Bitcoin (BTC) has remained rooted below $28,000 over the last 10 trading days as the bulls battle to reclaim losses from the August 17 flash crash. On-chain data analysis explores how Bitcoin price could react to the bearish tailwinds in the coming days.

On Monday, August 28, Bitcoin’s (BTC) price slid below the critical $26,000 support level amid slowing on-chain activity. Derivatives market data shows that trading activity in the Futures markets could further exacerbate bearish sentiment in the BTC spot markets.

Many Bitcoin Retail Investors Are Throwing in the Towel

Disillusioned by the sideways movement since the BTC price tumbled on August 17, many network participants have now refrained from performing transactional activities.

The chart below illustrates how Active Addresses on the Bitcoin network have been hitting new lows since August 15. As of August 28, it currently stands at 870,605, down a staggering 36% from the 1.18 million Active Addresses recorded on August 15.

Active Addresses estimates the daily number of unique wallet addresses carrying out economic transactions on a blockchain network. A decline in Active Addresses is a bearish signal indicating a drop in demand for the underlying cryptocurrency.

This chart above depicts that the number of investors deploying BTC for transactions has continued to drop since the August 17 price tumble. Notably, the last time Bitcoin recorded fewer active users was on June 28, when it was reduced to 859,363.

Bitcoin could experience further price downswing if this trend persists in the coming days.

Investor Caution Grows as Funds Flowing into Bitcoin Markets Drop to 5-Month Lows

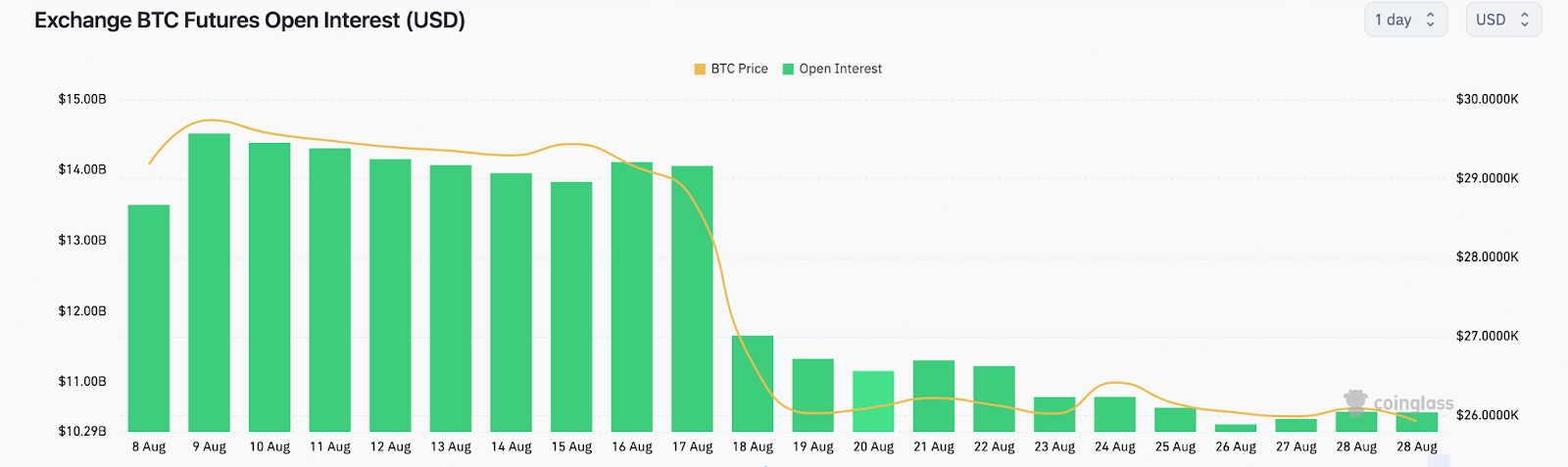

Furthermore, the August 17 flash crash saw Bitcoin investors lose nearly 500 million in Liquidations. Since then, crypto investors have grown reluctant to bring fresh funds into Bitcoin Futures Markets.

According to Coinglass, a crypto derivatives data analytics platform, BTC Futures Open Interest has now dropped to its lowest since March 2023, when the crypto market experienced a downturn prompted by the USDC de-peg and Silicon Valley Bank failure.

