Bitcoin (BTC) starts a new week in risky territory as sell-offs from whales mark a change in mood.

The latest weekly close has done little to comfort nervous traders as a pause in “up only” BTC price activity continues.

With just two weeks to go until the yearly candle concludes, the countdown is on — together with the pressure — across risk assets.

Macro data releases — key short-term volatility catalysts — are set to keep coming for the remainder of December, with United States gross domestic product (GDP) figures due as markets digest last week’s moves by the Federal Reserve.

It seems as if a “Santa rally” is less and less on the cards for Bitcoin at present. As high fees leave a bitter taste in hodlers’ mouths, commentators suggest refocusing on next month’s potential spot exchange-traded fund (ETF) approval.

A potential silver lining comes from market sentiment, both within crypto and beyond. While greed characterizes the landscape, unsustainable conditions are nowhere to be seen, potentially leaving room for further upside as disbelief plays out.

Cointelegraph takes a look at these factors in greater detail as crunch time for yearly BTC price performance nears.

Analysts line up key BTC price support levels

At around $41,300, the Dec. 17 weekly close came midway through a local sell-off for BTC/USD.

Downside continued overnight, with Bitcoin hitting $40,800 before reversing during the Asia trading session to return to just above $41,000, data from Cointelegraph Markets Pro and TradingView shows.

Traders and analysts — already wary of potential further dips based on recent BTC price action — remained cautious.

“The Charts Don’t Lie,” trading resource Material Indicators summarized at the start of one post on X (formerly Twitter) on the day.

Material Indicators noted that Bitcoin had lost its 21-day moving average into the new week — an event it says is “inherently bearish.”

It added that it was “expecting year end profit taking and tax loss harvesting to prevail in the near term.”

Continuing, co-founder Keith Alan flagged an ongoing battle for a key Fibonacci retracement level, which corresponds to the November 2021 all-time high.

It’s too early to say if this December 17th Pattern is going to play out. We can make that determination at the close. For now, but it’s safe to say that #BTC bulls need to push price back above .5 Fib to reclaim the Golden Pocket or risk losing the 21-Day Moving Average.… pic.twitter.com/Tjc4lkKEc2

— Keith Alan (@KAProductions) December 17, 2023

Popular trader Skew added some lines in the sand in the form of the 200-period and 300-period exponential moving average (EMA) on 4-hour timeframes, along with the 50-day EMA — all currently around $2,500 below spot price.

“From here there’s two technical levels on 1W/1M,” he continued in commentary on weekly and monthly timeframes.

“$39K – $38K ~ Potential support on HTF, an unsustainable push lower there would be a decent bid. $47K – $48K ~ HTF resistance, unsustainable drive higher higher would be a good area to take profits.”

PCE, GDP due amid increasing belief in Fed “pivot”

The coming week sees the November print of the Personal Consumption Expenditures (PCE) Index — the Fed’s preferred inflation gauge — leading U.S. macro events.

Coming after last week’s multiple key Fed decisions, data must now continue to show inflation abating heading into 2024.

The next Federal Open Market Committee (FOMC) meeting to decide changes to interest rates is not until the end of January, but since last week, markets have been entertaining the prospect of a pivot becoming reality.

The market is now pricing a full 25bps rate cut by July 2024 – following today’s Fed meeting. pic.twitter.com/zWXiUqx96Q

