Bitcoin (BTC) traded sideways at the Jan. 24 Wall Street open, with analysts at a loss over where the price would go next.

BTC price holds below key resistance

Data from Cointelegraph Markets Pro and TradingView tracked a day of consolidation for BTC/USD, which continued to linger near $23,000.

The pair saw little reaction to the start of trading, including technical problems at the New York Stock Exchange, while United States macroeconomic data also failed to change the status quo.

Bitcoin thus lacked direction after establishing a narrower trading range on Jan. 20.

“Bitcoin couldn’t break through a crucial resistance at $23.1K,” Cointelegraph contributor Michaël van de Poppe summarized.

“If we continue to make LHs, we’ll probably test and sweep around $22.3K before continuation. Grants some serious buying opportunities.”

A subsequent Twitter survey showed just how torn the average market participant was regarding where the market might head next. At the time of writing, 47.8% of around 4,000 responses agreed that a correction should take place on Bitcoin, with the remaining 52.2% betting on a trip to $25,000.

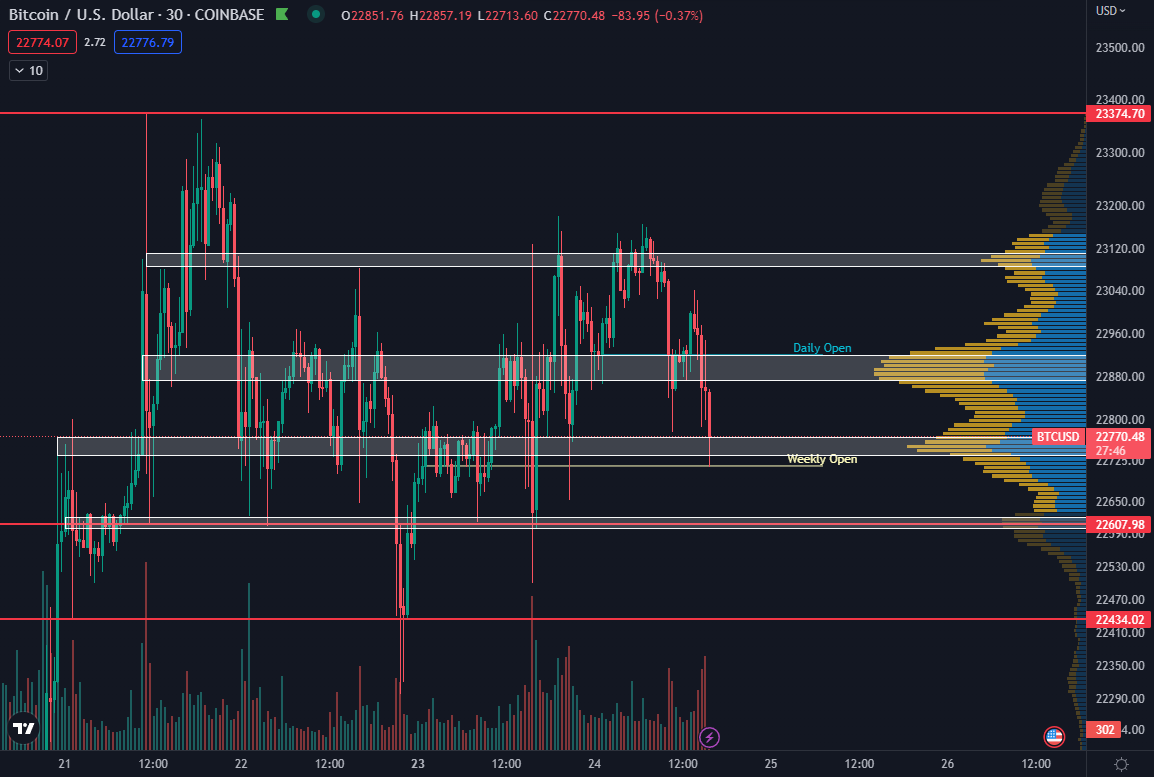

“Choppy price action without a clear pattern or direction,” trader Daan Crypto Trades continued alongside a chart with targets.

“On the intra-day I’m mainly watching these white area’s being the high volume nodes together with the Daily and Weekly open. Expansion above 23.1 and below 22.6K. Chop until then.”

Discussing the likelihood of upside continuation, fellow trader Gaah, meanwhile, highlighted $24,000 as an important level to watch.

Earlier, Cointelegraph had reported on the significance of the surrounding area, this being a site for short liquidations with Bitcoin’s 200-week moving average above.

“The first positive sign for reversal is $20.8k becoming floor. The second positive sign is $24k becoming the next floor,” part of Gaah’s analysis read.

