In the past seven days, Bitcoin (BTC) experienced a whopping 14.5% surge, hitting a 20-month high at $41,130 by Dec. 4. Traders and analysts have been abuzz with speculation, especially in the wake of the $100 million liquidation of short (bearish) Bitcoin futures within just 24 hours. However, when we dive into BTC derivatives data, a different story unfolds—one that places the spotlight on spot market action.

BTC liquidation map

Enough shorts to run it up all the way to $45-46k pic.twitter.com/7O2zYD4j8Q

— Nik Algo (@nik_algo) December 4, 2023

The impact of the recent liquidations in Bitcoin futures markets

While the Chicago Mercantile Exchange (CME) trades USD-settled contracts for Bitcoin futures, where no physical Bitcoin changes hands, these futures markets undoubtedly play a crucial role in shaping spot prices. The sheer scale of Bitcoin futures, with an aggregate open interest of $20 billion, underscores the keen interest of professional investors.

In the same seven-day period, a mere $200 million worth of BTC futures shorts were liquidated, representing only 1% of the total outstanding contracts. This figure pales in comparison to the substantial $190 billion in trading volume during the same timeframe.

Even when focusing solely on the CME, which is known for potential trading volume inflation, its daily volume of $2.67 billion should have readily absorbed a $100 million 24-hour liquidation. This has led investors to ponder whether the recent Bitcoin rally might be attributed to the targeting of a few whales within the futures markets.

$BTC Next Possible Plan

A Quick Wick to 42k-42.5k To Hunt BSL Of Shorts then A Quick Flushout of the Long’s & We Might see $BTC Pullback down to 39k-38.5k

Retracement to 39k-38.5k Will be good Buying Opportunity For the Last Leg upto 45k-47k Before ETF Approval pic.twitter.com/yc7k0hOBpZ

— VeLLa Crypto (@VellaCryptoX) December 4, 2023

One could attempt to gauge the extent of liquidations at different price levels using tape reading techniques. However, this approach fails to consider whether whales and market makers are adequately hedged or have the capacity to deposit additional margin.

Despite Bitcoin’s surge to a 20-month high, futures and options markets appear relatively subdued. In fact, three key pieces of evidence suggest that there is no compelling reason to anticipate a cascade of short contract liquidations should Bitcoin surpass the $43,500 threshold.

Bitcoin derivatives show no signs of excessive optimism

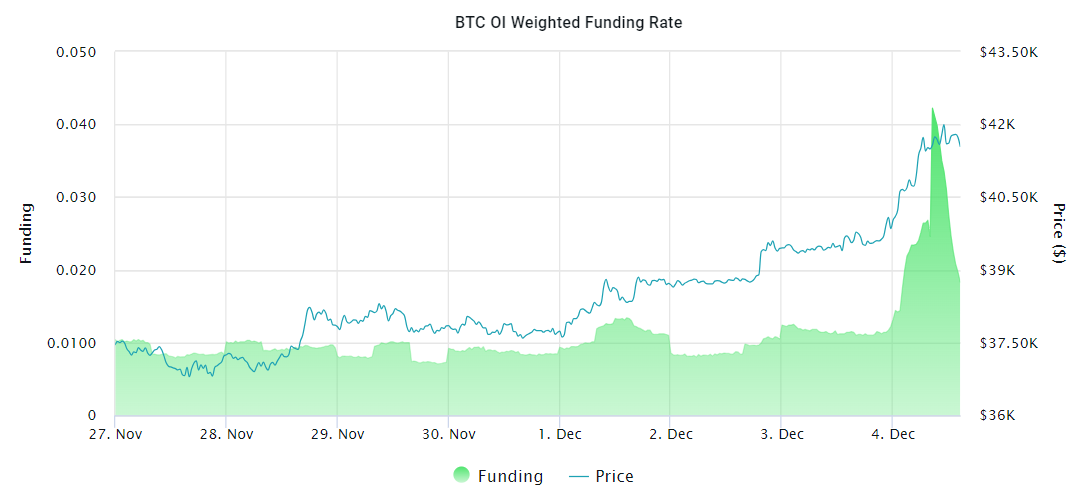

Perpetual contracts, also known as inverse swaps, incorporate an embedded rate that is typically recalculated every eight hours. A positive funding rate indicates an increased demand for leverage among long positions, while a negative rate signals the need for additional leverage among short positions.

Data reveals a peak of 0.04% per eight hours earlier on Dec. 4, but this level, equivalent to 0.9% per week, proved short-lived. The current 0.4% weekly rate places minimal pressure on leverage-seeking longs, indicating a lack of urgency among retail traders. Conversely, there is no sign of exhaustion among bears.

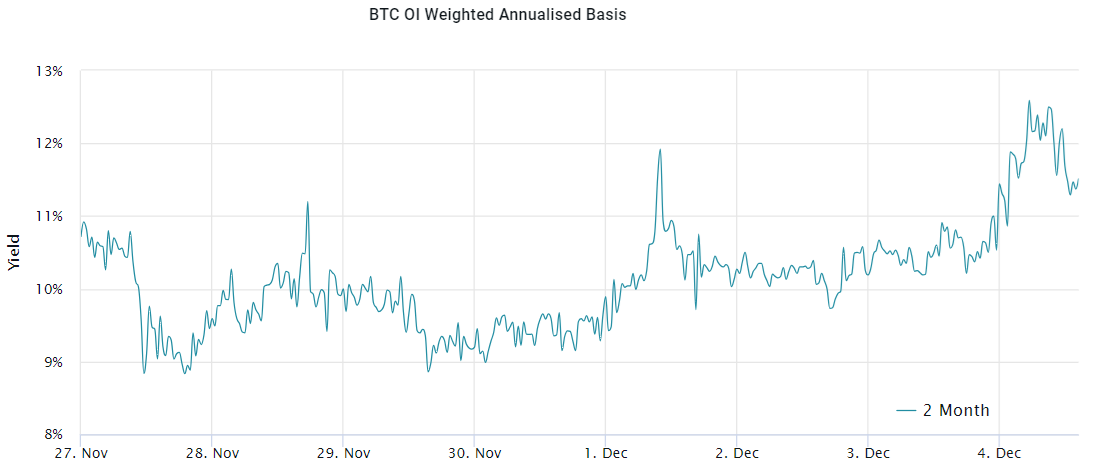

To evaluate whether Bitcoin perpetual swaps represent an anomaly, attention turns to BTC monthly futures contracts, favored by professional traders for their fixed funding rate. Typically, these contracts trade at a premium of 5% to 10% to account for their extended settlement period.

Related: How to prepare for the next crypto bull market – 5 simple steps

BTC fixed-term futures contracts data reveals a peak premium of 12% on Dec. 4, presently resting at 11%. This level remains reasonable, especially given the prevailing bullish momentum. Historical rallies in 2021 witnessed premiums surging beyond 30%, further challenging the notion of a rally predominantly driven by Bitcoin derivatives.

Ultimately, with Bitcoin’s price soaring by 14.5% in just seven days and only $200 million worth of short futures contracts liquidated, questions arise regarding whether bears employed conservative leverage or diligently increased margin deposits to safeguard their positions.

When considering the funding rate and futures basis rate, there is no clear indication that surpassing the $43,000 mark would trigger substantial stock losses.

In essence, the recent surge finds support in spot market accumulation and a decline in the available supply of coins on exchanges. Over the past week, exchanges recorded a net outflow of 8,275 BTC, according to Coinglass.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Be the first to comment