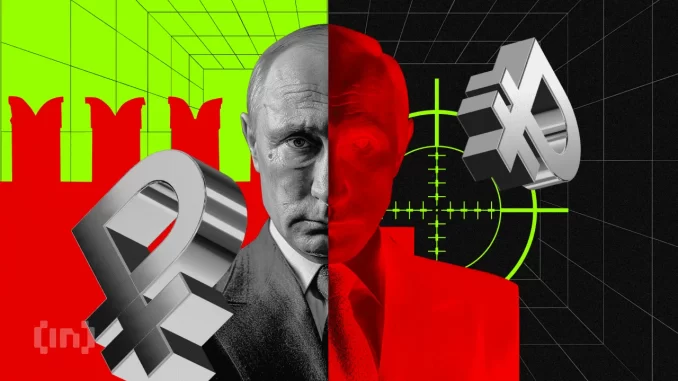

The US Department of Justice (DOJ), in collaboration with State and Treasury agencies and other federal and international law enforcement teams, charged two Russian nationals in an ongoing fight against money laundering operations.

The authorities unsealed documents involving multiple money laundering services enabling cybercriminals and seized websites linked to illicit cryptocurrency exchanges.

US DOJ Cracks $1 Billion Russian Laundering Services

Sergey Ivanov and Timur Shakhmametov, two Russian nationals, have made millions of dollars by facilitating money laundering, helping fuel a global network of cybercriminals. Ivanov, also known by the alias “Taleon,” has been a professional cyber money launderer for nearly two decades.

He has been involved in enabling bank fraud and providing payment-processing support to the notorious Rescator website, which illegally acquires and sells stolen credit and debit card data. Rescator has trafficked stolen payment card information from US financial institutions and personally identifiable information (PII) from American citizens. Ivanov also laundered the proceeds from Rescator and a related carding website, Joker’s Stash, further entrenching his role in cybercrime.

“Over the years, Ivanov’s laundering services and payment systems have catered to cybercrime marketplaces, ransomware groups, and hackers responsible for significant data breaches of major US companies,” read the report.

Read More: Crypto Regulation: What Are the Benefits and Drawbacks?

Cryptocurrency blockchain analysis revealed key details about Ivanov’s money laundering business. It showed:

Transactions totaling approximately $1.15 billion in value between July 12, 2013, and August 10.

Nearly 32% of all traced Bitcoin (BTC) sent to these addresses originated from other cryptocurrency addresses associated with criminal activity.

Over $158 million of BTC flowed into Ivanov’s addresses, representing fraud proceeds.

Over $8.8 million represented proceeds from known ransomware payments.

Nearly $4.7 million originated from Darknet drug markets.

Timur Shakhmametov, also known as “JokerStash” or “Vega,” faces charges as an accomplice to money laundering, with specific accusations related to selling data from around 40 million payment cards annually. This operation made him a key figure in one of the largest carding markets in history, widely advertised on cybercrime forums.

Authorities eventually shut down Cryptex, an illicit cryptocurrency exchange connected to the domains Cryptex.net and Cryptex.one. The platform bypassed Know Your Customer (KYC) regulations, making it a haven for criminals. Investigations revealed that Cryptex processed $1.4 billion in Bitcoin transactions, with 31% tied to criminal activity. Furthermore, 28% of Bitcoin sent from Cryptex was funneled to US-sanctioned entities or Darknet markets.

Authorities Target Firms Aiding Crypto Crime

This development adds to the thread of US authorities combating Russia-related cybercrime, particularly where crypto is used to evade sanctions. In March, the US Treasury’s Office of Foreign Assets Control (OFAC) expanded its sanctions against Russia, targeting individuals and entities within the country’s financial and technology sectors.

In April, the US Treasury also warned of Russia using Tether (USDT) stablecoin to evade sanctions and fund military operations. This culminated in authorities freezing all US assets and property interests of thirteen entities and two individuals.

Russian criminals allegedly use crypto to circumvent Western restrictions, procuring deals and facilitating transactions considered unlawful. Other cited crimes include converting Russian rubles into USDT and paying foreign suppliers, effectively circumventing detection.

Read more: 8 Best Crypto Wallets to Store Tether (USDT)

This report, as enabled by blockchain analytics, shows that the scale of crypto use for illicit financing, including terrorism, is substantial. It fuels the argument on the necessity and scope of stringent crypto regulations.

Some lawmakers advocate aggressive regulatory measures, while others argue for a balanced approach to avoiding stifling innovation in the digital asset sector.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment