Kang Hyung-suk’s faith in cryptocurrencies was shattered by the $40bn collapse of Do Kwon’s cryptocurrency operator Terraform Labs, where he used to work in Seoul. Now he is looking for payback.

In about 10 days, Kang is flying to Dubai, the capital of the crypto-friendly United Arab Emirates, where he believes Kwon is hiding. “Finding him could be easier than thought,” said Kang.

The 26-year-old software engineer belongs to the UST Restitution Group, an association of nearly 4,400 crypto investors trying to track down Kwon, who is wanted in South Korea on charges of financial fraud.

“I want to recruit other people to join the search,” said Kang. “There’s a 50-50 chance of getting him in Dubai.”

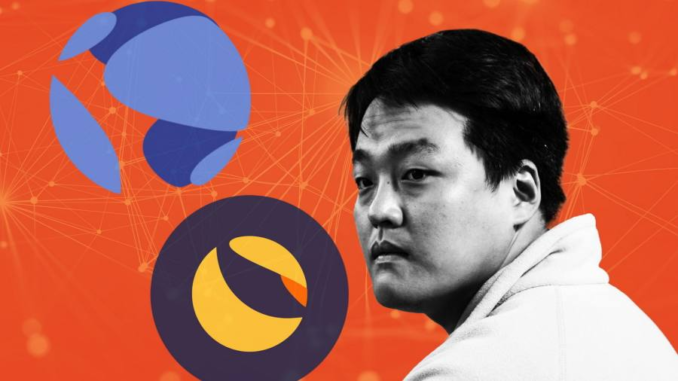

The international manhunt for Kwon, a 31-year-old Stanford-educated entrepreneur, is intensifying as retail investors try to recover from the devastating losses caused by the collapse of his terraUSD and luna coins in May.

Investors have launched class action lawsuits against Kwon in Singapore and the US, while Interpol has issued a red notice for him. South Korea is expected to revoke his passport on Wednesday.

Kwon claimed in an interview on crypto podcast Unchained this week that the charges against him were not “legitimate” and were “politically motivated”. He said he was complying with document requests from South Korean prosecutors and apologised to the victims of his blockchain system’s collapse.

He denied any wrongdoing but declined to disclose his whereabouts, citing security concerns. His last known location, at the end of April, was Singapore, according to South Korean authorities.

URG members share their findings on Kwon and his company via Discord, a social messaging platform, and comb through the internet for clues on his whereabouts. Members have suggested that Kwon could be in Dubai, Russia, Azerbaijan, the Seychelles or Mauritius, among other locations.

“Dubai is friendly to crypto, very international (he would not stand out), and has limited extradition treaties in place,” a URG member wrote in a report dated September 28. “It would seem like the best fit for the 3-5 hour timezone shift apparent in the data.”

URG comprises members from around the world. “His days are numbered,” said a top URG member with the nickname Antithesis, who introduced himself as a 31-year-old Ivy League-educated American. “We have people who are very, very close to Do Kwon.”

He claimed that his group was doing “lots” of work to track down Kwon. “I obviously wouldn’t delve into specifics because publishing our methods would render them ineffective. I think we’re doing more than anyone else, though.”

Antithesis said he lost a big chunk of life savings worth several hundred thousand dollars by betting on terraUSD and called the experience “devastating”.

“The entire timetable for my life’s plans has been upended and set back many years. The stress on top of it has also probably shaved off several years from my lifespan,” he said.

Another URG member nicknamed HKTrader said he worked for a fintech company headquartered in Hong Kong and had blown his savings for a house on terraUSD. He said he spent a month organising a Singapore class action lawsuit against Kwon and discovered his whereabouts in the country by hiring a private detective.

“We tracked [him] down pretty well when he was in Singapore,” HKTrader said, but he added that his group lost track of Kwon after he left the city-state.

He said he was sceptical of Interpol’s ability to locate Kwon. “You know how Interpol works. It’s up to the hosting country to act,” he said.

Recommended

Yet even if Kwon were arrested and extradited to South Korea, experts said it would not be easy to convict and punish him for financial fraud or breach of capital market rules because of uncertainty about whether crypto is subject to securities law.

“I wonder how effective the legal action against him could be, given the lack of legal ground to punish crypto players,” said Choi Hwa-in, a crypto expert in Seoul. “This would just strain the crypto market further, dragging down their value and hurting investors more as a result.”

This month, a South Korean court rejected prosecutors’ request to issue an arrest warrant for Kwon’s close aide who headed Terraform Labs’ business operations, questioning if terraUSD and luna qualified as investment securities under the country’s capital market act.

Terraform Labs said the company would continue to communicate with authorities but blamed South Korean prosecutors for speaking to the press.

“Recent developments reaffirm that Terraform Labs and its stakeholders remain subjected to a highly politicised and erratic legal environment in South Korea,” the company said. “The facts are on our side, and we look forward to the truth coming to light in the coming months.”

Cryptofinance

Critical intelligence on the digital asset industry.

Explore the FT’s coverage here.

Be the first to comment