Cryptocurrency exchange Binance released its latest proof-of-reserves (PoRs) on Aug. 1, offering transparency into its crypto reserves. However, the movement of its USD Coin (USDC) reserves at the time of Silvergte’s collapse caught many people’s attention and became a topic of discussion on X (formerly Twitter).

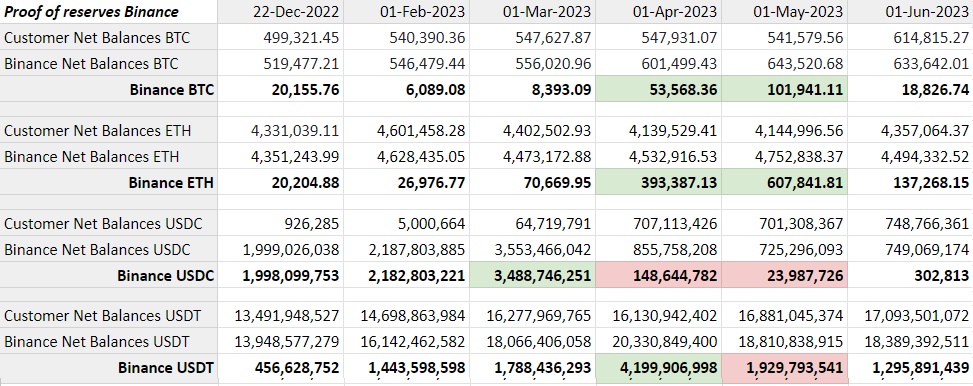

The latest reserve audit suggests Binance holds more than enough crypto and cash to cover user funds. The ratio of Binance’s net balances to its customers’ net balances is more than 100% for all its assets as shown in the snapshot below.

While the report presents a healthy financial situation for Binance, its USDC reserve movements post-Silvergate collapse and the depeg of the stablecoin were the main topics of discussion. The PoR shows that Binance’s USDC balance decreased from $3.4 billion on March 1 to $23.9 million by May 1.

Binance started converting customer’s USDC to Binance USD in September internally, but at the time, it did hold a significant amount of USDC in its reserves as well. On-chain data suggests that right after Silvergate collapsed on March 12, Binance started converting its USDC reserves into Bitcoin (BTC) and Ether (ETH).

Twitter on-chain analyst Aleksandar Djakovic noted that Binance purchased approximately 100,000 BTC and 550,000 ETH between March 12 and May 1, totaling around $3.5 billion, the same amount as the surplus of USDC i had.

Binance didn’t respond to Cointelegraph’s requests for comments at the time of writing.

Related: USD-backed stablecoin pilot project launched by Pacific island nation of Palau

The revelation around Binance’s USDC reserves has become a hot topic, especially after Coinbase CEO Brian Armstrong quipped during the company’s Q2 earnings call meeting that Binance has sold USDC for another stablecoin.

PoRs have become a popular way for crypto exchanges to attest their holdings and share the same with the public as a way of transparency after the collapse of the FTX crypto exchange. Calls for more transparency grew in the crypto ecosystem after FTX became crippled despite founders claiming its financial situation was well-balanced until its collapse in November 2022.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Yuan stablecoin team arrested, WeChat’s new Bitcoin prices, HK crypto rules: Asia Express

Be the first to comment