Global markets and cryptocurrencies have been experiencing deep declines for months. The strong correlation of Bitcoin’s price with traditional stock markets further exacerbates this trend. Dominating all of this is the parabolic rise of the U.S. dollar index, which is only accelerating.

However, currently, global markets and their major indexes have reached long-term support levels that may mark the spot for a rebound. What’s more, the DXY is slowly reaching its own macro resistance, which could stop the exponential surge of the US dollar.

In today’s analysis, BeInCrypto looks at the SPX and NASDAQ price action in correlation to the BTC and altcoins charts. We then look at the DXY chart and its rapid dominance over other global currencies. It all culminates with a bit of harmonic analysis that suggests an upcoming bounce.

Global markets in a downtrend

The chart of the S&P 500 (SPX) has been in a bearish trend since reaching the all-time high (ATH) of $4,818 on January 4, 2022. Shortly thereafter, the ongoing decline began, and the index hit a nearly 2-year low (665 days) yesterday. The SPX retraced to the $3,624 level, losing almost 25% from the ATH.

If the SPX initiates a bounce at this point, a double-bottom pattern could be in place. In June, the index fell to the $3,636 level, only to rebound to the $4,325 area, which previously served as support (red rectangle). This resistance is located in the area of the 0.618 Fib retracement, measured for the entire downward movement.

The NASDAQ chart looks similar to the SPX, but the drop from the ATH was stronger and the bounce from the bottom was weaker. The index reached an all-time high at $16,770 on Nov. 22, 2021. This happened less than two weeks after Bitcoin’s ATH of $69,000 on November 10.

So far, the decline has led to the $11,035 level reached on June 16, which is 34% below the ATH. The short-term bounce that took place this summer reached an area of resistance/support at $13,727 just below the 0.5 Fib retracement for the entire downward movement.

Also on this chart, a double bottom pattern is possible, but the NASDAQ would have to initiate a strong rebound. The last time we saw such low prices on the index of technology companies was in November 2020, 693 days ago.

Shorting macro support? Not the best idea

Traditional markets and cryptocurrency analyst @TrendRidersTR tweeted 4 charts: SPX, NASDAQ, Bitcoin, and altcoins. According to him, on each of them, it is currently possible to mark areas of macro support that can help stop long-term declines.

He goes on to say that “markets have reached a great risk/reward zone with clear invalidation levels.” Only if the levels marked below are lost will global markets remain long-term bearish.

Source: Twitter

Supporting the above argument is a tweet from another analyst @IncomeSharks, who looks at the behavior of retail investors in the context of the S&P 500 price. He claims that there are currently a “record number of retail shorting and buying puts. Right at major horizontal $SPX support.” The analyst expects a short squeeze and a bounce to the $4,040-4,080 range.

Source: Twitter

All eyes on the DXY

The primary determinant of the continued price action of global markets and cryptocurrencies is the U.S. Dollar Index (DXY). Its value affects not only the stock and digital asset markets but also the world’s major currencies.

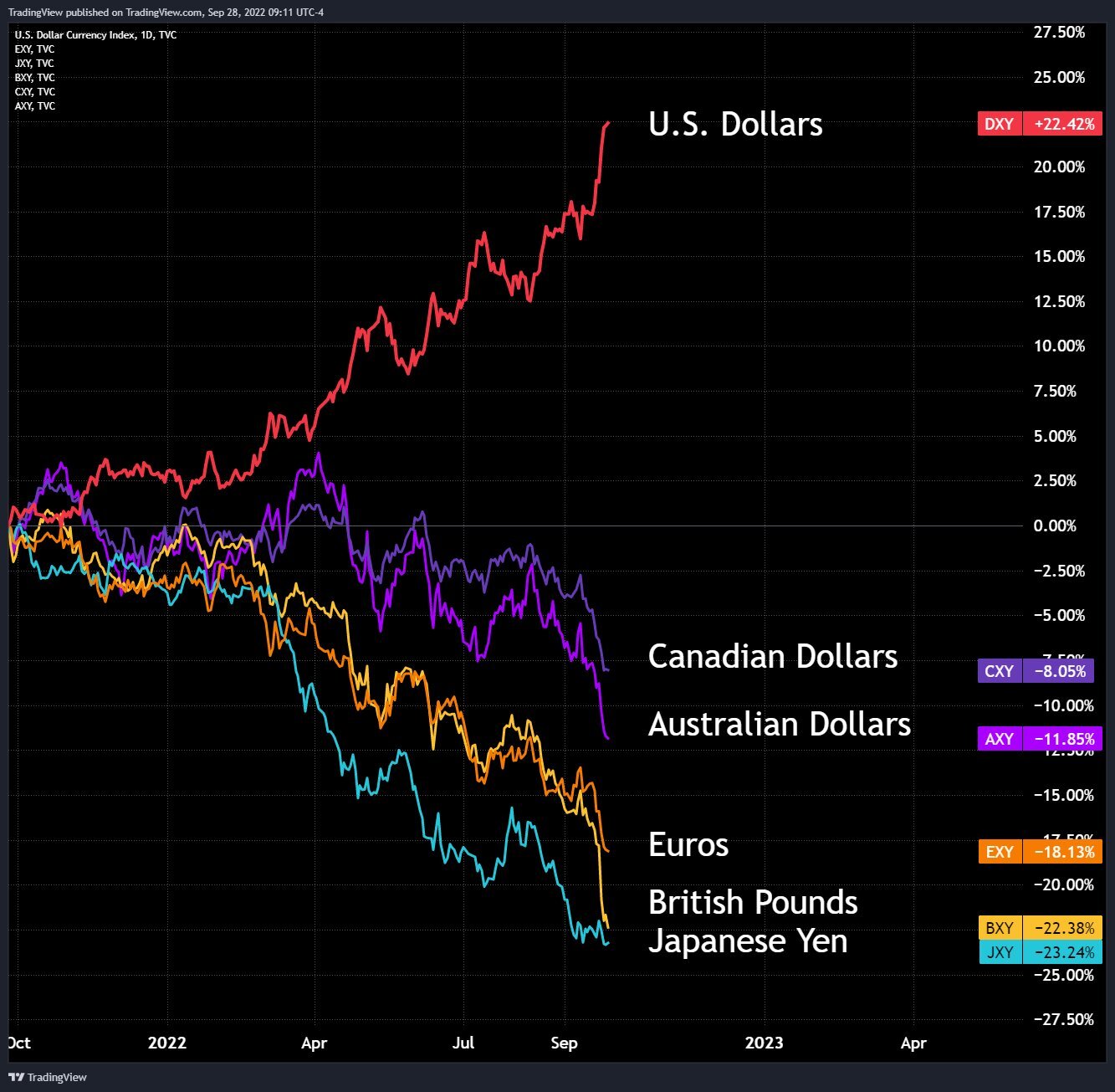

An annual chart of the USD against several major currencies was published on the official @tradingview Twitter account. It shows not only the dollar’s increasing parabola but also its negative correlation with all other currencies.

For example, the euro lost 18.13% year on year, and the Japanese yen lost as much as 23.24%. The U.S. dollar, meanwhile, gained 22.42%. The deviation already seems so great, and the recent declines so steep, that a reversal of this trend is becoming increasingly probable.

In a previous analysis, BeInCrypto pointed out that the DXY’s parabolic surge may not end before historical resistance in the 119-120 range. However, this would still imply an increase of about 6% from the current valuation, which would certainly further negatively affect markets and currencies.

For the moment, the DXY is trying to close a monthly candlestick above resistance at 113 (red rectangle). If it succeeds, reaching the 120 level in a further step would be highly likely.

Harmonic patterns to the rescue

An interesting harmonic analysis of the SPX and DXY was posted on Twitter by analyst and trader @MagicInternetM1. Harmonic patterns use geometry and Fibonacci numbers to determine precise turning points. Based on this, they try to predict future asset price movements. Gartley, bat and crab are among the most popular formations in harmonic analysis.

In the published analysis, we see a bearish bat formation on the 3-month DXY chart. Its apex D is located in the aforementioned 119-120 resistance zone. Additional confluence is provided here by the long-term 0.618 Fib retracement level.

On the other hand, a bullish deep crab formation is outlined on the weekly chart of the SPX. Here, the final D apex may have already been reached. A potential bounce could lead to the $4,050-4,100 area in the 0.382 Fib retracement level, which is also the Q1 2022 low. This area remains in confluence with the bullish target found above in the second section.

Summarizing the above analysis, it can be concluded that there are more and more signals suggesting an imminent end to the cycle of falling asset prices and the surging U.S. dollar. Although no one knows where and when the current bear market will end, the likelihood of at least a medium-term bounce is increasing.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment