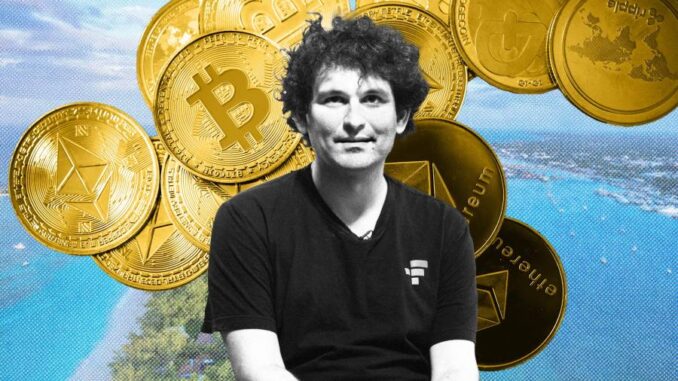

Sam Bankman-Fried chose a slice of prime Bahamas real estate to build the new headquarters of his fast-growing cryptocurrency exchange FTX, posing with a shovel alongside the Caribbean country’s prime minister in a shared embrace of the huge potential for digital assets.

Just seven months later, FTX’s spectacular collapse has sent shockwaves through an industry that promised to revolutionise finance, and shattered the credibility of the Bahamas — which put the crypto boom at the heart of its economic strategy — as a jurisdiction that properly monitors digital asset businesses.

“Crypto was going to be our way out. We could interact with the global economy in a way we couldn’t before,” said Stefen Deleveaux, of the Caribbean Blockchain Alliance, from a seafront restaurant on the island group’s north coast.

“A huge part of my work has been destroyed — and that’s because of Sam Bankman-Fried.”

The collapse of FTX, once valued at $32bn, has left venture capital firms including Sequoia Capital nursing big losses, along with potentially more than 1mn creditors. Many are ordinary investors, lured in by the opportunity to make a quick profit. The coastal site that was to be FTX’s HQ now lies abandoned, strewn with rubble and overgrown hedges.

FTX was a recent arrival to the Bahamas, setting up there just over a year ago after moving from Hong Kong. This switch was central to the Bahamas’ crypto bet as it sought to diversify away from offshore banking, which in large part has uprooted to rival jurisdictions such as the Cayman Islands.

The Bahamas “was looking for other options, and here came crypto”, said Jack Blum, a defence attorney who serves as a senior adviser to the Tax Justice Network, an advocacy group.

It proved successful, helping spearhead the island nation’s push for broader digital asset investment. Just days before FTX collapsed, rival exchange OKX announced that the Bahamas would be its new regional hub after securing registration from its regulators.

In the same month that FTX’s founder was breaking ground with prime minister Philip Davis, the company hosted a lavish crypto gathering at the country’s Baha Mar resort. The guest list was a “who’s who” list of names who helped propel Bankman-Fried to his status as crypto’s flag bearer, including Bill Clinton and Tony Blair, as well as pop star Katy Perry and NFL legend Tom Brady.

“There had been large conferences before, but this was beyond any of that,” Deleveaux recalled, noting how the crypto crowd were the country’s “golden children”. “Everything they did seemed incredibly professional,” he said.

Yet in Nassau, the capital situated on New Providence island, where financiers rub shoulders with tourists disembarking from one of the many cruise ships, a once promising crypto scene has barely left a physical footprint. This is partly because Bankman-Fried and his associates ran FTX from his penthouse nestled in Albany, an exclusive luxury resort in the isolated south-west of the island.

FTX’s unravelling has shone a harsh spotlight on the Bahamas, and those in power there who have sought to distance themselves from the fallout. Davis last week defended the Securities Commission of the Bahamas, the country’s chief watchdog, in an address to parliament, saying he had “not identified any deficiencies” in the island nation’s regulatory approach.

Yet Bankman-Fried’s successor at FTX, John Ray III, said he had never seen “such a complete failure of corporate controls and such a complete absence of trustworthy financial information”. Sam Trabucco, the one-time co-chief executive of FTX’s sister firm Alameda Research, described conditions at the Albany penthouse, where work and leisure mixed freely, as “toxic”.

Bankman-Fried, now rapidly transformed into the industry’s leading villain, has made repeated attempts on social media to explain himself, but remains out of the public eye. He did not return a request for an interview from the Financial Times.

Ordinary Bahamians have been left reeling by the rapid turn of events. One local who worked at the Baha Mar resort said he was “still trying to figure out how something going so well could crash so quickly”.

John Christensen, an economist and offshore finance specialist, was scathing over how FTX was given, in his view, free rein to operate.

“[The authorities] turn a blind eye to these things, it’s good business, it all appears to be going smoothly until it’s not. If the prime minister can’t see that a massive failure has happened on his watch, then he’s failing in his duty,” he said.

The desire to protect its reputation seems to have bled into the Bahamas’ close-knit communities. Michael Pintard, leader of the Free National Movement, the main opposition, said it was “entirely too early” to say what impact the Bahamas’ regulation of crypto might have.

Several Bahamian law enforcement officials declined to comment on FTX or its founder. The Securities Commission of the Bahamas declined a request for an interview.

One Bahamian, pressed for insights surrounding the FTX collapse, said there was little appetite on the island nation to criticise the authorities publicly. “You could upset the wrong person and you might not even realise how that impacts you and your business,” the person said.

Christensen added: “If the regulator is seen to be too actively engaged in trying to understand the business models, looking at the risks, then that is seen somehow as ‘anti-business’.”

Yet Clement Stanley, a taxi driver in the capital, took issue with those who run the Bahamas for not safeguarding the nation’s good name. He said the group of islands is the “crown jewel of the Caribbean . . . we have to protect that reputation at all costs. We’re taught that as kids.”

His concern was for ordinary Bahamians, who unlike Bankman-Fried were never given a fair chance to succeed. The authorities do “so much due diligence on ‘the little guy’,” he noted, but much less so for the new crypto incomers.

“I wish they’d give guys like me a chance,” he said.

Be the first to comment