— tedtalksmacro (@tedtalksmacro) December 14, 2023

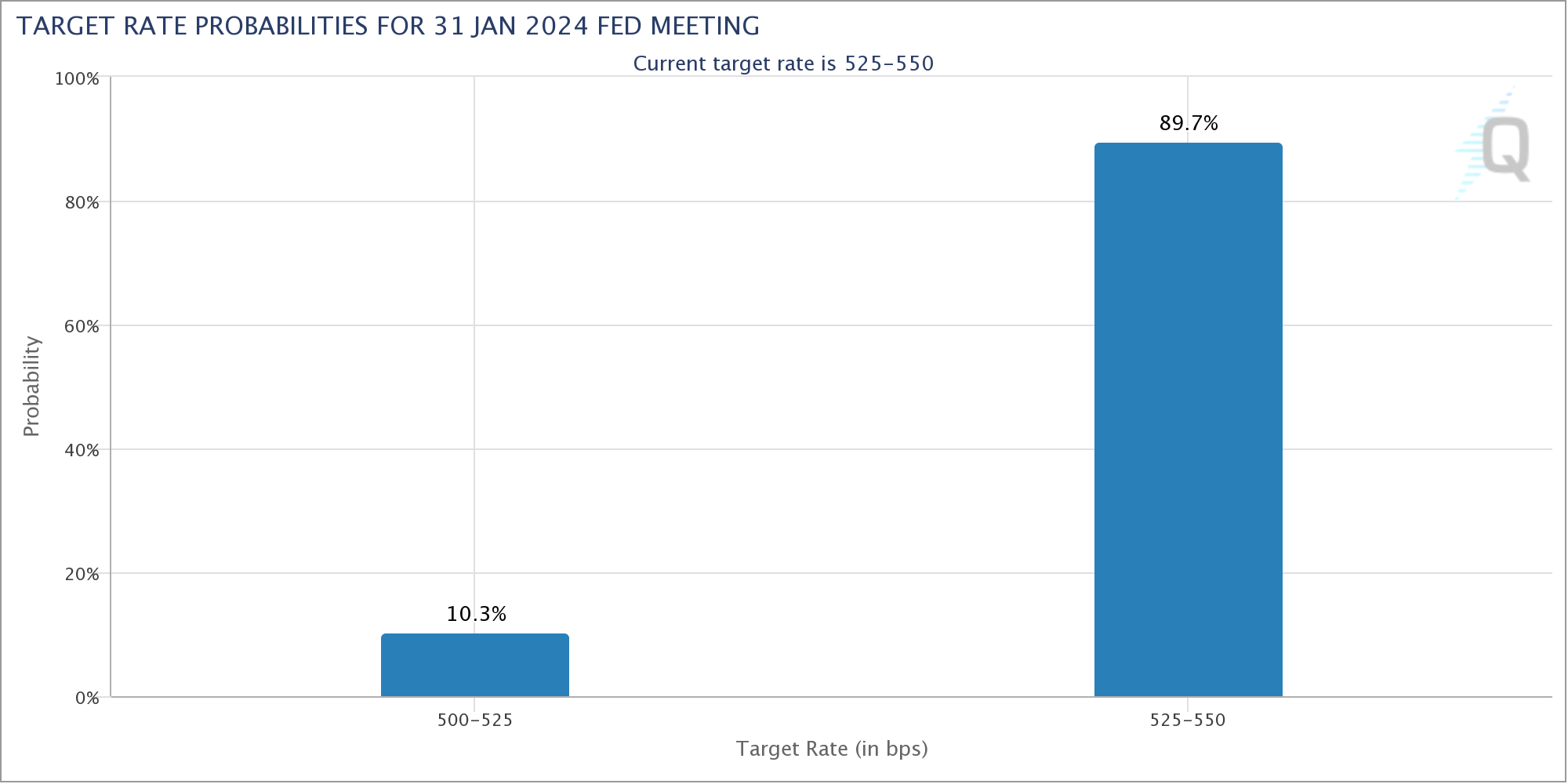

The latest data from CME Group’s FedWatch Tool currently puts the odds of a rate cut next meeting at around 10%, with the majority of key macro figures still to come.

“Even with stocks up, uncertainty is still everywhere,” trading resource The Kobeissi Letter concluded in an X post outlining the coming week’s prints.

Key Events This Week:

1. November Building Permits data – Tuesday

2. Consumer Confidence data – Wednesday

3. Existing Home Sales data – Wednesday

4. Q3 2023 GDP data – Thursday

5. November PCE Inflation data – Friday

6. New Home Sales data – Friday

Another busy week with…

— The Kobeissi Letter (@KobeissiLetter) December 17, 2023

In addition to PCE, jobless claims and revised Q3 GDP will both hit on Dec. 21.

As Cointelegraph reported, U.S. dollar strength hit multimonth lows around the FOMC in a potential fresh tailwind for crypto markets. Those lows have now faded as the U.S. Dollar Index makes a modest comeback, still down around 1.9% in December.