As shown below, as of August 28, BTC Open Interest from all centralized exchanges currently sits at $10.58 billion, a 33% decline from the $14.06 billion recorded on August 17.

Open Interest sums up the total value of active derivative contracts for an asset. A downtrend in Open interest is a bullish signal, indicating a lack of significant capital inflows. Notably, the timing of this 33% decline in the Bitcoin Open Interest suggests that most investors are reacting cautiously to the recent price crash.

Furthermore, the looming Fed rate announcement in September and lack of movement on the much-publicized Bitcoin ETF applications have seen investors grow skittish about the next dominant BTC price action.

In conclusion, the dearth of capital flows in the futures markets and the slowing network activity could send Bitcoin prices below $25,000 in the coming days.

BTC Price Prediction: Market Liquidations Could Send BTC Below $25,000

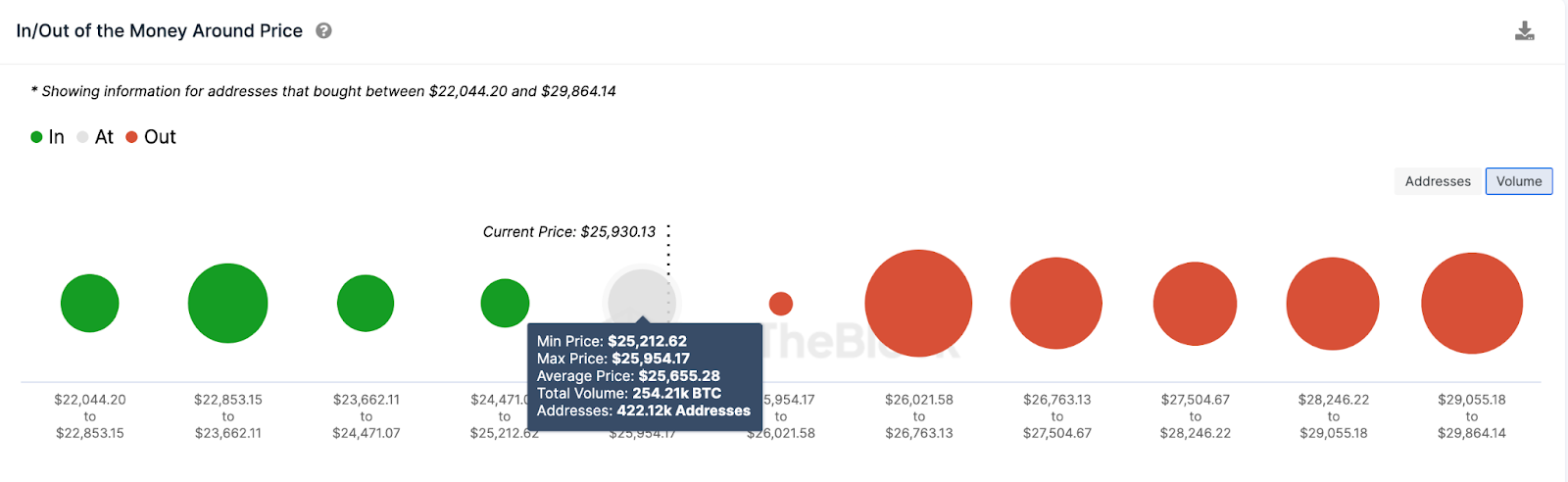

Given the crucial indicators identified above, the BTC price could slip below $25,000. The In/Out of Money Around Price (IOMAP) data, which shows the entry price distribution of current Bitcoin holders, also validates this prediction.

As seen in the chart below, 422,120 addresses had bought 254,210 BTC at the minimum price of $25,200. To avert the risk of another wave of liquidations, the bulls could buy more BTC to cover their positions.

But if that support level caves, it could trigger another panic sell-off, sending the Bitcoin price below $25,000

In contrast, if strategic investors take advantage of the bearish tailwinds to buy the dip, Bitcoin could reclaim $29,000. But in that case, 3.2 million addresses have bought 1.14 million BTC at the maximum price of $27,500. They could trigger a pullback if they close their positions early.

However, if that resistance level cannot hold, Bitcoin price could reclaim $29,000 for the first time since early August.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

Be the first to comment