Shiba Inu’s (SHIB) price has followed the broader market cues registered red candlesticks daily.

The resulting drawdown led to considerable losses for the meme coin investors, who plan to take it back.

Shiba Inu Investors Lose Big

Shiba Inu’s price has declined by nearly 40%, which has caused more damage than anticipated. One of the biggest blows was the billions of dollars worth of loss endured by SHIB holders.

According to the Global In/Out of the Money (GIOM) indicator, nearly 424 trillion SHIB worth more than $7.3 billion slipped into losses. This supply was bought between $0.00001700 and $0.00001900. As the meme coin fell over the past month, it dragged this supply along with another 190 trillion SHIB down to bearing losses.

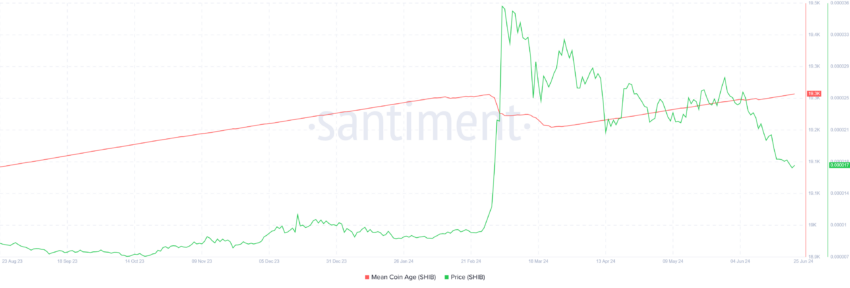

The investors, however, are not disheartened by this loss and intend to reclaim their profits. Evidence of the same can be found in Mean Coin Age (MCA). Mean coin age measures the average age of all coins in the network, reflecting the time since they were last moved.

A higher mean coin age typically indicates a trend of holding, while a lower age suggests increased trading activity. Since SHIB is maintaining the uptick, the meme coin investors seem to be HODLing their assets for now.

Read More: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

This is a good sign as it suggests that Shiba Inu investors are highly conviction-based, which could enable recovery.

SHIB Price Prediction: Consolidation Ahead

Shiba Inu’s price is likely to surge in the coming days, but this will be limited by the resistance level at $0.00002093. Just above the key price level of $0.00002000, the altcoin has tested it as a support floor multiple times in the past.

SHIB will thus remain consolidated under this and would require strong bullish cues from the market to breach it.

Read More: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

On the other hand, if the decline continues, the meme coin could drop to $0.00001473. This price point marks the critical support floor for Shiba Inu’s price. Losing it could invalidate the bullish-neutral thesis completely.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment