The cryptocurrency market recently experienced a significant shockwave, with $1.13 billion in trader liquidations.

This event followed massive Bitcoin (BTC) price swings, highlighting the volatile nature of the crypto sector.

Bitcoin Crashes 14% After Tapping ATH

On Tuesday, Bitcoin, the flagship crypto asset, moved above its previous all-time high, briefly reaching over $69,000. This peak came after a lengthy 847-day wait, showcasing the market’s bullish momentum. However, this uptrend did not last.

Subsequently, a wave of selling pressure emerged on crypto exchanges. This pressure dramatically reversed Bitcoin’s gains, causing its price to plummet below $60,000 at one point.

Initially, Bitcoin’s price soared to $69,208. It then fell sharply, dropping over $1,000 in a minute. The decline didn’t stop there. The price crashed, reaching a low of $59,300. As of writing, BTC has partially recovered, trading at around $63,261.

Moreover, other major cryptocurrencies showed varied responses. Solana (SOL) and Ethereum (ETH) saw decreases of 5.92% and around 4%, respectively. In contrast, meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) faced over 20% losses in the past 24 hours.

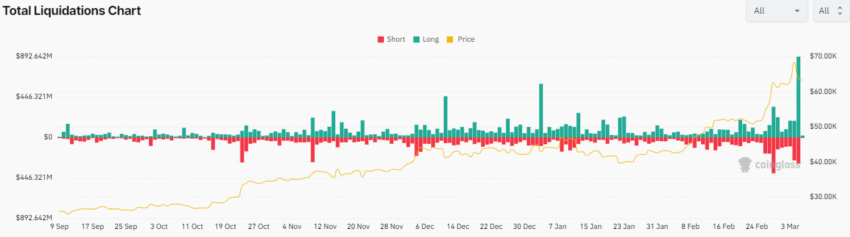

This dramatic price action led to a significant liquidation event. Over $1.13 billion worth of derivatives trading positions were erased across all digital assets. Coinglass data revealed that $879.68 million of these were long positions. Additionally, $254.80 million were short positions. Altogether, this turmoil resulted in the liquidation of 308,465 traders.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Liquidations are pivotal moments in the crypto markets. They occur when exchanges close leveraged positions because a trader’s margin falls below the required maintenance margin.

Such events can amplify market volatility and deepen price declines. Tuesday’s liquidation volume highlights the high-risk nature of crypto trading. It surpasses the $1 billion leverage flush from last August.

Seasoned traders have compared Tuesday’s events to some of the most severe market downturns. These moments serve as reminders of the risks and volatility inherent in cryptocurrency trading.

“I think the worst day I ever had in crypto was March 2020. It was a day of liquidation. When Bitmex had to shut down to prevent BTC from going to 0 as the liquidation engines kicked in overdrive. Everything was down 70% + in a single day,” crypto trader Pentoshi said.

Read more: 13 Best AI Crypto Trading Bots To Maximize Your Profits.

As a result, investors and traders are advised to exercise caution, especially with leveraged positions.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment