SUI price rally halted over the last few days as the market cooled down, resulting in a failed breach of $1.00.

This halt, however, was propelled by investors’ declining optimism as they opted to withdraw their money from the asset.

SUI Loses Confidence

SUI price could continue its decline as potential buying pressure decreases. The MACD indicator reveals that bullish momentum is starting to fade just two weeks after it began. This shift in momentum could negatively impact the crypto asset, raising concerns among traders and investors.

The diminishing momentum indicated by the MACD suggests that the initial surge in buying interest may be losing steam due to the recent correction. This weakening trend is critical as it could signal a reversal or a period of consolidation, putting downward pressure on SUI’s price.

Read More: Everything You Need to Know About the Sui Blockchain

One potential reason for this decline in momentum is the recent withdrawal of funds from the market. A significant amount of capital appears to have exited, leading to a reduction in trading activity and market confidence.

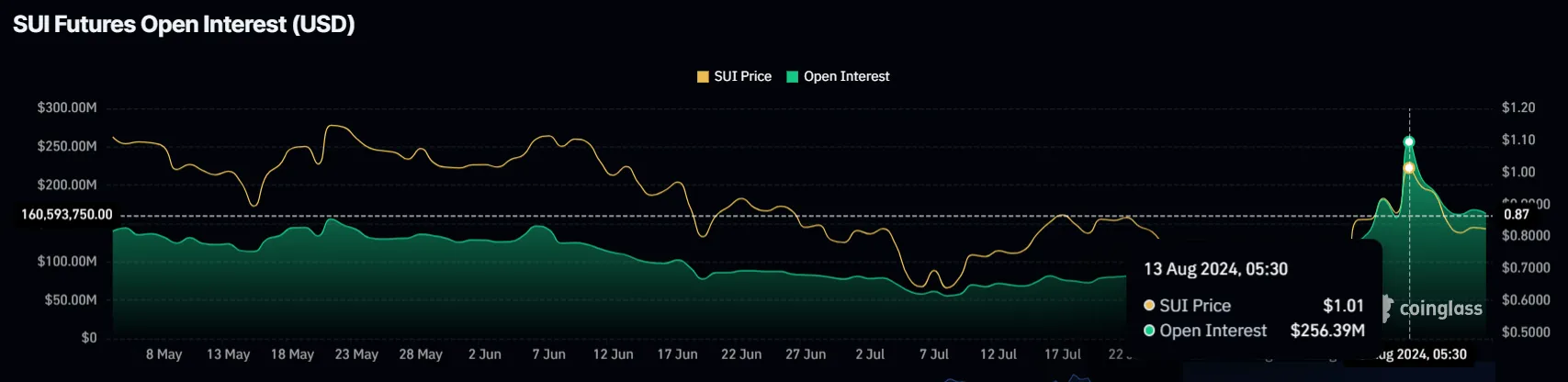

Further emphasizing this point, Open Interest has seen a notable decline, losing $94 million in just one week. This reduction in Open Interest reflects a decreasing level of commitment from traders, which could exacerbate the challenges faced by SUI’s price.

SUI Price Prediction: Slow Recovery or No Recovery

SUI’s price at $0.85 is looking at a potential drop to test the support at $0.77. Since this level has been tested as support in the past, there is a chance that the altcoin could bounce back from this point.

Thus, the likely outcome will be consolidation under $0.89, with SUI making efforts to breach the resistance. While the aforementioned factors and broader market cues are bearish, the altcoin could sustain above the support of $0.77.

Read More: A Guide to the 10 Best Sui (SUI) Wallets in 2024

On the other hand, if the bearish cues dominate, they could pull the altcoin below the aforementioned support line. This would invalidate the bullish-neutral thesis, resulting in a drop to $0.70.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment