Blur’s new Layer 2 scaling network, Blast, has got off to an incredibly strong start just three days after launch. According to Spot on Chain, Blast has already exceeded $250 million in total value locked (TVL).

This TVL comes from two primary sources – over 100,000 ETH worth $221 million staked with Lido, and 30.6 million DAI deposited into Maker.

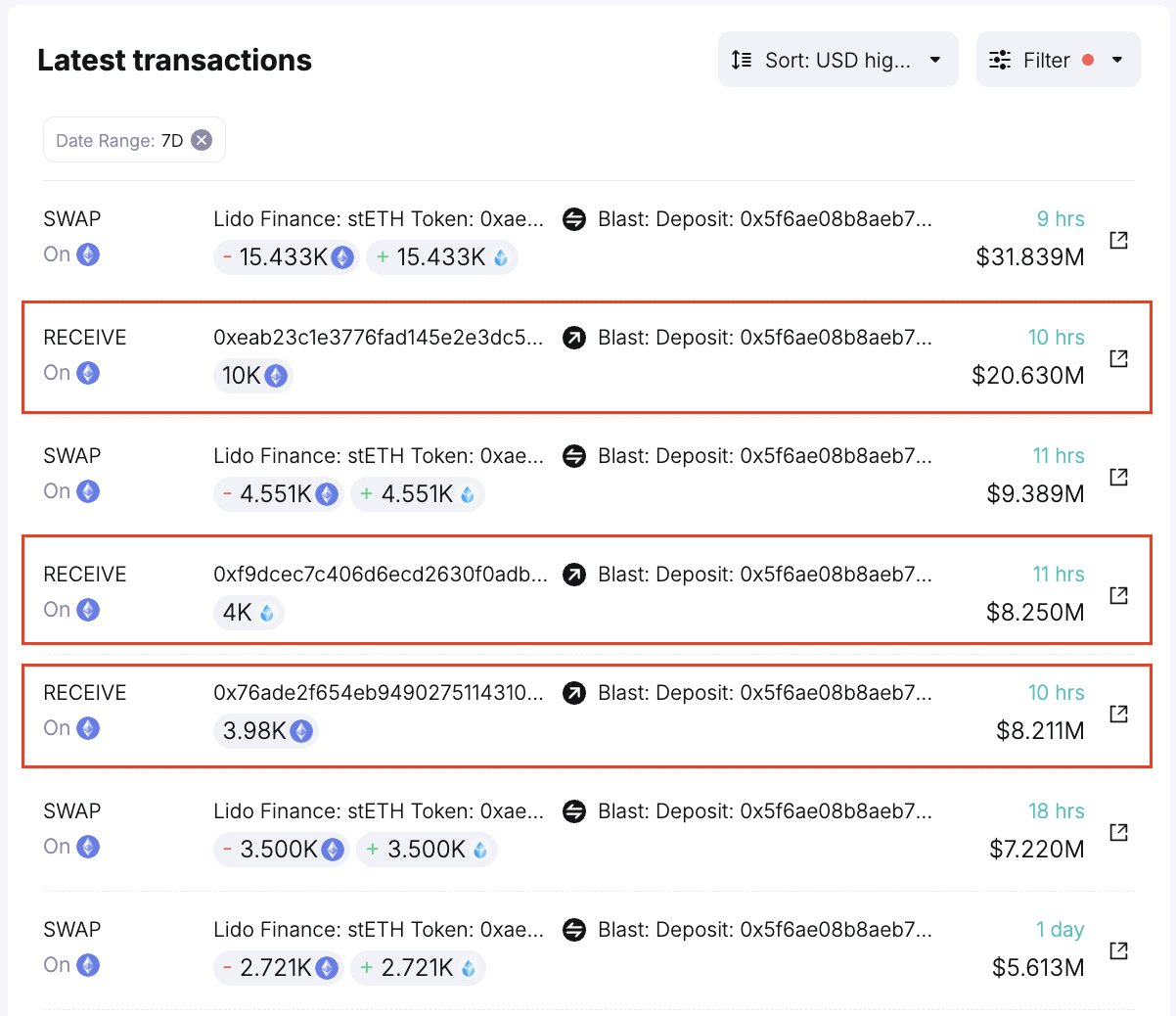

The growth has been driven by some major players diving headfirst into Blast. The largest depositor so far is wallet 0xeab, which has contributed 10,000 ETH ($20.6 million). Nftcoin.eth has also jumped in with 4,128 ETH ($8.51 million), while whale wallet 0xf9c has added 4,000 stETH ($8.24 million).

In order to earn Blast points used to boost rewards and reduce fees, 22 whales and institutions have purchased over 55.9 million BLUR tokens worth $20.8 million after the recent airdrop. An additional 53.5 million BLUR worth $26.3 million were then sent to staking to earn points.

The biggest BLUR staker appears to be whale 0x154, with 15 million tokens ($7.37 million) locked up. Smart whale 0x828 with around $12 million in ETH trading profits has added 6.52 million BLUR ($3.2 million), while crypto investment firm Sigil Fund has staked 3.1 million BLUR ($1.53 million). Venture firm Mandala Capital is also getting in on the action with a 1.98 million token position worth $973,000.

