Bitcoin is currently in a very wobbly position. The price action remains just above fragile support in the $25,000 area. Its loss could lead to a sharp decline.

On the other hand, the uptrend, which has been in place since the beginning of 20203, does not seem to be broken. There is a chance that holding this level will initiate a bounce, which could eventually lead to a breakout through resistance at $30,000.

Both scenarios seem possible with on-chain analysis. The realized price and historically low volatility suggest that a big move in the cryptocurrency market is coming. The price of BTC could retest $20,000.

Realized Price in Bitcoin Historical Cycles

The realized price of Bitcoin is an indicator that divides the realized market capitalization by the current supply. In turn, the realized capitalization values different parts of the supply at different prices (instead of using the current daily close). Specifically, this metric computes by valuing each UTXO at the price when it was last moved.

We see cyclical similarities in a long-term chart of the realized price against the daily BTC price action. First of all, in each cycle, the market capitulation period began when the BTC price dropped below the realized price (red circles).

At the same time, this was always the last stage of the bear market, where each time, the Bitcoin price established the macro bottom of the full cycle.

Then, we see that the opposite event – the breakout of the BTC price above the realized price (green circles) – started a long-term bull market. From then on, Bitcoin price (rarely) fell below the realized price until the end of the bear market of the next cycle.

The only exception is March 2020, when the price of BTC also declined sharply due to the COVID-19 crash in global markets. Then, the largest cryptocurrency made a bullish retest of the realized price (blue circle). This moment turned out to be an excellent buying opportunity.

Looking at the events of the current cycle, we see these similarities. Bitcoin dropped below the realized price in June 2022. It then oscillated around this line for a long time before capitulating with the collapse of the FTX exchange in November 2022.

In contrast, as early as January 2023, BTC broke the downward trend and initiated a bounce. It led to a recovery and a quick retest of the realized price line.

Will BTC Retest $20,000?

Currently, the price of Bitcoin is at a key support in the $25,000 area. Technical analysis suggests that a drop to the next support at $23,500 is possible if it is lost. However, can BTC dip even lower and retest $20,000?

The realized price chart alone shows that such a possibility is in the cards. Currently, the indicator is almost exactly in this area. Therefore – if a scenario similar to March 2020 were to play out – the BTC price could still dip below $20,000. If the analysis of Bitcoin cycles is correct, this would be an excellent buying opportunity.

