Sam Bankman-Fried keeps talking with journalists about his adventures in non-ring-fenced assets. At least this time it was on purpose. We’re not sure this was any more successful at clearing things up though.

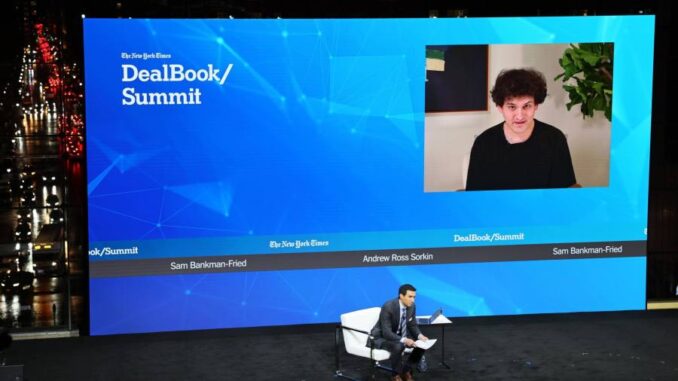

SBF said he “didn’t ever try to commit fraud on anyone” in a live-broadcast discussion with NYT’s Andrew Ross Sorkin. But he claimed he was only tracking Alameda’s share of trading volumes on the platform, not the actual size of its positions or their risk, which seems like a pretty key detail.

“These are positions where FTX could, if it needed, to margin call those positions and close them down in time such that it would cover all of those . . . liabilities. Obviously this isn’t the case here, and that was a massive failure of responsibility.”

To translate: one selling point for crypto exchanges has been the way they carry out “margin calls”, in that they don’t really call. Platforms are just supposed to liquidate traders automatically once their positions get too extended.

But in his First Day Declaration, new FTX CEO John Ray said that FTX suspended its auto-liquidation requirements for Alameda. This could be one form of “backdoor” that allowed Alameda to lever up even if SBF doesn’t “even know how to code”, as he told interviewer Tiffany Fong in a video released this week.

And then there’s the question of how he mislabelled accounts. It sounds like, years ago, the exchange decided to accept deposits from customers through Alameda. From the interview:

So I’m still looking into the details of some pieces of this. But I do think that in addition to what I had seen, of a lot of the standard borrows here, that when you throw back to 2019, FTX didn’t have bank accounts. It didn’t have any bank accounts globally. We were trying to get [bank accounts], it took us a while, it took us a few years. And you know, there were customers who wanted to wire money to FTX.

So in the meantime some of them were wiring money to Alameda Research to get credited on FTX. That was a substantial sum . . . the FTX’s internal accounting did correctly effectively try to debit alameda for those funds, but it didn’t happen in the primary account. And so it created a discrepancy between the display of the account and what was really going on there. And I’m still looking into how that worked mechanically.

Whew!

If only we had clarity from other global crypto exchanges about how they ringfence their customers’ money.

It sure looks like Binance doesn’t, for example, despite its lengthy blog post last week. In the post it claims customer cash is in “segregated accounts”, before continuing to explain why the money is not actually kept separate at all:

“ . . . other than instances of deposits and withdrawals, the sweeping and moving of funds between the deposit, hot and cold wallets are totally independent of user account balance updates.”

So while Binance isn’t telling customers to deposit money through a hedge fund, it’s not keeping exactly their cash ringfenced, either. Anyway, once SBF signed off from the Dealbook interview, he kept tweeting. And he did win over at least one viewer:

I deeply appreciate that.

I messed up. I’m going to do everything I can to make it right–even though I knew it might never be enough.

— SBF (@SBF_FTX) December 1, 2022

Be the first to comment