The crypto market pushes upwards as Bitcoin, Ethereum, and other larger cryptocurrencies are turning critical resistance points into support. ETH’s price currently leads the market recovery as it records a 40% profit in the past seven days trading at $1,500.

Related Reading | Solana Adds 70% More Shine – Can SOL Keep The Light Coming?

On the other hand, BTC’s price is more conservative but has begun recording important gains. At the time of writing, BTC trades at $22,800 with a 14% profit over the same period and is on track to securing further gains.

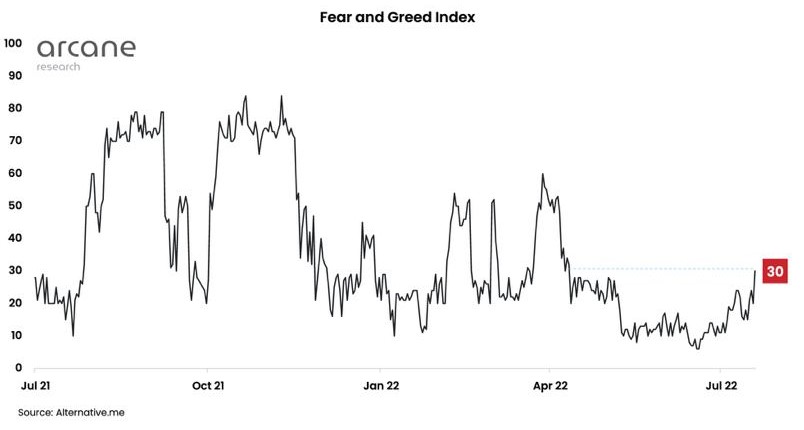

As a result of the bullish momentum, the Fear and Greed Index has broken out of its 74-day streak moving to extreme fear levels, according to a report from Arcane Research. Again, this confirms the profitability of taking long positions when this Index consolidates around those levels.

As seen in the chart below, the Crypto Fear and Greed Index has returned to its Q1 2022 levels. This indicator plummeted in May when the price of Bitcoin broke below the $30,000 barrier and into a multi-year low at around $17,500.

Despite the current bullish momentum, the Index is still gravitating in fear territory suggesting BTC, ETH, and the crypto market will need to follow the Index and reclaim its Q1 2022 prices before more market participants turn more optimistic. Arcane Research noted the following:

While the sentiment is improving, the Fear and Greed Index remains deep in the fearful territory, and other viable sentiment indicators from the derivatives market suggest that market participants still exercise caution.

The chart above suggests the sector is at a turning point as it pushes above 30 in the Crypto Fear and Greed Index. A break above these levels could confirm a change in the current market trend.

Why The Crypto Market Could Seize This Window Of Opportunity

In the short term, the crypto market has a chance to extend the bullish momentum. The factors pushing BTC and ETH into yearly lows seem to be mitigating.

These include the U.S. Federal Reserve (Fed) trying to stop inflation by hiking interest rates. The financial institution has entered a blackout period, meaning its representatives won’t make public statements until the next Federal Open Market Committee (FOMC) meeting.

Inflation, as measured by the Consumer Price Index (CPI), seems poised to slow down. As NewsBTC reported, this metric experienced a 40-year hike but might take a step back as oil, copper, and others trend to the downside. The CPI print relies heavily on the price of commodities.

Related Reading | Polygon Price Explodes By 60% – Is MATIC Nearing $1 Target?

The crypto market is also apparently receiving support from traditional equities. The two sectors have been correlated since the start of the downtrend, and thus BTC and other cryptocurrencies might benefit from stock bouncing to previous levels.

#Stocks keep on pushing up, bringing #Bitcoin with it. When markets correct 70 to 90% you load up and trade the risk. Did it in March 2020 and been doing it again. Even just a relief rally is huge profits at this point.

— IncomeSharks (@IncomeSharks) July 19, 2022

Be the first to comment