Fees stay elevated

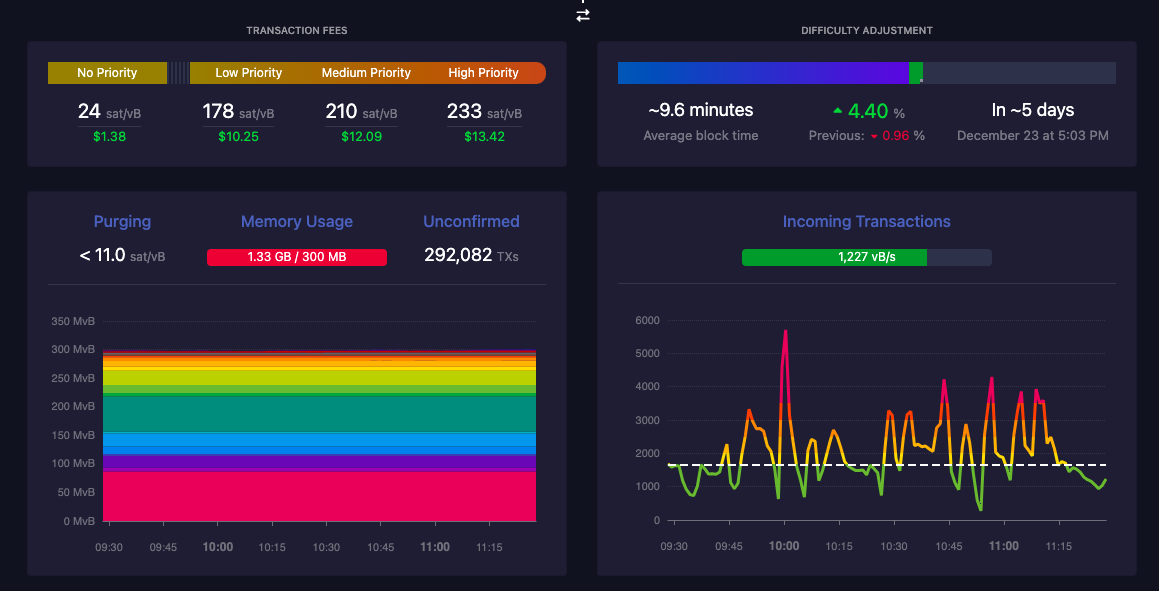

The heated debate over Bitcoin transaction fees has swelled in recent days, thanks to these hitting their highest levels since April 2021.

With Ordinals back on the radar, those wishing to transact on-chain faced $40 fees at the weekend, while “OG” commentators argued that the fee market was simply functioning as intended given the competition for block space.

Miner revenues have skyrocketed as a result, hitting levels not witnessed since Bitcoin’s $69,000 all-time high.

Into the new week, however, fees have already fallen considerably, with next-block transactions confirming for under $15 at the time of writing.

Commenting on the situation, popular social media personality Fred Krueger argued that market participants should now turn their attention to the decision on approving the first U.S. spot Bitcoin ETFs due early next month.

Noting that fees were “already falling fast,” he defended Ordinals’ creators’ right to use the blockchain to store their work.

“This debate looks like a nothingburger for now. Back to waiting for the ETF,” he concluded.

Others, including researcher and software developer Vijay Boyapati, also referenced the transitory nature of the fees debate as it has occurred throughout Bitcoin’s history.

#Bitcoin concern trolls circa 2017: “Bitcoin’s network will not be secure because the block subsidy is shrinking and transaction fees won’t be enough!!!”

Bitcoin concern trolls today: “transaction fees are too high!!!”

— Vijay Boyapati (@real_vijay) December 17, 2023

Calling for so-called layer-2 solutions to speed up development, reactions to the recent elevated fees underscored that off-chain solutions for regular users — specifically the Lightning Network — already exist.

“L1 fees are incredibly high right now. Seems obvious — even if self-serving — that defaulting most transactions to the Lightning Network is the way to go for all exchanges and wallets,” David Marcus, the former Facebook executive now CEO of co-founder of Lightning startup Lightspark, wrote in part of an X post at the weekend.

