Central banks in countries that face a risk of being sanctioned by the US could shift their international reserves to include bitcoin (BTC), a new Harvard University research paper has argued.

The research paper based the idea of central bank risk hedging with bitcoin on the fact that many central banks – and in particular those facing a higher risk of US sanctions – in recent years have increased the share of their reserves made up by gold, a traditional central bank reserve asset.

According to the author, adding a BTC allocation in addition to gold would further increase the resilience against sanctions for these countries. This is especially true in cases where the country struggles to acquire enough physical gold, the author argued.

Titled Hedging Sanctions Risk: Cryptocurrency in Central Bank Reserves, the newly published research paper is written by Matthew Ferranti, a PhD candidate in economics at Harvard University.

“The ability of fiat reserve issuers to freeze transactions, which constitutes a form of de facto default on the underlying obligations, calls into question fiat reserve currencies’ status as ‘safe haven’ assets,” Ferranti wrote.

Ukraine war could make central banks more interested in Bitcoin

In the paper, Ferranti pointed to the freezing of Russia’s international central bank reserves in the aftermath of the invasion of Ukraine as an example of why this question is now more relevant than ever.

“[…] it is timely to explore the question of how, and to what extent, the risk of financial sanctions may motivate changes in central bank reserve composition,” the PhD candidate noted in the paper.

Proof-of-work is censorship-resistant

Ferranti also noted in his paper that bitcoin, as a proof-of-work-based digital asset, is particularly useful as a sanction hedge.

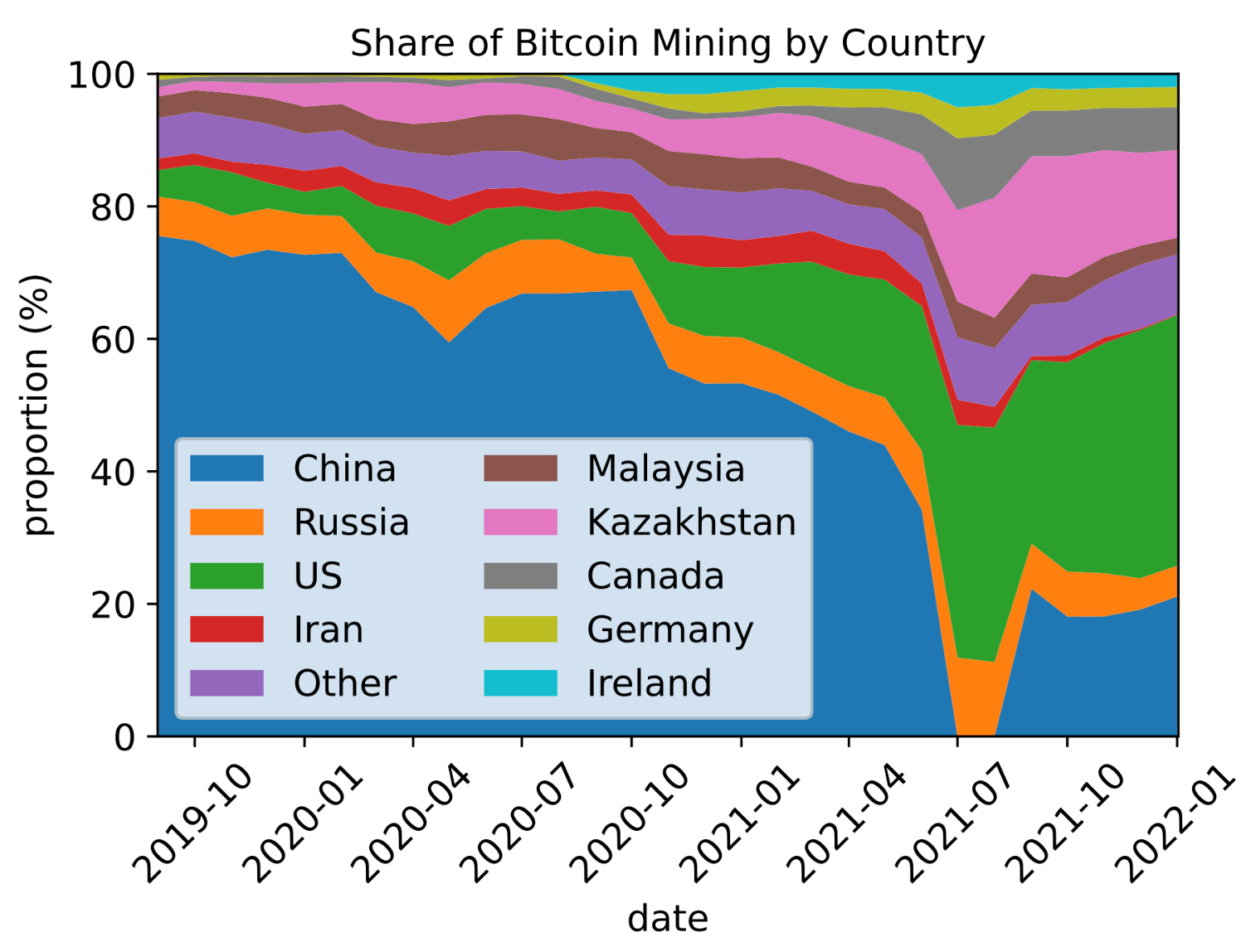

“Under a proof-of-work system, the ability to censor transactions on the blockchain requires achieving ‘majority hash power,’ meaning that the censor must control at least 51% of the computing power employed by all miners,” the paper said.

It added that achieving such a status is unfeasible “due to the sheer quantity of computing power dedicated to Bitcoin mining, as well as the amount of electricity required to power the mining chips.”

In conclusion, Ferranti admitted that no asset is “totally safe” in the presence of sanctions, but that cryptocurrencies like bitcoin can offer “some protection,” although the protection comes with higher volatility.

Be the first to comment