With the Bitcoin price rallying, one analyst has taken to X, highlighting the current state of bullish affairs. In a post, the analyst thinks the world’s most valuable coin is approaching “escape velocity,” with price action deviating from candlestick arrangements in the past. This is usually the case, especially when prices are approaching all-time highs.

Will Bitcoin Rip Past $70,000 In Coming Days?

The analyst notes that a normal BTC cycle would, at current prices and considering how the coin has been rallying in the past few weeks, typically have seen a pullback. The correction would then be followed by an extended period of consolidation, often stretching at least six months.

However, since there is a clear deviation, looking at price action in the monthly chart, the analyst is convinced that Bitcoin is about to lift off. The resulting rally would be at “escape velocity,” the coin would easily extend gains, easing past all-time highs.

Bitcoin is firmly in an uptrend at spot rates, looking at events in the daily chart. Specifically, Bitcoin trades above $57,200 when writing, registering new 2024 highs. Over the past day, the coin has broken above key resistance levels, easily breaking $53,000 and later $55,000 in a buy trend continuation formation.

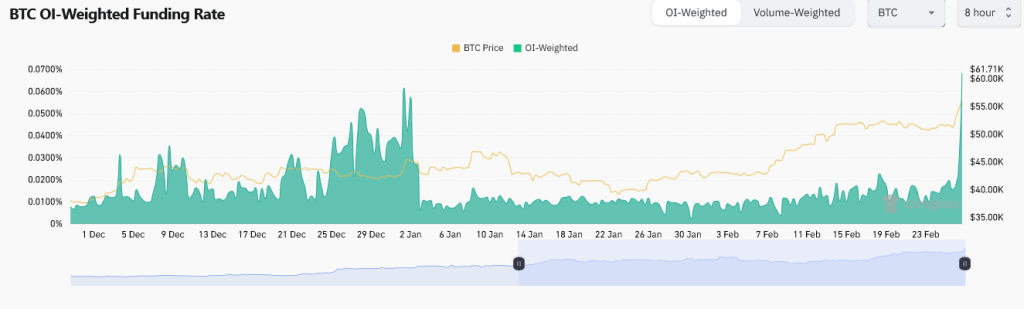

Rising Funding Rates And Open Interest As Institutions Double Down

With soaring interest, exchange data shows that there has been a spike in annualized funding rates and open interest across multiple platforms, enabling the trading of Bitcoin perpetual futures. Data from Coinglass shows that the funding rate in Binance is now at over 0.0686%. The same has been observed with open interest, which now stands at over $6.2 billion on Binance.

Changes in open interest and funding rates are leading indicators that can be used to gauge market sentiment. Usually, rising open interest and funding rates suggest increasing bullish sentiment, especially among leverage traders. In this scenario, the possibility of prices maintaining the uptrend remains high.

Confidence among traders is exceptionally high. It is fueled by recent institutional developments, macro factors, and the expectations ahead of the incoming halving event. For context, the ten approved spot Bitcoin exchange-traded funds (ETFs) in the United States have since received billions.

Observers now worry that at this pace, and ahead of the Bitcoin halving event, there would be a supply shock crisis. The concern is that after April, the number of coins released will be way less than those being gobbled by institutions. BTC prices will likely rally out of this, which will be out of reach for ordinary folks.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Be the first to comment