Ethereum price is currently trading at $1,565 as altcoins struggle to stay afloat amid bearish tailwinds. Can the recent 100 million user milestone propel ETH price to new all-time highs?

Ethereum’s recent network adoption milestone has coincided with bearish headwinds from the escalating crisis in the Middle East. On-chain metrics provide data-driven insights into Ethereum’s potential price action for the weeks ahead.

Ethereum Reaches 100 Million Non-Zero Balance Addresses

When Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS) consensus, the major premise was to mitigate energy demands, reduce fees, and deepen global adoption.

Since The Merge on September 15, 2022, the Ethereum network’s energy consumption has reduced by a self-reported 99.988%. Average Transaction Fees dropped to a 3-year low. And now, global adoption has skyrocketed to a new milestone.

Ethereum reached an all-time high of 100 million non-zero balance addresses on October 16, according to on-chain data compiled by IntoTheBlock.

A deeper dive into the data shows the ratio of non-zero balance addresses has increased considerably since the Ethereum Merge.

The chart below shows that only 30% (57.64 million of 192 million) of total Ethereum addresses held at least 1Gwei balance as of September 15, 2022.

As of October 19, 2023, the number has increased to 37%, as 100.07 million of 270 million total ETH addresses now hold an active balance.

Non-Zero Balance Addresses are crypto wallets or accounts on a blockchain that currently hold a positive balance of the native currency.

These accounts currently hold some units of ETH and are distinguished from empty or unused addresses with zero holdings.

This significant increase in Non-Zero Balance Addresses indicates growing adoption and global interest in Ethereum. This visible bullish signal could potentially drive up Ethereum market demand and, subsequently, the price.

Notably, the timing of this surge in the Non-Zero balance addresses has coincided with the Ethereum Merge. This suggests that reduced transaction fees and energy-consumption optimization have successfully lowered the entry barriers and attracted new active investors.

Ethereum is Attracting Unusually High Transactions From New Users

The 100 million Non-Zero Balance milestone implies that many new users have joined the Ethereum ecosystem. Interestingly, the “New Adopters’ Participation Rate” further affirms that new ETH investors are already playing a big part in daily economic activity.

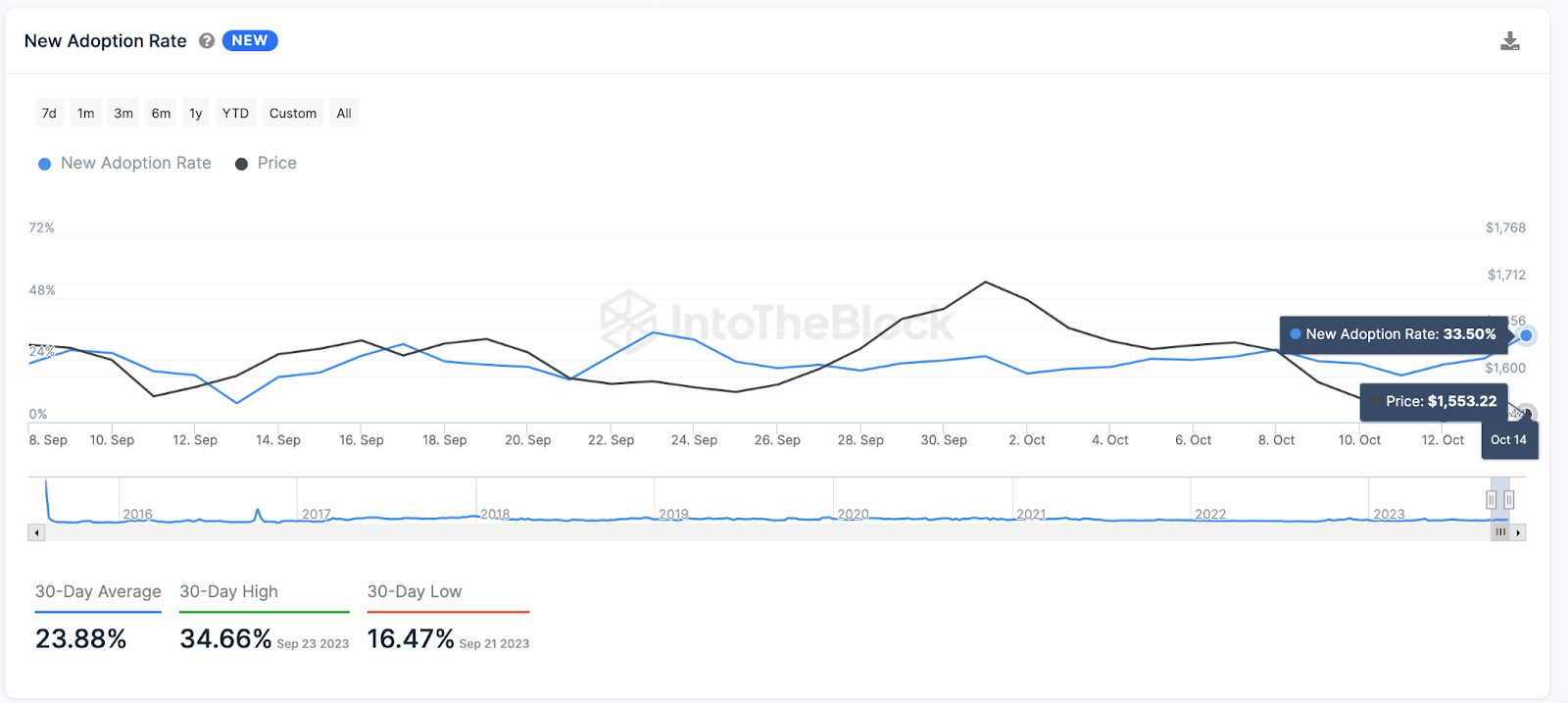

New Adopters’ Participation rate on the Ethereum network rose as high as 34% on September 26 and October 14, respectively. The last time this happened in two consecutive months was in October and November 2022.

The “New Adoption Rate” metric evaluates the percentage of addresses that made their first-ever transaction out of all active addresses on a given day.

This provides a clear insight into how the newcomers’ transactional activity has been driving up the Ethereum network demand.

Unsurprisingly, ETH has held firm at the $1,500 support amid the growing bearish FUD from the escalating Middle East crisis.

The data confirms that newcomers’ transactions have been pivotal in recent weeks.

Ethereum Price Prediction: The $1,600 Territory is Within Reach

From an on-chain perspective, the spike in the number of new investors and their transactional activity puts ETH in a prime position to break into a new all-time high, targeting $5,000 during the next bull rally.

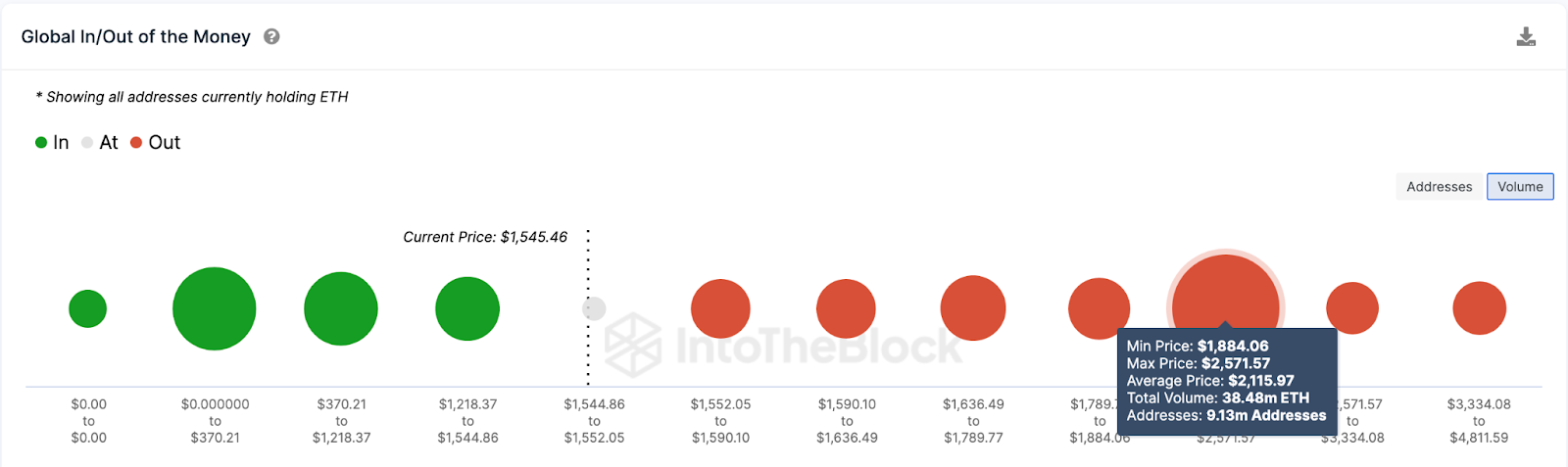

The Global In/Out of the Money data, which groups all current Ethereum holders by their entry price distribution, also confirms this narrative. It shows that the giant sell-wall at $1,900 is the main obstacle between ETH and a new all-time high.

As depicted below, 9.13 million addresses had bought 38.48 million ETH at the minimum price of $1,884. They could trigger an ETH price reversal from that range if they opt for early profits.

Since Ethereum’s share of non-zero balance addresses has increased to 37%, the New Adopter’s participation rate has the potential to surpass 35% consistently.

This could propel the ETH price above the $1,900 resistance in the mid-to-long term.

But on the downside, the bears could push for an Ethereum price reversal below $1,400. However, the growing network demand could fortify the initial buy-wall at $1,500. If that buy-wall holds as expected, ETH price could rebound.

But if, against the odds, the bears flip that support level, an ETH price drop toward $1,400 could be on the cards.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

Be the first to comment