Layer-2 scaling solution Synthetix recently collaborated with liquidity provider Curve Finance to create Curve pools for sETH/ETH, sBTC/BTC, & sUSD/3CRV, allowing investors to cheaply convert synths such as sETH to Ether (ETH).

Given the investors’ willingness to hold tokens instead of synths, the protocol racked up over $1.02 million in trading fees — overshadowing Bitcoin’s (BTC) daily performance by five times.

Synthetix, Ethereum-based decentralized finance (DeFi) protocol, created a buzz across the crypto ecosystem after witnessing a sudden increase in trading activities and an unprecedented comeback of its in-house token, SNX, during an unforgiving bear market.

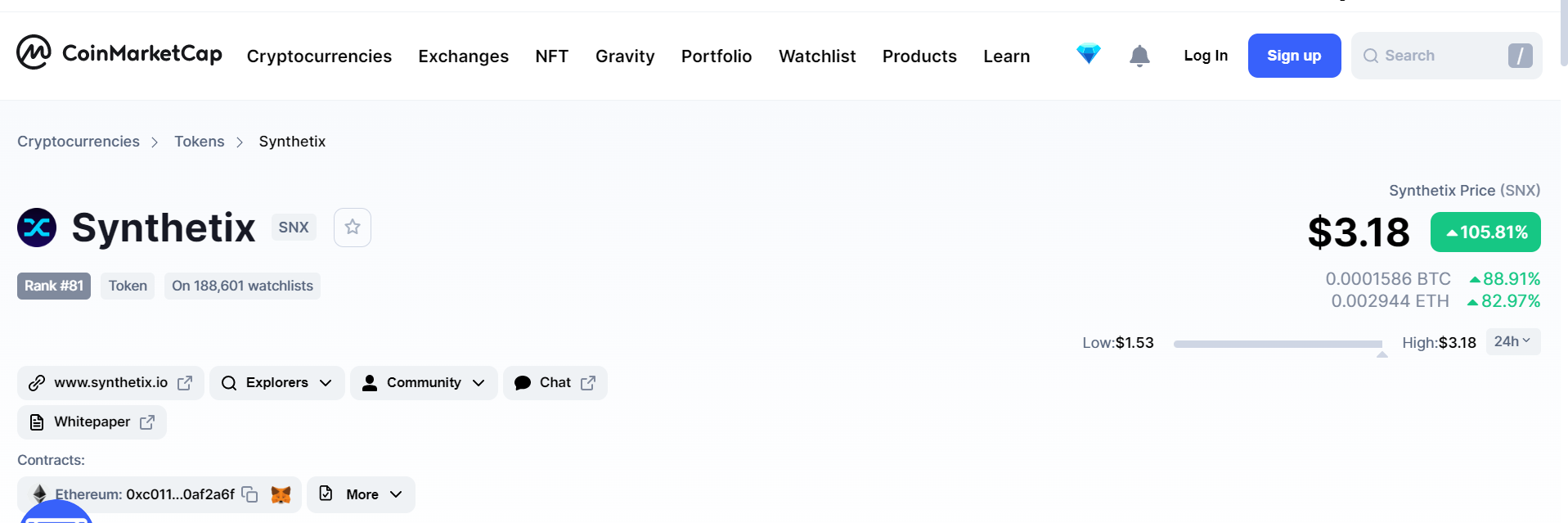

As a direct result of the massive trading volumes, the SNX token, too, witnessed a momentary surge of 105%, bringing up its value to over $3 based on data from CoinMarketCap.

Sharing his thoughts on the development, Synthetix founder Kain Warwick a.k.a kain.eth released a blog post that highlighted the difficulty of DeFi protocols to absorb Bitcoin’s volatility if the price drops even further:

“This is critical to understand, Synthetix is an over-collateralised crypto-backed suite of stablecoins, it CAN implode.”

However, he attributed Synthetix’s recent success to the responsiveness of the community to difficult circumstances and a willingness to experiment with novel mechanisms to provide stability.

On May 31, the entrepreneur revealed that SNX tokens contribute to 99% of his overall liquid portfolio.

As of this morning my liquid crypto portfolio is 99% SNX.

— kain.eth (✨_✨) (@kaiynne) May 31, 2022

On the flipside, on-chain metrics revealed the intentions of shorting the SNX token across numerous exchanges. @napgener from Crypto Twitter disclosed that 15 million SNX tokens maintain a short position on popular exchanges including Binance, FTX, ByBit and OKX. While only 20 million SNX tokens exist on exchanges, the revelation points to an oncoming price hike, which might see SNX breach a value of $10.

15m $snx is short now. only 20m exist on exchangesthis thing could powder keg to $10+$sirin / $unfi style pic.twitter.com/b0LM8zs5x5

— napgener 0xDONE (@napgener) June 20, 2022

The Twitter user also alleged that the Celsius network is offering a 300% Annual Percentage Rate (APR) to users for shorting their SNX holdings.

Related: El Salvador president addresses bear market concerns with Bitcoin hopium

With Bitcoin prices falling below $20,000 over the weekend, El Salvador President Nayib Bukele shared a piece of optimistic advice on Twitter.

I see that some people are worried or anxious about the #Bitcoin market price.

My advice: stop looking at the graph and enjoy life. If you invested in #BTC your investment is safe and its value will immensely grow after the bear market.

Patience is the key.

— Nayib Bukele (@nayibbukele) June 19, 2022

In his tweet, Bukele advised fellow investors to “stop looking at the graph and enjoy life.” He reassured investors about Bitcoin’s inevitable comeback, stating that:

“If you invested in #BTC your investment is safe and its value will immensely grow after the bear market. Patience is the key.”

Be the first to comment