Bitcoin sends hodlers into the black

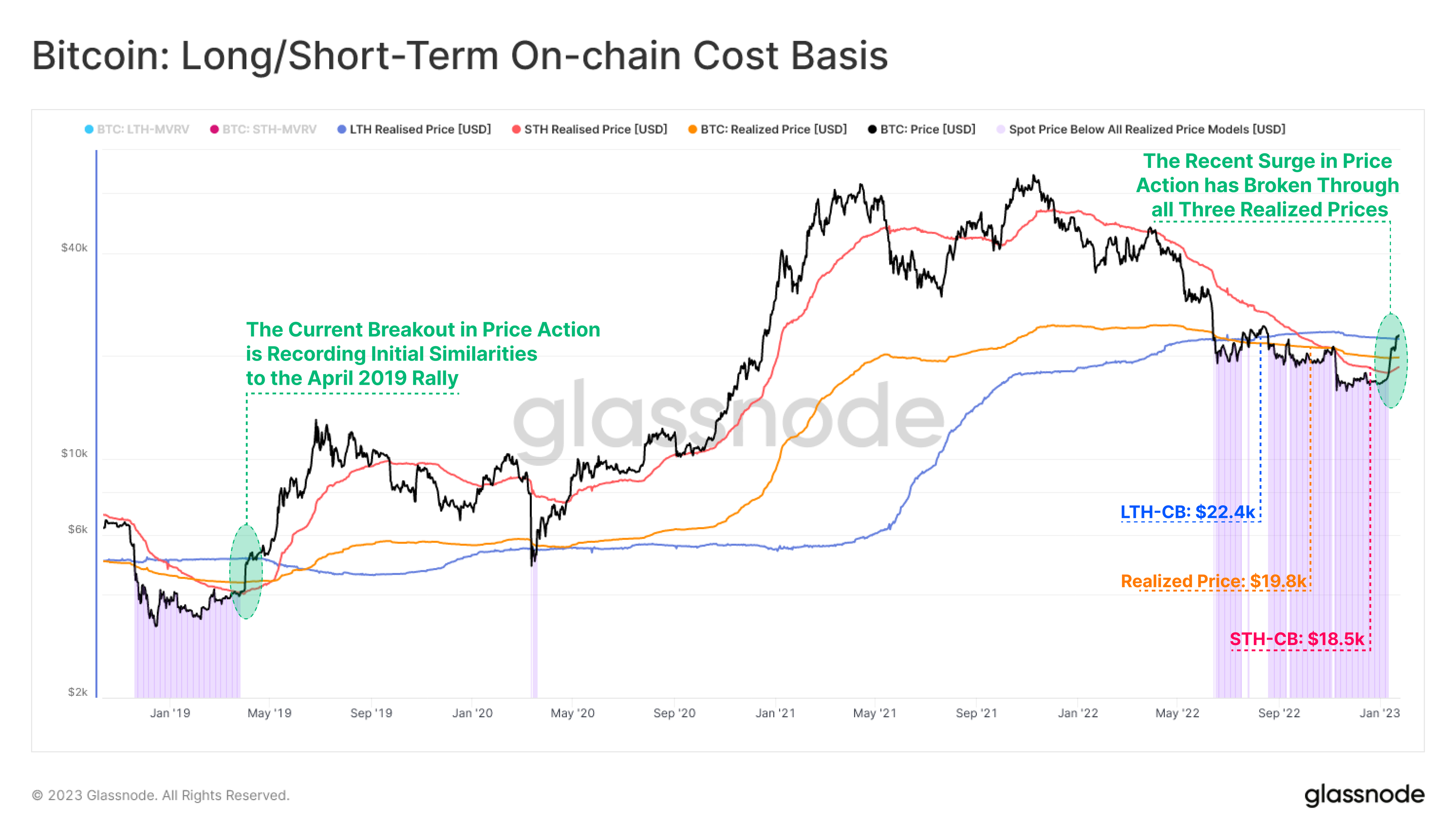

Zooming out, it was on-chain analytics firm Glassnode tha was cautiously optimistic about the significance of the BTC price breakout.

Related: BTC metrics exit capitulation — 5 things to know in Bitcoin this week

In hitting current levels, it noted, BTC/USD had surpassed three key trend lines in one fell swoop, this not occurring since March 2020.

“The recent surge in Bitcoin price action has resulted in an initial breakout above all three cost-basis for the first time since the 2018/19 bear market and the March 2020 Covid crisis,” accompanying comments read.

“A sustained duration above these key psychological levels would be considered constructive.”

The chart showed the cost bases — the aggregate price paid — for short-term and long-term Bitcoin holders, along with the realized price that reflects the aggregate price at which the supply last moved.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Be the first to comment