Bitcoin (BTC) continues to capture the attention of investors and analysts alike. Amidst fluctuating market conditions, a bold prediction has emerged by renowned market analysts.

One suggested that Bitcoin will never drop below $40,000 again, while others expect a parabolic move on the horizon.

Bitcoin Price Will Never Drop Below $40,000

Renowned Bitcoin analyst, known by the pseudonym PlanB, has provided a bullish outlook based on a series of realized prices. This metric reflects the average price at which Bitcoin has been traded in the past.

According to PlanB, the realized price of Bitcoin has seen a consistent uptrend, currently standing at $23,000 for the last month, $32,000 for the two-year, and, notably, $40,000 for the five-month period. With Bitcoin trading above these benchmarks at approximately $42,000, PlanB interprets this as a strong bullish sign.

He even suggested that any dips to the five-month realized price of $40,000 could represent the lowest bounds for Bitcoin’s value in the foreseeable future.

“All these realized prices are going up and Bitcoin is above all of them and that’s a very bullish sign. We see that at the start of every bull market… They all go up, and Bitcoin stays above… So that might mean no guarantee, again, but that might mean that Bitcoin will not go below $40,000 ever again,” PlanB noted.

Parabolic Move Amid Soaring BTC Accumulation

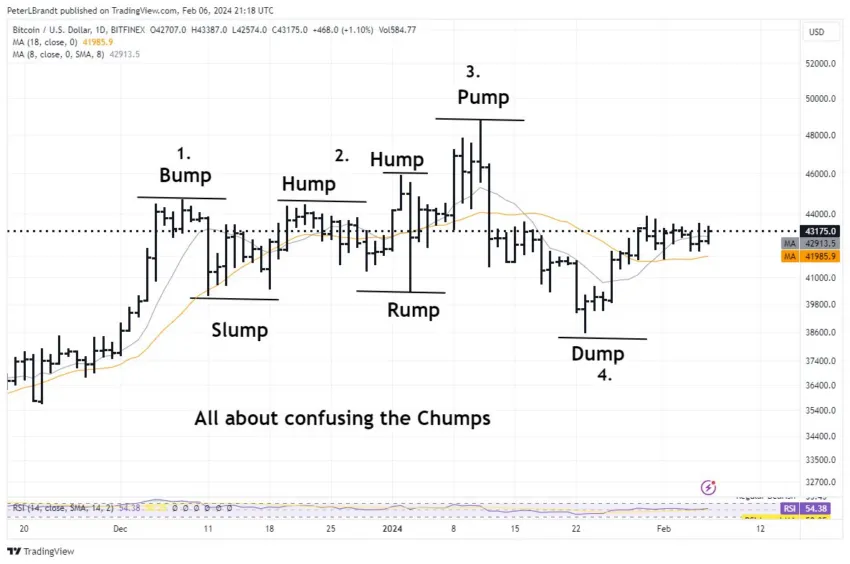

Echoing this bullish sentiment, trading veteran Peter Brandt pointed to the potential for another parabolic run in Bitcoin’s price. Inspired by Elliott Wave Theory, Brandt’s analysis identifies a market pattern of peaks and troughs indicative of investor psychology and potential for significant price movements.

The sequence he identifies – bump, hump, lump, and pump – has historically preceded notable surges in Bitcoin’s value. Brandt’s recent observations suggest that Bitcoin may be on the cusp of entering the “pump” phase, poised for exponential growth if it successfully overcomes key resistance levels.

“Is history repeating itself? As Yogi Berra once said, ‘it’s like deja vu all over again,’” Brandt said.

Read more: Bitcoin Price Prediction 2024/2025/2030

Further supporting the bullish sentiment, Ali Martinez, BeInCrypto’s Global Head of News, highlighted a significant trend in Bitcoin accumulation.

According to him, Bitcoin is undergoing one of its “most significant accumulation streaks in almost 3 years.” Martinez pointed to the Accumulation Trend Score, which has remained near 1 for the past four months. This indicates a strong confidence in the market, with larger entities significantly investing in Bitcoin.

The convergence of these analyses presents a compelling case for Bitcoin’s future trajectory. PlanB’s insight into realized prices, Brandt’s interpretation of market patterns, and Martinez’s observations on Bitcoin accumulation collectively underscore a market sentiment ripe with optimism.

As Bitcoin hovers above critical price thresholds, the prospect of it not dropping below $40,000 again becomes increasingly plausible. Therefore, it paints a picture of a digital currency on the brink of another historic run.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment