South Korean crypto exchange Korbit said it would administer accounts of employees and their families to strengthen internal control.

Local reports noted on Jan. 16 that the country’s rules under the Enforcement Decree of the Specified Financial Information Act bar employees and executives from trading virtual assets on the exchange for which they work.

Upbit and Korbit Change Rules

In November, Upbit operator Dunamu extended these trading restrictions on family members of its staff.

The changes are being made to eliminate conflict of interest and instill ethical management in the market. Korbit also voluntarily decided to exercise internal control over employee families’ accounts, including those of brothers and sisters.

Oh Se-jin, CEO of Korbit, said in a translated statement, “The implementation of monitoring the family accounts of our employees is part of our efforts to raise Korbit’s internal control standards to the level of traditional financial institutions.”

Last year, the top five crypto exchanges vowed to work under a joint consultative body to safeguard the market.

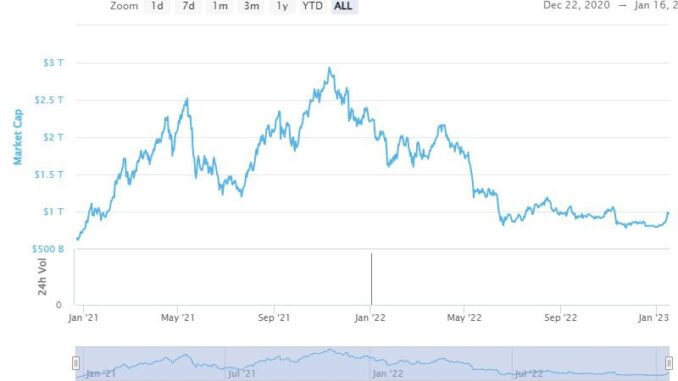

The changes came on the back of two major market meltdowns: Last year’s Three Arrows Capital (3AC) collapse and the recent demise of FTX. The market mayhem played a major part in wiping over a trillion dollars from the cumulative cryptocurrency market cap.

South Korea Gets Strict After 3AC Crisis

Prosecutors in South Korea recently placed a freeze on the assets of parties with connections to Terra Luna. In June 2022, the South Korean government announced a Digital Asset Committee to supervise the sector.

To improve investor protection and strengthen market oversight, the nation consolidated the operations of several ministries under the planning and finance, finance commission, science and technology, information communications, and personal information protection verticals.

The South Korean Financial Supervisory Service (FSS) has previously hinted that the nation’s securities and capital markets regulations may soon include virtual assets.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

Be the first to comment