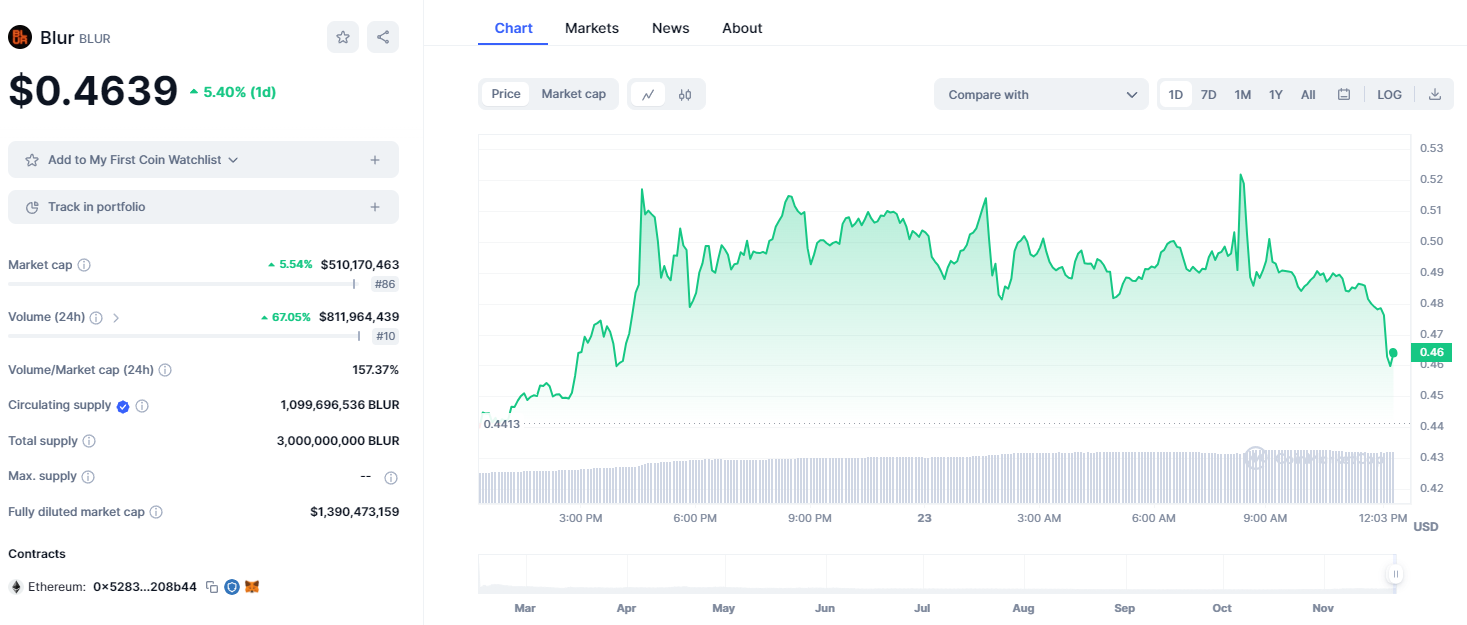

The frenzy of activity has led to huge price growth for BLUR after the airdrop. The token surged 73% from $0.2977 up to $0.5146 before settling around $0.47 currently.

A closer examination of BLUR’s price charts provides insight into the growth dynamics. In the lead-up to the surge, BLUR traded sideways in a consolidation pattern under a key resistance level. But the large amount of tokens purchased after the airdrop signals strong bullish conviction from major holders, possibly anticipating long-term utility.

This buying frenzy likely triggered a bandwagon effect, as additional investors jumped in noticing the momentum shift. These cascading chain reactions are common in crypto, with news and on-chain movements catalyzing swift value repricing. Following such a sharp rise, some retracement, or reversal, around overextended areas is expected. The relative strength index (RSI) momentum indicator entered overbought territory during the peak, often preceding pullbacks as early buyers secure profits.

However, at the time of writing, the RSI on BLUR’s daily price charts reads 29 – a level indicating the token is currently oversold. An RSI below 30 typically signals a price decline to extreme negative territory.

BTCETF Offers Deflationary Token Exposure to Bitcoin ETF Hype

As the crypto industry awaits the potential approval of the first Bitcoin exchange-traded fund (ETF) in the US, a new token Bitcoin ETF (BTCETF) aims to let investors capitalize on the expected impact of such a product.

The theory is that SEC approval of a Bitcoin ETF would unlock trillions in fresh institutional capital ready to flow into crypto assets. To align itself with this impending influx, BTCETF features a deflationary token model designed to concentrate value.

There are a few key mechanisms that accomplish this for holders. First, 25% of the total supply will be burned at each of 5 major milestones related to a Bitcoin ETF launch. On top of this, each transaction imposes a 5% burn tax to further deflate the circulating token count. Together these burns are intended to make BTCETF more scarce over time.

The second main utility lies in the token’s staking rewards. However, the size of the reward pool is capped, meaning APY will fall as more users stake their tokens.

Lastly, BTCETF also provides a news aggregation feed focused specifically on tracking the latest Bitcoin ETF developments. This allows token holders to stay updated on a niche, but high-impact area for their investment.

BTCETF has already raised over $1.4 million in its ongoing presale and cost $0.0056.

Check BTCETF Presale

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment