Tesla published its Q4 financial report, beating earnings and revenue expectations. However, its Bitcoin investments remain at a loss.

Tesla’s Bitcoin investments are still underwater, according to its fourth-quarter earnings report from Jan. 25. Despite this, the company’s overall earnings and revenue have beaten expectations.

TSLA stock is up today and has grown by over 13% over the past five days. Shares of the company also rose when CEO Musk said that the company could potentially produce two million Teslas this year.

The total revenue that Tesla earned was $24.32 billion, which was about 200 million more than the projected value of $24.16 billion. Earnings per share reached $1.19 as opposed to the expected $1.13. While the company did note that the average sales price was on a downward trend, it countered this by saying that more affordable rates were necessary to help the EVs sell to a wider population.

The company also reported that its automotive revenue was 33% up year-over-year. The total revenue here in the fourth quarter was $21.3 billion.

As for Tesla’s Bitcoin holdings, it reported $34 million in impairment charges. It also did not buy or sell any Bitcoin in the last quarter, with its total holdings valued at $184 million.

Tesla’s Bitcoin Investment

Tesla first shook the crypto and investment world when it purchased $1.5 billion worth of Bitcoin in February 2021. The sizable investment has seen its value fluctuate tremendously with the market, and in March 2021, Tesla allowed payments in Bitcoin.

However, it paused BTC payments not long after, causing the asset’s price to fall. Since then, with Bitcoin’s price dropping, it reported impairment losses in consecutive quarters.

MicroStrategy Not Backing Down From Bitcoin Bet

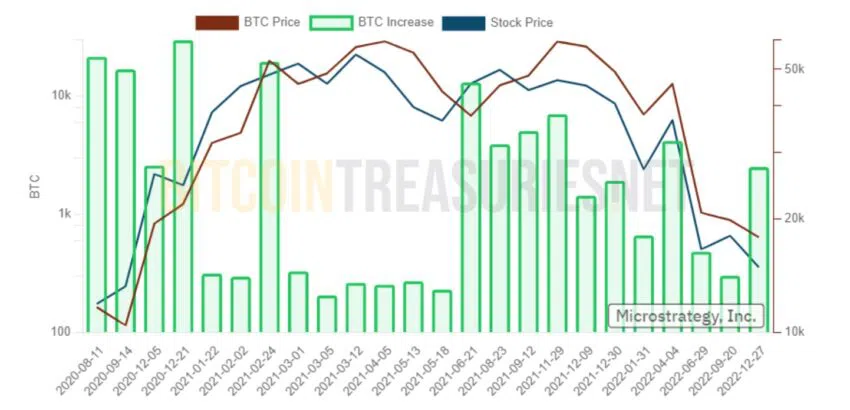

Tesla’s investments in Bitcoin are often compared to MicroStrategy, as both are established firms that are among the top investors in Bitcoin. Unlike Tesla, however, MicroStrategy is far more bullish on Bitcoin, with CEO Michael Saylor among Bitcoin’s strongest proponents.

The firm has consistently bought BTC over the years, most recently purchasing 2,501 BTC in December 2022. The company’s total holdings are now 132,500 BTC, worth about $3 billion at today’s prices.

The company had $1.8 billion in unreported losses from its Bitcoin investment because of the crypto winter.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

Be the first to comment