Bitcoin has retreated a little overnight, but this Friday’s big BTC options expiry event may have an impact on weekend movements. After closing in on $38,000 on November 16, Bitcoin prices have started to correct.

Friday is Bitcoin options expiry day, and around 35,000 contracts are set to expire. The notional value for today’s expiring tranche is just under $1.3 billion, according to Deribit.

Bitcoin Options Expiry

The put/call ratio for today’s Bitcoin options batch is 0.49, meaning there are almost twice as many sellers of long contracts than shorts.

Deribit is also reporting a total open interest notional value of $14.6 billion, which is close to peak levels. Open interest is the number of open contracts that have yet to be closed or expire.

Moreover, BTC options OI has now surpassed that of BTC futures. This is a signal of “increasing market sophistication,” reported Deribit earlier this week.

Deribit CCO Luuk Strijers said, “The surpassing of BTC options open interest over futures OI is a clear sign of the market maturing,” before adding:

“This shift indicates a growing preference for options as tools for strategic positioning, hedging, or access to the recent rise of implied volatility, reflecting the market’s evolving sophistication.”

Analysts added that Bitcoin’s realized volatility rebounded into the 40% range as its spot price tested but failed to sustain the 38,000 level this week.

If you’re interested in trading Bitcoin derivatives, check out BeInCrypto’s guide here.

In addition to the big BTC options expiry event, around 268,000 Ethereum options contracts will also expire today. These have a notional value of roughly $531 million and a put/call ratio of 0.41.

Again, there are more than twice as many sellers of call (long) contracts than puts (shorts). Deribit analysts wrote:

“Ethereum experienced a significant increase in realized volatility, surging 12% in a single day following the news of BlackRock’s ETF filing, pushing its 10-day realized volatility towards 60%.”

Crypto Market Outlook

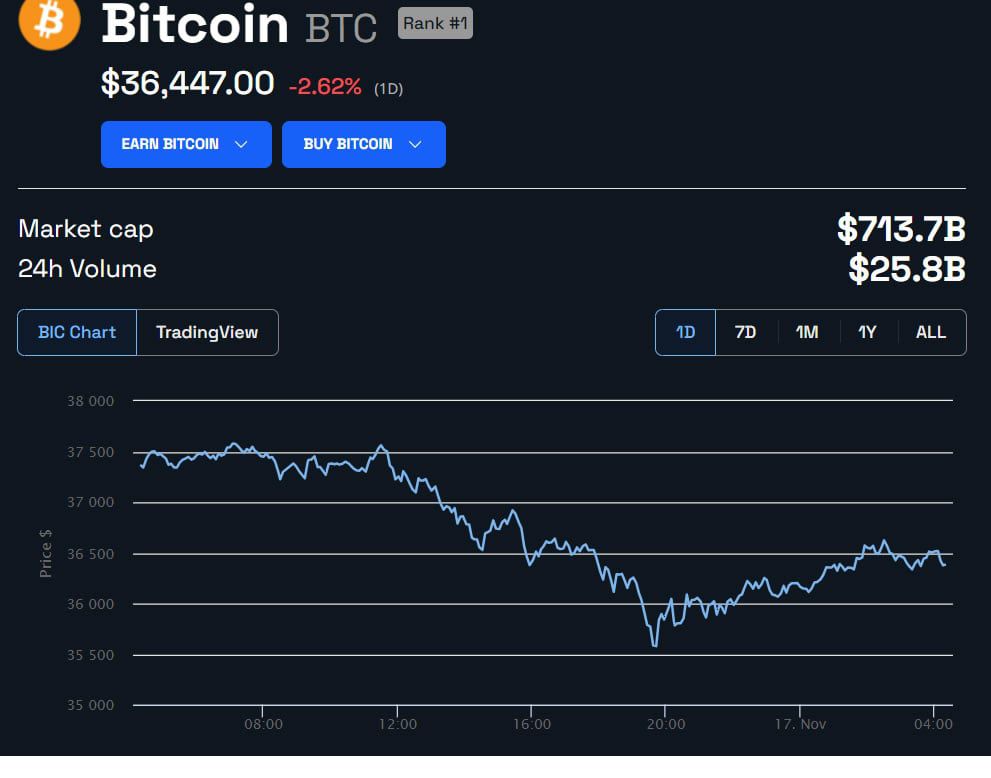

Crypto markets have retreated by 2.5% on the day as the correction from the 2023 high of just under $1.5 trillion continues. The total market cap was $1.44 trillion at the time of writing, up 28% since the same time last month.

Bitcoin prices were down 2.6% to $36,447 at the time of press and back to the same levels it was at this time last Friday.

Ethereum had fallen 3.3%, retreating back below $2,000 to trade at $1,982 at the time of writing. Additionally, altcoins were mostly in the red during Asian trading on Friday.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Be the first to comment