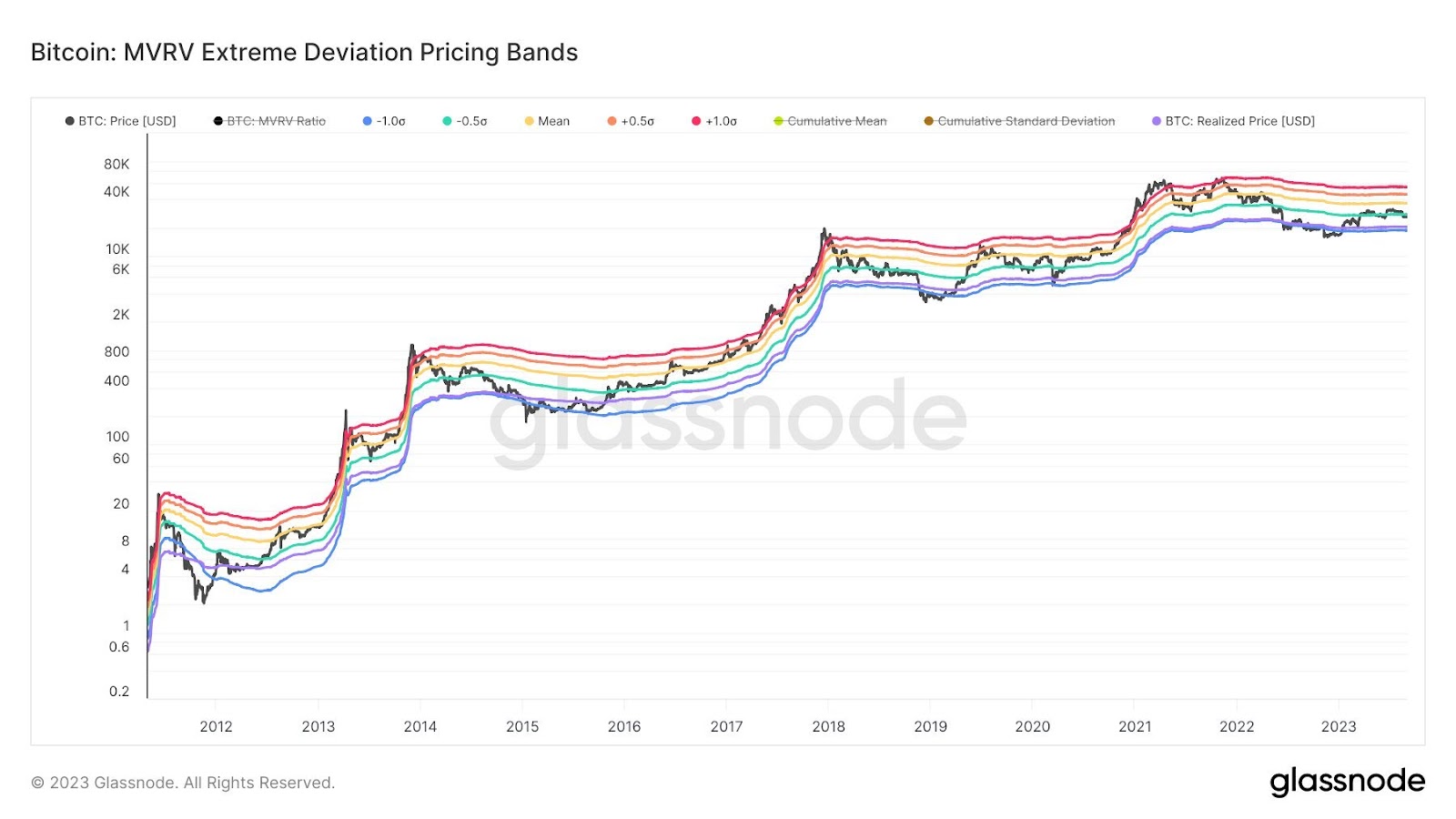

Moreover, famous analyst @WClementeIII published yesterday on X a long-term chart of the BTC price and color bands based on various on-chain indicators. He believes that:

“Bitcoin is in a tricky spot from a HTF [High Time Frames] valuation perspective across multiple metrics.”

He does not rule out a drop to the lower range (purple and blue lines). The purple line on his chart is our realized price. While the blue one marks the 1 standard deviation from the median (orange).

Also, Clemente suggests possibly testing the bottom of the range he outlined. He adds, “Any retests of those lower bounds are for buying.”

Historically Low Volatility: A Big BTC Move Is Coming

Another well-known long-term analyst @el_crypto_prof pointed out Bitcoin’s extremely low volatility on high time frames yesterday. In a tweet he published, he highlighted the BBWP (Bollinger Band Width Percentile) indicator for the 2-week chart of BTC.

For the first time in history, Bitcoin has reached minimum blue volatility in this time frame. The Bollinger Bands, within which the BTC price moves, are today the tightest in the entire history of Bitcoin.

One should always expect a sharp move and an increase in volatility after such a compression period. Unfortunately, the BBWP remains directionally neutral, so it is unclear whether there is a greater chance of an upward or downward move.

Also, the relative strength index (RSI) on the 2-week interval remains in the neutral area of 50. This indicates that there is no clear trend direction.

Therefore, a sharp move in the coming weeks could go in two directions. The BTC price will fall to test the realized price level near $20,000 in a bearish scenario. This would be an excellent opportunity to enter the market.

In the bullish scenario, the increase in volatility will coincide with the resumption of the uptrend. Then, the first and most important resistance to overcome will be the psychological threshold of $30,000. Its recovery would be a very bullish signal ahead of the impending halving of the Bitcoin network.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

Be the first to comment