Three days before Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS), the world’s largest derivatives marketplace in terms of volume, CME Group, announced plans to list ethereum options. While CME’s ether options product prepares for regulatory review, the company detailed that the options contract will be measured at 50 ether per contract, using the CME CF Ether-Dollar Reference Rate.

CME Group Reveals Ethereum Options Launch

The Chicago Mercantile Exchange otherwise known as CME Group revealed the company’s intentions to list ethereum options contracts three days before The Merge on September 12, 2022. CME detailed that the new ether options join the firm’s bitcoin (BTC) options and micro-sized bitcoin and ether options contracts.

“These new contracts deliver one ether futures, sized at 50 ether per contract, and based on the CME CF Ether-Dollar Reference Rate, which serves as a once-a-day reference rate of the U.S. dollar price of ether,” the derivatives marketplace said on Thursday. CME’s global head of equity and FX products, Tim McCourt, noted on Thursday that the new ether options contracts add to the company’s existing lineup of crypto derivatives products.

“The launch of these new options contracts builds on the significant growth and deep liquidity we have seen in our existing Ether futures, which have traded more than 1.8 million contracts to date,” McCourt said in a statement. The CME executive added:

As we approach the highly anticipated Ethereum Merge next month, we continue to see market participants turn to CME Group to manage ether price risk. Our new ether options will offer a wide array of clients greater flexibility and added precision to manage their ether exposure ahead of market-moving events.

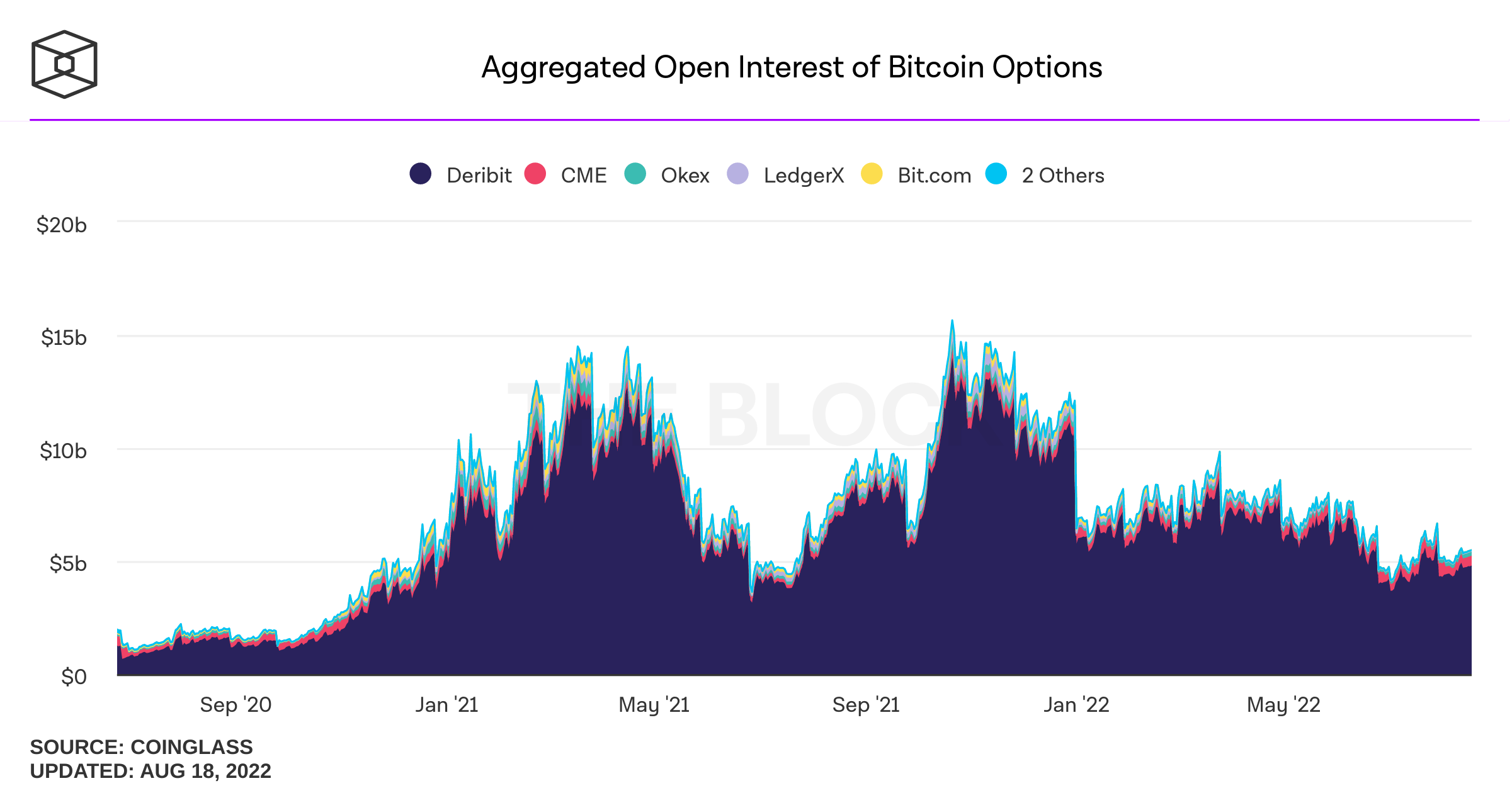

CME Group will join a number of exchanges that already offer ethereum options contracts including Deribit, Okex, Bit.com, and Huobi. In July there was $11.38 billion in ether options volume with Deribit commanding $10.86 billion out of all four exchanges that list ETH options. The market share of ether options open interest is also dominated by Deribit, in comparison to open interest figures associated with Huobi, Okex, and Bit.com.

In terms of bitcoin options, Deribit also outshines CME as CME Group is the second largest in terms of bitcoin options open interest with $441 million recorded on August 17. In the same fashion, CME is the third largest in terms of bitcoin options volume while Deribit takes the lead. Okex manages to capture a touch more volume as far as bitcoin options are concerned.

With the new CME ether options, TP ICAP Digital Assets and Akuna Capital are supporting CME’s ether options roll out. TP ICAP Digital Assets is excited to support CME Group in the rollout of its full-sized Ether options contract,” TP ICAP’s head of brokering Sam Newman remarked during the announcement. “This larger-sized Ether option, in tandem with the already popular Micro Ether option, has been eagerly awaited by TP ICAP’s customers.”

What do you think about CME Group offering ethereum options on September 12, 2022? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, The Block Crypto Data

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment