Data shows the crypto market almost escaped from the extreme fear territory earlier in the week, but the sentiment has once again slumped down during the last few days.

Crypto Fear And Greed Index Continues To Point At “Extreme Fear”

As per the latest weekly report from Arcane Research, the current streak of extreme fear, which happens to be the longest ever, couldn’t be broken this week.

The “fear and greed index” is an indicator that measures the general investor sentiment in the crypto market.

The metric uses a numeric scale that runs from zero to hundred for displaying this sentiment. All values of the index greater than fifty imply greed, while those below the threshold suggest fear.

Related Reading | How NFTs Forecasted A Crypto Recovery, Nansen Report Claims

Values of more than 75 and less than 25 towards each end of the range indicate sentiments of “extreme greed” and “extreme fear,” respectively.

Now, here is a chart that shows the trend in the crypto fear and greed index over the last year:

The value of the indicator seems to have slumped back down after a rise | Source: Arcane Research’s The Weekly Update – Week 27, 2022

As you can see in the above graph, the crypto fear and greed had a value of 16 two days ago, when the report came out. According to alternative.me, the value is 18 today, slightly more than that.

Nonetheless, both values are firmly inside the extreme fear territory, which means the current record streak of bottom sentiment has continued for 70 days now.

During the past week, the indicator’s value did look to be catching some upwards momentum as it briefly climbed to 24 on the weekend, which is just at the edge of the extreme fear region.

Related Reading | Negative CPI Report Causes Bitcoin Market Cap To Lose $15 Billion In 10 Minutes

However, this improvement in the sentiment didn’t last too long and the index once again dropped back down, before the longest extreme fear run in the history of the crypto market could be broken.

Though, the report notes that the index may be overstating the fearfulness due to the special conditions right now. The fear and greed index’s value depends on two major factors, the volatility and the trading volume. Binance removing trading fees from its platform has certainly influenced these two metric’s values and hence the index as well.

For the crypto market to escape from this stretch of extreme fear, positive news and price action will be needed to make investors more optimistic.

BTC Price

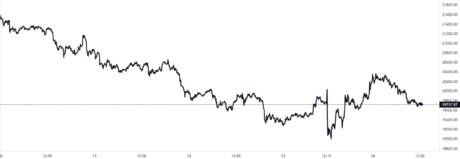

At the time of writing, Bitcoin’s price floats around $19.7k, down 3% in the past week.

Looks like the value of the crypto has declined over the last few days | Source: BTCUSD on TradingView

Featured image from Pierre Borthiry on Unsplash.com, charts from TradingView.com, Arcane Research

Be the first to comment