The crypto market has lost momentum after the extended weekend in the United States. Bitcoin and other larger cryptocurrencies have been recording losses during today’s trading session and could continue to trend downside in the short term.

Related Reading | TA: Ethereum Regains Strength, Showing Early Signs of Fresh Rally

At the time of writing, the crypto total market cap stands at $860 billion with sideways movement over the past weeks. This metric has been trending to the downside since late 2021, but took a severe loss in April-May 2022, as seen in the chart below.

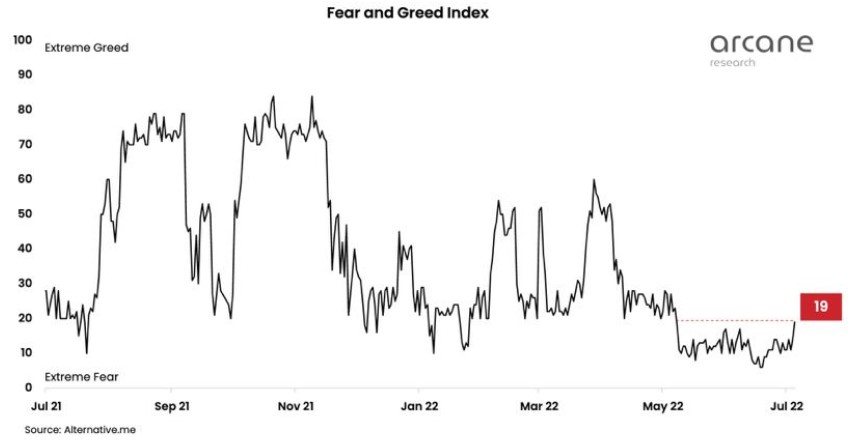

As a consequence, the general sentiment across the crypto market trended to the downside and recorded extreme fear levels on the Fear and Greed Index. The price of Bitcoin and other larger cryptocurrencies often finds a local bottom or top when the Index stands close to 10 or 80 respectively.

The crypto market did find a bottom in June when BTC’s price traded close to $17,000 and pushed the Fear and Greed Index to extreme levels. Since that time, the number one cryptocurrency has pushed the market slightly upwards and has been forming a new range between $18,600 and $21,000.

These levels stand as the major area of resistance along with $22,000. Market participants seem more positive on a probably break above these levels, according to a recent report from Arcane Research. The first stated the following on the shift in market sentiment over the past weeks:

The sentiment in the crypto market has been depressed for several months, but we’re seeing a slight improvement this week. After the Fear and Greed Index climbed to 19 yesterday, we’re at the highest point in two months. While we’re still comfortable in the “Extreme Fear” area, we’re now pushing towards the “Fear” area, and the market is slightly more optimistic (…).

Ready For More Crypto Downside?

The crypto total market cap and the performance of the altcoin market are bound to BTC, ETH, and larger cryptocurrencies. As NewsBTC has been reporting, the sector is currently impacted by macro-economic factors; rising inflation, and interests rates hikes by the U.S. Federal Reserve (FED).

These factors’ influence over the market must mitigate before the nascent asset class can decouple from traditional finances. In the meantime, any bullish momentum will remain susceptible.

Related Reading | Cardano Releases New Update On Testnet, How Will The Price Respond?

If the price of Bitcoin is unable to push above $22,000 soon, the market could see a decline in the Fear and Greed Index. Data from Material Indicators and their Trend Precognition Indicators suggest it is likely to see a re-test of lower levels. Via Twitter, the analysts wrote:

BTCUSDT and ETHUSDT were both rejected at the 21 Day Moving Average and now we see the Trend Precognition A1 Slope Line rolling over on the D chart indicating a short term loss of momentum.

Be the first to comment