Per data from monitoring resource Mempool.space, meanwhile, block space remains in huge demand, with the backlog of unconfirmed transactions still circling 300,000.

New addresses pose bull market momentum risk

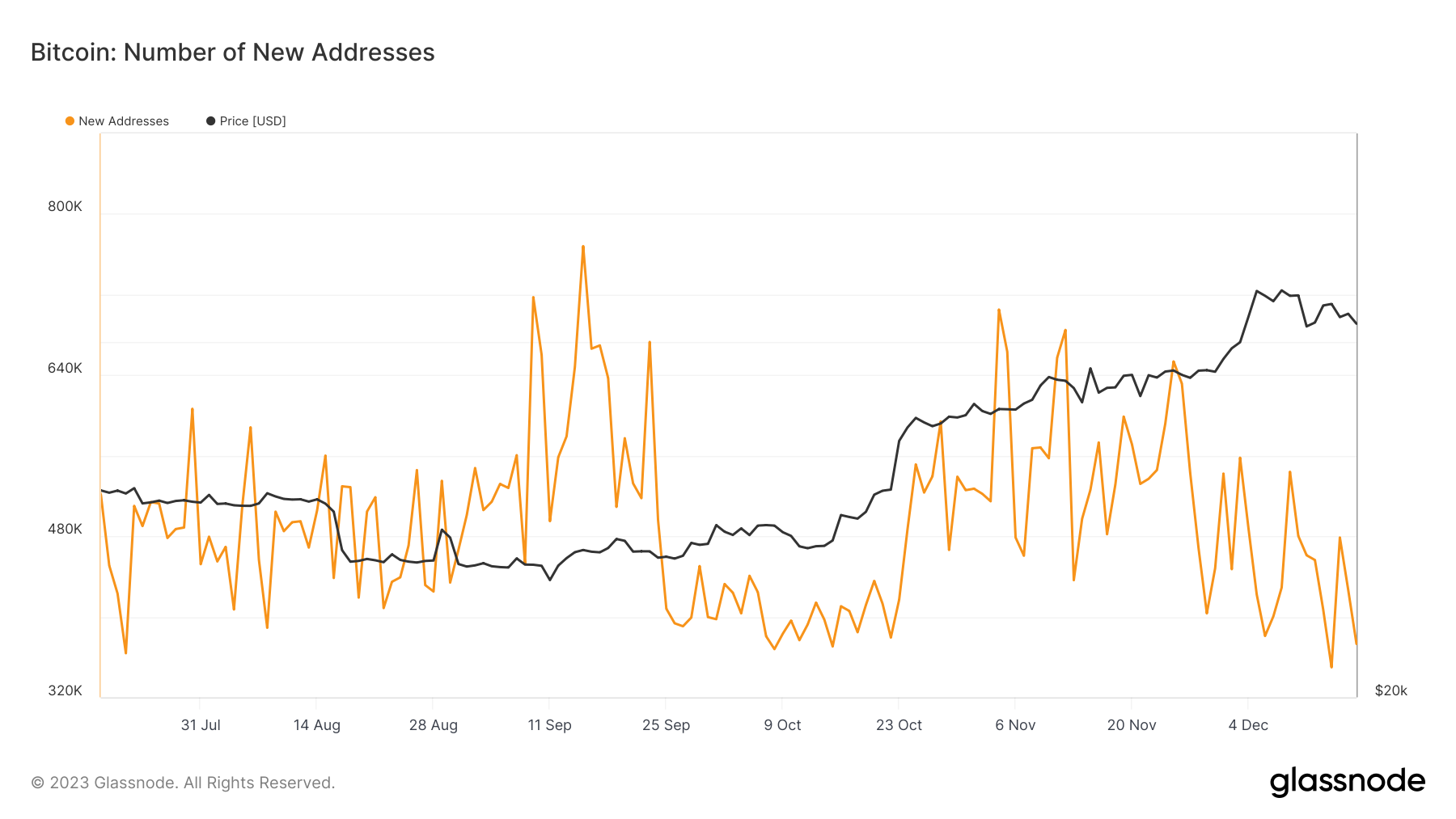

Bitcoin network growth has taken a breather this month — in line with the bull market comeback.

New data from on-chain analytics firm Glassnode confirms that the number of new BTC addresses has continued its downtrend throughout December.

For Dec. 17, the latest date for which data is available, around 373,000 addresses appeared in an on-chain transaction for the first time. This is approximately half of the recent local daily high, which Glassnode shows came in early November.

Commenting on the numbers, popular social media analyst Ali described the tailing-off of new addresses as noticeable and a hurdle to BTC price expansion.

“There’s been a noticeable dip in Bitcoin network growth over the past month, casting doubt on the sustainability of $ BTC’s recent move to $44,000,” he wrote.

“For a robust continuation of the bull rally, it’s crucial to see an uptick in the number of new $BTC addresses. This would provide the needed support for sustained bullish momentum.”

Disbelief behind the fear

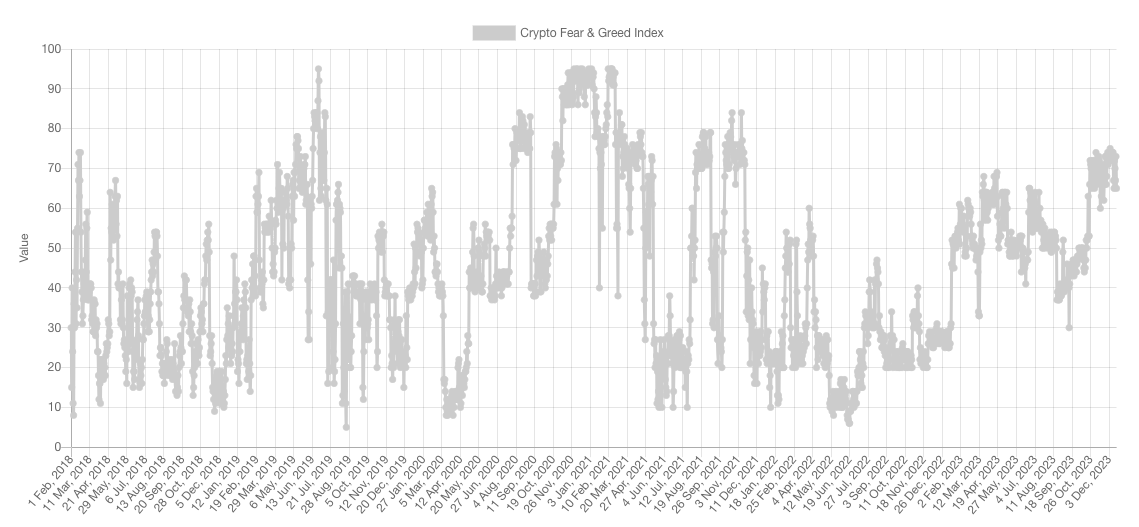

The recent cooling in Bitcoin’s latest “up only” phase has delivered a corresponding pause in market greed.

Related: ‘No excuse’ not to long crypto: Arthur Hayes repeats $1M BTC price bet

According to the latest data from the Crypto Fear & Greed Index, most crypto market participants have been given pause for thought over the past week.

Currently at 65/100, Fear & Greed, which is the go-to sentiment gauge in crypto, still defines the overall mood as greedy, but near its least heated in almost a month.

Zooming out, Index scores over 90/100 have corresponded to long-term market tops, as irrational exuberance becomes the average market participant’s mindset. A notable exception, as Cointelegraph reported, was the 2021 $69,000 all-time high, which saw Fear & Greed reach 75/100 before reversing.

Commenting on the current status quo for the traditional market Index, meanwhile, Caleb Franzen, senior analyst at Cubic Analytics, suggested that sentiment was still emerging from the extended Fed tightening cycle that also began in late 2021.

“The Fear & Greed Index is comfortably in the ‘Greed’ range. However, it was just in ‘Fear’ 4 weeks ago and was in ‘Neutral’ to ‘Extreme Fear’ for 2.5 months in September through November,” he told X subscribers on Dec. 14.

“Euphoria? No. This is disbelief.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Be the first to comment