The litany of applications for a spot Ethereum exchange-traded fund (ETF) has positively impacted Grayscale’s Ethereum Trust (ETHE).

The rising interest has significantly increased trading volume across various crypto exchanges, narrowing ETHE discount to under 15%, its lowest level this year.

Grayscale’s Ethereum Trust Discount Falls

The discount on Grayscale’s Ethereum Trust has narrowed to 13.94% as of November 10, according to data from Coinglass. This represents a massive turnaround for an asset whose discount was as much as 60% earlier this year.

ETFStore president Nate Geraci posits that this contraction in the discount signals the market’s anticipation of a spot Ethereum ETF. He believes the narrowing discount is a real-time indicator akin to a “live betting line.” Therefore, forecasting the possibility of approval of an ETF.

In recent months, the US Securities and Exchange Commission (SEC) has been reviewing applications for spot ETFs covering major cryptocurrencies, including Bitcoin and Ethereum. The regulator received several applications from leading traditional financial institutions such as BlackRock and Grayscale.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

These applications have contributed to the current bullish sentiments in the crypto market, propelling Bitcoin to a yearly high of nearly $38,000 and Ethereum above $2,000. Notably, they have also substantially reduced discounts for Grayscale’s Bitcoin and Ethereum Trusts, which presently do not support redemptions.

Observers believe that the discounts in Grayscale’s Trust would be closed if the SEC approved its applications to convert them into ETFs.

Spot Ethereum Trading Volume Soars

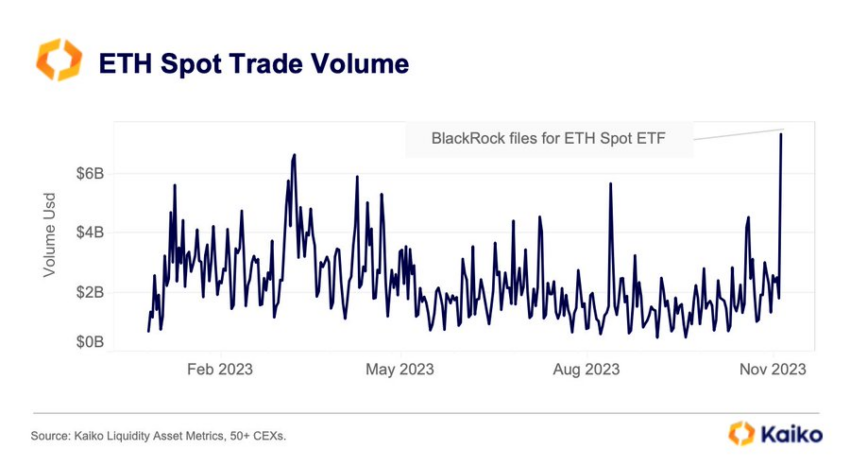

The ETF-driven rally has catapulted Ethereum trading volume over $6 billion, a milestone not seen since FTX collapsed last year. This surge follows a comparable increase in March, when it briefly surpassed $6 billion, according to data from Kaiko.

The rising trading volumes also suggest crypto investors are heavily trading Ethereum again after a lull for most of the year.

Read more: How To Buy Ethereum (ETH) With a Credit Card: A Step-by-Step Guide

Recently, the crypto market witnessed a transformative journey, with the recent ETF-inspired rally reversing the fortunes of several crypto assets, pushing them to new highs. Data from BeInCrypto shows that ETH is trading at $2,052 as of press time, up 12% during the past week.

Top crypto platforms in the US | November 2023

Paybis

No fees for 1st swap →

iTrustCapital

Crypto IRA →

Coinbase

$200 for sign up →

Uphold

No withdrawal fee →

eToro

$10 for first deposit →

BYDFi

No KYC trading →

The post Grayscale’s Ethereum Trust Discount Narrows Amid Rising ETH Trading Volume appeared first on BeInCrypto.

Be the first to comment