After hitting $38,000 for the first time this year last Friday, Bitcoin has been unable to break through the critical $38k resistance level over the weekend. At the time of writing, Bitcoin is trading at around $37,400, according to CoinMarketCap. What do prominent analysts see on the horizon for the largest cryptocurrency?

Renowned analyst CryptoCon, who maintains a large X (Twitter) following of 65k, shared his analysis on Bitcoin reaching an important technical milestone. As CryptoCon told his followers, “For the first time this cycle, #Bitcoin has hit the 3.5 ADR level.”

The “ADR” refers to the Average Daily Rate, a technical indicator used to measure the average range of price movement within a single day. These bars help traders gauge the potential volatility of a cryptocurrency over a specific period. It’s a useful tool for assessing potential price swings and setting realistic profit and loss targets.

According to CryptoCon, this development means “this is still only the start of a move in the shorter-term.” It also signals that “this is the very beginning of the bigger picture.”

CryptoCon went on to compare the current bull cycle to previous ones. As he stated, “the differences between the cycles are shown yet again.” Looking particularly at data from analyst BitTime, “both black cycles saw strength early in the green accumulation year, while our 2 white cycles took into the end of the green year to reach the 3.5.”

CryptoCon’s overall assessment, based on historical patterns, is that “in any cycle, it was the start of something, and not the end.” His powerful message to investors is one of confidence rather than concern over Bitcoin’s recent consolidation near $38,000.

Another crypto analyst CrediBULL, who shares insights with over 350,000 X followers, also weighed in on Bitcoin’s price action over the weekend. As he observed, Bitcoin saw liquidations below $37,500, dropping under this key support level.

However, CrediBULL noted open interest rose significantly as well. In his view, this meant “a lot of leveraged players just positioned themselves on this drop rather than it serving to wash them out.” Considering open interest remained elevated, CrediBULL assessed it had returned to the “danger zone.”

What might this imply for Bitcoin’s next moves? As CrediBULL explained, there are two possible outcomes: “We will either see 1) a major short squeeze right back up or 2) a continued flush back down.” With neither scenario clearly more likely than the other at that time, the analyst recommended exercising caution.

His advice was to “sit on your hands and wait for the volatility to play out.” Only after price action becomes clearer should one consider entering positions, he cautioned. As CrediBULL stated, if a short squeeze materializes and Bitcoin reclaims local lows above $37,600, then it may be safer to buy the rebound. Otherwise, further downside could present a more attractive entry point.

Bitcoin ETF Token Poised to Capture Regulatory Growth

For investors seeking exposure to the promising but uncertain crypto regulatory environment in the United States, one token gaining traction is Bitcoin ETF (BTCETF). As its name implies, BTCETF aims to benefit from launching the first Bitcoin ETF products approved by the U.S. Securities and Exchange Commission (SEC).

The presale for BTCETF has already raised $1.775 million since launching a few weeks ago. Remarkably, the token price has risen from $0.005 to the current price of $0.0058, with the next scheduled price rise to $0.006 just one day away.

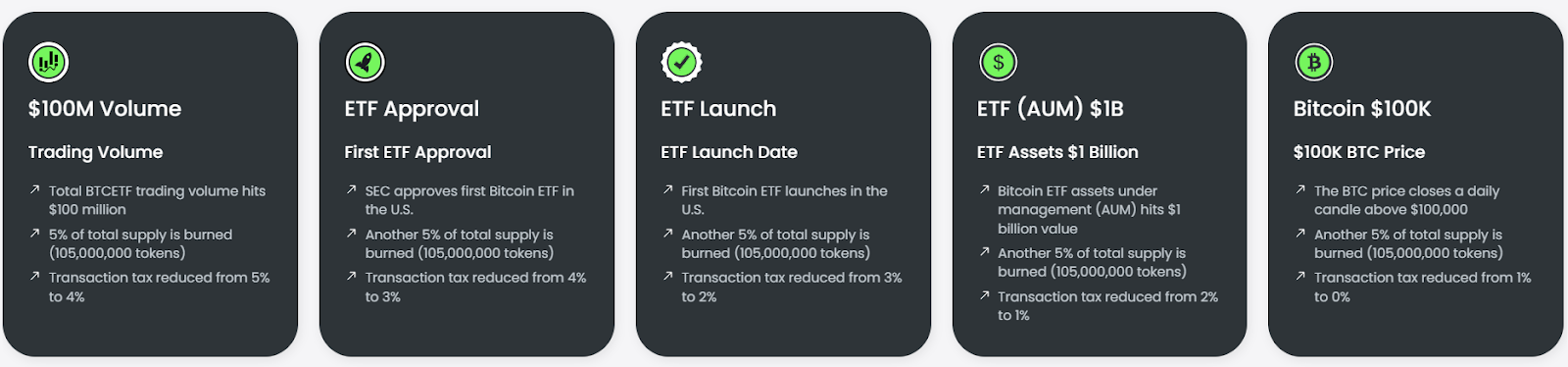

To position itself for the expected large inflows once a Bitcoin ETF launches, BTCETF employs a deflationary token model. A total of 25% of the supply will be permanently removed from circulation through a series of burns tied to ETF approval milestones. For example, 5% of tokens will be burned if the first U.S.

Bitcoin ETF commences trading. Reaching $1 billion in ETF assets or Bitcoin hitting $100k would trigger further reductions. As each milestone occurs, like an approval announcement or a trading launch, a portion of the total supply is withdrawn from circulation. This will reduce BTCETF from its original 2.1 billion total supply down to 1.57 billion in circulating supply.

This deflationary mechanism is designed to boost BTCETF’s scarcity and reward long-term holders. In addition, 25% of the total supply has been allocated to staking rewards to promote network participation and stability.

The current staking APY is an impressive 1,000%+ due to high early participation, although this rate will steadily decrease as more tokens are staked. BTCETF’s presale is structured into 10 tiers, each with 84 million tokens priced progressively higher to reward early buyers.

The presale is currently in Stage 4 and will enter Stage 5 in just one day, providing a final opportunity to lock in lower prices. BTCETF is an ERC-20 token, so a wallet like MetaMask is needed. Payments are accepted in ETH, USDT, and via credit/debit cards on the project’s website. As word spreads on social media platforms like Telegram and Twitter, the project’s communities are growing rapidly.

Bitcoin continues to consolidate around $37,000, but analysts see more volatility ahead but remain confident in its longer-term potential. For investors seeking leveraged regulatory upside, BTCETF presents a compelling opportunity with its innovative tokenomics designed to reward long-term holders as the U.S. ETF environment develops. Its ongoing presale offers the chance to get involved before projected listings and exchange debuts in the future.

As ever, do your own research, but BTCETF may be worth watching.

Visit BTCETF Presale

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment