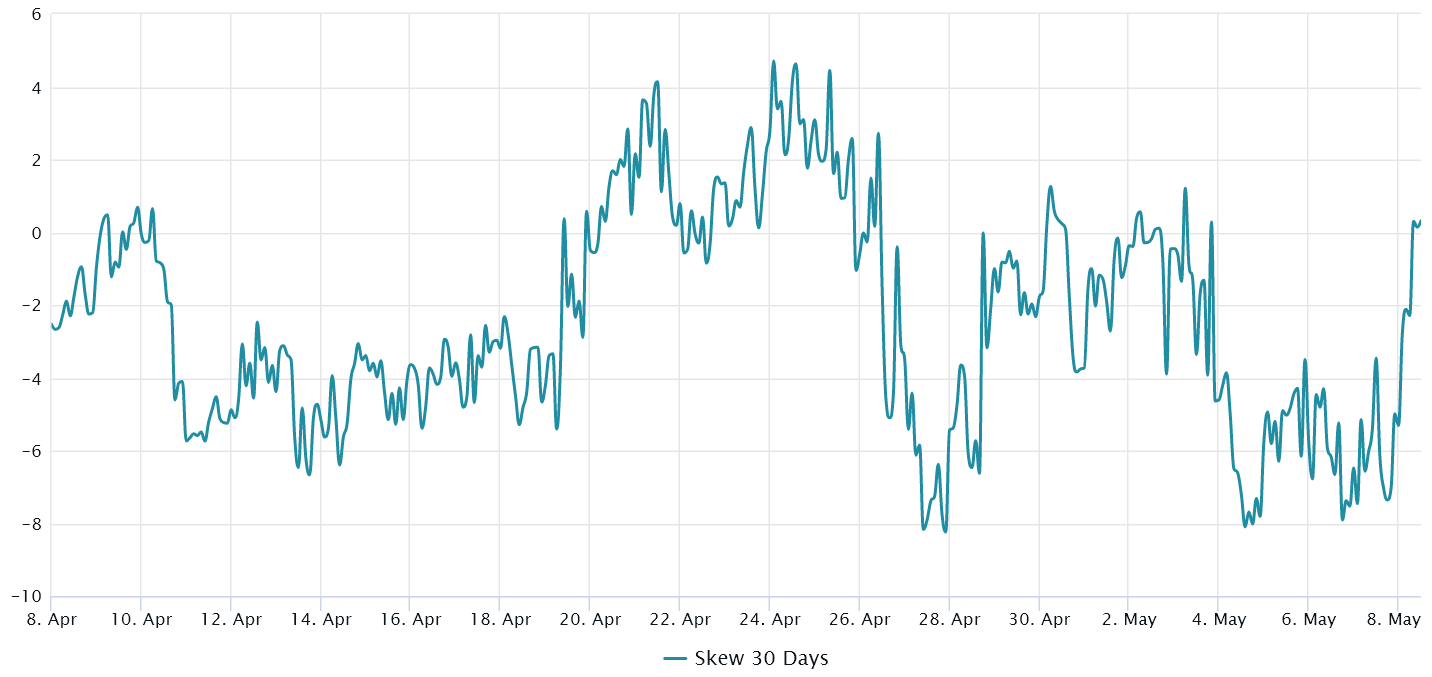

Traders should also analyze options markets to understand whether the recent correction has caused investors to become more optimistic. The 25% delta skew is a telling sign when arbitrage desks and market makers overcharge for upside or downside protection.

In short, if traders anticipate a Bitcoin price drop, the skew metric will rise above 7%, and phases of excitement tend to have a negative 7% skew.

Related: ‘Bitcoin is not under attack:’ BTC maxis allay fears of a DoS offensive

As displayed above, the options 25% delta skew has recently flirted with excessive optimism, as the protective put options were trading at a 7% discount on May 7 relative to similar neutral-to-bullish call options.

Still, the trend quickly reverted, as the Bitcoin price tested levels below $28,000. Currently, this is a balanced risk appetite according to BTC options pricing, as the 25% delta skew indicator stands near 0%.

Bitcoin options and futures markets suggest that pro traders are less confident, favoring sideways trading. Thus, traders should not flip bearish due to weakening derivatives indicators.

In other words, if there was enough conviction that $28,000 would become resistance, one would expect a much higher appetite for risk-averse put options and a negative BTC futures premium, or “backwardation.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Be the first to comment