Este artículo también está disponible en español.

SUI has experienced an impressive surge of over 160% since the start of September, with its price now hovering around $2. This remarkable rally has analysts and investors highly optimistic about the future of the layer-1 blockchain. Beyond its soaring price, SUI is showing strong growth across key metrics, signaling increasing adoption and usage.

According to data from DefiLlama, SUI’s total value locked (TVL) has reached new all-time highs, indicating a robust demand for its decentralized finance (DeFi) ecosystem. The rising TVL highlights a growing interest from users and developers, further boosting confidence in SUI’s long-term potential.

Related Reading

The price surge is not just driven by market sentiment but is backed by tangible growth in the platform’s fundamentals. With both TVL and user engagement increasing, the positive outlook for SUI continues to build. Investors are now eyeing higher price targets as they anticipate further growth for the layer-1 blockchain in the coming weeks.

As SUI pushes to higher levels, its performance reflects both strong market support and underlying network growth, making it one of the most talked-about projects in the crypto space.

SUI TVL Signals Ongoing Rally

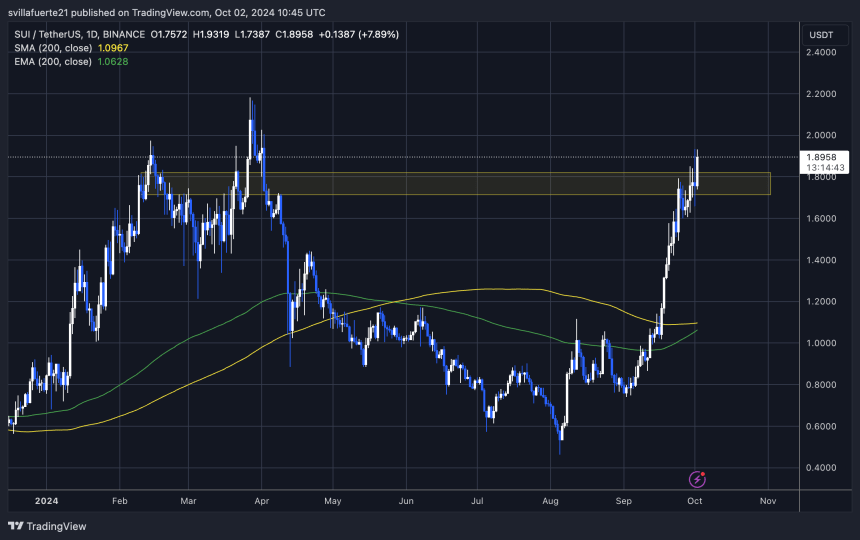

SUI is currently testing a crucial supply level around the $2 mark, a psychological barrier that, once surpassed, could pave the way for a surge to new highs.

Analysts are watching this level closely, as breaking through it would likely trigger a strong bullish move. On-chain data from DefiLlama supports this optimism, revealing that SUI’s total value locked (TVL) has reached an all-time high of $1.07 billion. This marks a remarkable 65% increase in TVL over the past 30 days, signaling growing confidence in the platform’s utility and long-term potential.

The rise in TVL is a net positive for the SUI coin, as it reflects the increasing adoption of the Sui ecosystem. As more value flows into the network, the demand for SUI tokens will likely grow, creating upward pressure on its price. Investors often view rising TVL as a bullish signal, suggesting that the platform is gaining traction and trust among users.

Related Reading

If these positive trends in TVL and overall network activity continue, a rise above SUI’s previous all-time high of $2.16 seems likely in the coming weeks. With momentum building, many expect SUI to achieve further gains, reinforcing its position as a leading layer-1 blockchain.

Price Action: Liquidity Levels To Watch

SUI is currently trading at $1.89, just 15% away from its all-time high of $2.18. The recent price action has been promising, with an 8% surge in the past hours. Many analysts believe that if SUI can break above the critical $2 level, the chances of reaching new all-time highs are very high. This psychological barrier could trigger a wave of buying pressure, pushing the price to new levels.

However, some investors are cautious, expecting a healthy correction before further upward movement. If SUI fails to break past the $2 mark, a retracement to support levels around $1.60, or even down to $1.45, would not be unexpected. Such a correction could provide a solid foundation for the next bullish leg, allowing SUI to gather momentum before attempting to breach the $2 resistance again.

Related Reading

Despite this, the overall sentiment remains optimistic, with many investors holding out for a new all-time high shortly. SUI’s recent performance and market dynamics suggest that the coming days will be crucial for determining its next move.

Featured image from Dall-E, chart from TradingView

Be the first to comment