Bank-induced financial mayhem has triggered an array of reactions signaling depleted trust in centralized banking bodies. Thus, giving rise to a “TradFi winter.” Can crypto like Bitcoin rise to the occasion amid discouraging steps from regulators?

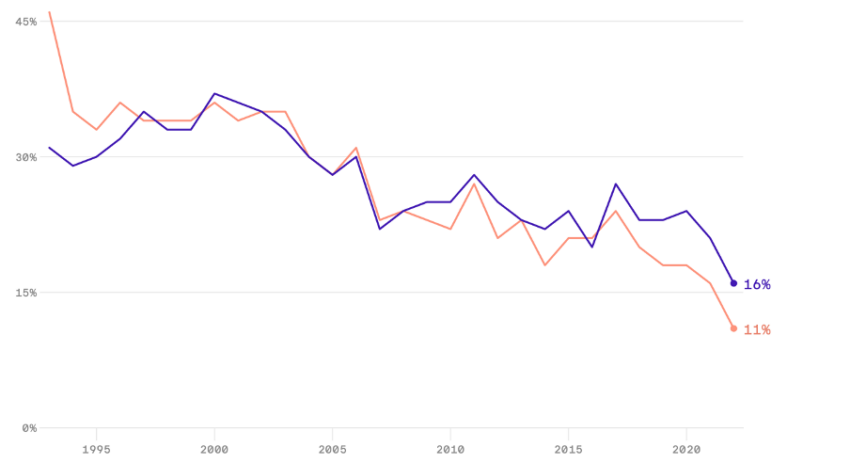

The traditional finance (TradFi) industry has faced challenges recently, including increased regulation, competition from fintech firms, and changing consumer preferences. One of the industry’s biggest concerns is the possibility of a sudden financial crisis, similar to the 2008 global meltdown. Banking institutions have struggled to regain trust following the great recession.

This concern has been amplified by the COVID-19 pandemic, which exposed weaknesses in the financial system and increased the likelihood of a financial debacle.

One of the most significant risks facing the TradFi industry is the possibility of a bank run. A bank run occurs when many depositors withdraw their funds at once, causing the bank to run out of cash and potentially leading to its collapse. Various factors, including rumors of financial instability, concerns about the safety of deposits, and changes in government policies, can trigger bank runs.

Deep Uncertainty

The risk of bank runs has increased in recent years due to several factors. One is the increased interconnectedness of the global financial system. Banks are now more interconnected than ever, with complex financial instruments linking them in a web of financial obligations. This means that if one bank fails, it can trigger a cascade of failures across the system.

Another factor that has increased the risk of bank runs is the growth of shadow banking. Shadow banking refers to providing banking services outside of traditional banking channels, such as through hedge funds, money market funds, and other non-bank financial institutions. Shadow banking is often less regulated than traditional banking and can be more vulnerable to financial shocks.

The COVID-19 pandemic further upped the risk of bank runs by exposing weaknesses in the financial system. Many governments implemented lockdowns and other measures that severely affected the economy during the pandemic. This led to a sharp decline in economic activity, which reduced the value of many financial assets.

Immense Pressure

The decline in asset values has put pressure on banks and other financial institutions, as they are often heavily invested in these assets. This has increased the risk of bank failures and made bank runs more likely. In addition, the pandemic led to an increase in unemployment, which reduced the ability of consumers to repay their debts. Of late, bank account holders of all sizes are now dealing with a novel risk after the high-profile collapse of Silicon Valley Bank (SVB).

This has put further pressure on the financial system and heightened the risk of economic instability. Traditionally, the financial industry remains heavily regulated and centralized, with banks and other institutions acting as intermediaries between customers and financial markets. However, in recent years, decentralized finance (DeFi) has become increasingly popular with the emergence of blockchain technology and cryptocurrencies. DeFi is built on a decentralized infrastructure that allows for peer-to-peer transactions without intermediaries.

While DeFi has brought about several benefits, such as increased transparency, accessibility, and reduced costs, it has also been associated with risks such as price volatility, scams, and hacks. Some argue that traditional finance is adopting some of these negative aspects of DeFi, leading to a “TradFi winter.”

TradFi Winter Is Bad News

The former Coinbase CTO Balaji Srinivasan tweeted a report from the research arm of New York-based AllianceBernstein. Herein, Srinivasan raised red flags around banks, calling out the industry.

“Tradfi is taking on some of the worst aspects of Defi. I call this Tradfi winter.”

Drawing a few parallels, he criticized regulators for not alerting users of a potential bank failure. He also noted the opaque reporting nature of banking institutions:

“Prior to the printing, banks used accounting tricks to fool themselves and others into thinking they have liquid assets to meet withdrawals. It’s Uncle Sam Bankman Fried.”

By the time the news gets aired by a reputed reporting agency, “it’s often too late,” he added. These instances have led to a systemic loss of trust in western banking, similar to the loss of trust in western media.

In conclusion, the former Coinbase executive called it “Low trust banking, low trust society.”

A Few Options

People now realize the dangers of hyper-speed bank runs that can be magnified by social media and instant payment systems. The Federal Reserve is willing to step in and provide liquidity to troubled banks, but that comes at a cost. Ergo, depositors have good reason to look for other options, thereby minimizing financial complexity to the extent possible.

Can crypto such as Bitcoin help? The niche yet growing asset class has seen a mammoth surge in its value since its inception. Bitcoin and other cryptocurrencies have the potential to address some of the counterparty risks that bank customers may face. One of the benefits of Bitcoin is that it allows for peer-to-peer transactions without the need for a trusted intermediary such as a bank.

This means that users can transact directly with each other, which can reduce the counterparty risk associated with traditional banking transactions. But again, crypto is still a new face in this game. The report states:

“The simplicity of crypto as digital bearer assets solves for the immediate counter-party risks that bank customers are dealing with, but customers also require stability of value. And thus, Bitcoin, as a digital bearer asset, may not immediately appeal to customers who view stability in nominal USD terms.”

Obstacles on the Crypto Path

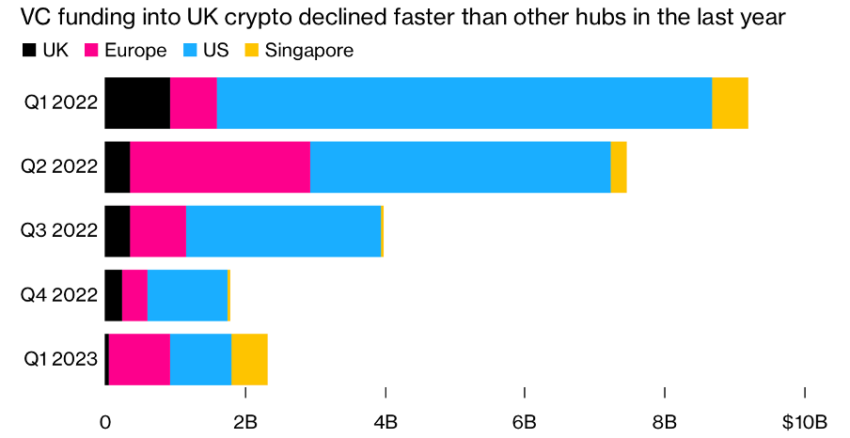

Bitcoin, or crypto’s potential in general, is immense. But the course to reach its potential is full of obstacles. Regulators across the globe have taken immediate steps to disregard crypto. In March, the White House called out crypto for possessing no fundamental value. Recently, the UK government undertook measures to discourage crypto growth in the region.

Crypto companies are generally subject to myriad restrictions and regulations that vary by jurisdiction. Some conditions that crypto companies may face include the following:

Licensing requirements: In many jurisdictions, crypto companies must obtain a license to operate as a money transmitter or digital asset exchange.

Anti-money laundering (AML) and Know Your Customer (KYC) requirements: Crypto companies must comply with AML and KYC regulations, including identity verification, transaction monitoring, and reporting suspicious activity.

Capital requirements: Some jurisdictions may require crypto companies to maintain a certain amount of capital to operate.

Taxation: Crypto companies may be subject to taxation on their profits and may need to report their transactions to tax authorities.

Security and privacy requirements: Crypto companies must protect user data and prevent unauthorized system access.

Failure to comply with these restrictions and regulations can result in penalties, fines, or criminal charges. Additionally, some crypto companies may face additional challenges, such as difficulty obtaining banking services or having their accounts frozen by financial institutions due to perceived risks associated with the industry.

The paperwork burden can also be significant, particularly for companies that operate across multiple jurisdictions or that offer a wide range of services.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

Be the first to comment