Key Takeaways

MATIC has seen its price surge by nearly 37% over the past 36 hours.

The upswing correlated with Polygon’s entrance into Disney’s accelerator program.

Gains could be limited at $1 as on-chain data shows stiff resistance ahead.

Share this article

MATIC’s price action has stolen the crypto spotlight after the Walt Disney Company chose Polygon to participate in its accelerator program.

Polygon’s MATIC Overcomes Resistance

MATIC appears to be breaking out after Polygon was selected as one of six companies to participate in Disney’s accelerator program.

The American mass media and entertainment conglomerate will provide guidance to Polygon from its leadership team and offer dedicated mentorship. The main focus of disney’s initiative is to build the future of immersive experiences in technologies such as augmented reality, non-fungible tokens, and artificial intelligence.

Ryan Watt, CEO of Polygon Studios, noted that Polygon was “the only blockchain selected” to participate in the program. He added that this “speaks volumes to the work being done [at Polygon], and where we’re going as a company.”

MATIC has seen its price surge by nearly 37% since the announcement was made Wednesday. The Layer 2 scaling solution’s token went from a low of $0.53 to a high of $0.73. Further buying pressure around the current price level could result in more significant gains despite the current uncertainty in the cryptocurrency market.

Indeed, MATIC appears to have broken out of an ascending triangle that developed on its 12-hour chart. This technical formation anticipates a 47% upswing toward $1 as long as prices remain above $0.60.

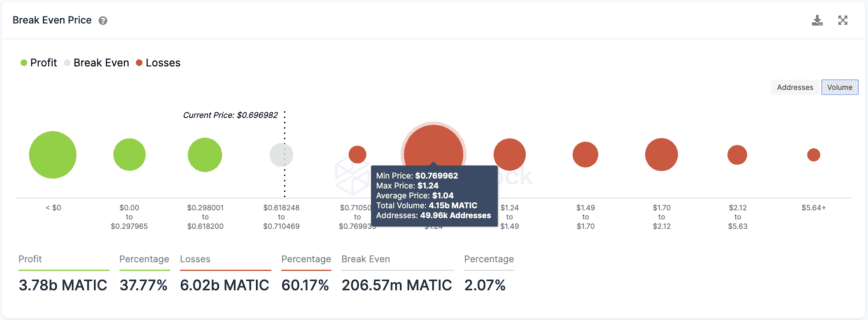

On-chain data shows that MATIC likely faces no significant resistance on its way to $1; however, overcoming this hurdle may prove challenging. Data from IntoTheBlock shows that nearly 50,000 addresses holding over 4.15 billion MATIC may attempt to break even on their long positions at around $1. The potential spike in selling pressure could prevent MATIC from advancing further, limiting its upside potential.

Only a sustained close above $1 on the 12-hour chart could signal further higher highs. Until then, the short-term outlook for MATIC appears to favor the bulls.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Be the first to comment