Despite rising whale activity, Cardano’s (ADA) price action has remained neutral amid recent regulatory squabbles with the SEC. Are the retail network participants losing interest in the Cardano ecosystem?

The Cardano team has made several attempts to address centralization concerns highlighted by the SEC lawsuit. However, this has not fully resonated with the retail network participants.

Cardano Has Maintained a Healthy Whale Activity

Amid ongoing regulatory squabbles, on-chain data shows that Cardano has maintained a healthy level of whale activity.

As seen below, even while ADA price dropped to a 2-year low of $0.23, millionaire whales on the Cardano network have maintained a steady level of transactional activity.

The chart below shows that since June 2023, Cardano has maintained an average of 100 daily transactions exceeding $1 million daily.

The Whale Transaction Count metric shows the daily number of transactions that exceed $1 million. As shown below, Cardano whales have generally maintained a neutral disposition over the past month.

If ADA price is to break above the $0.30 resistance, increased traction among the whales will be pivotal to the recovery.

Retail Network Participants Could Keep Price Action Neutral

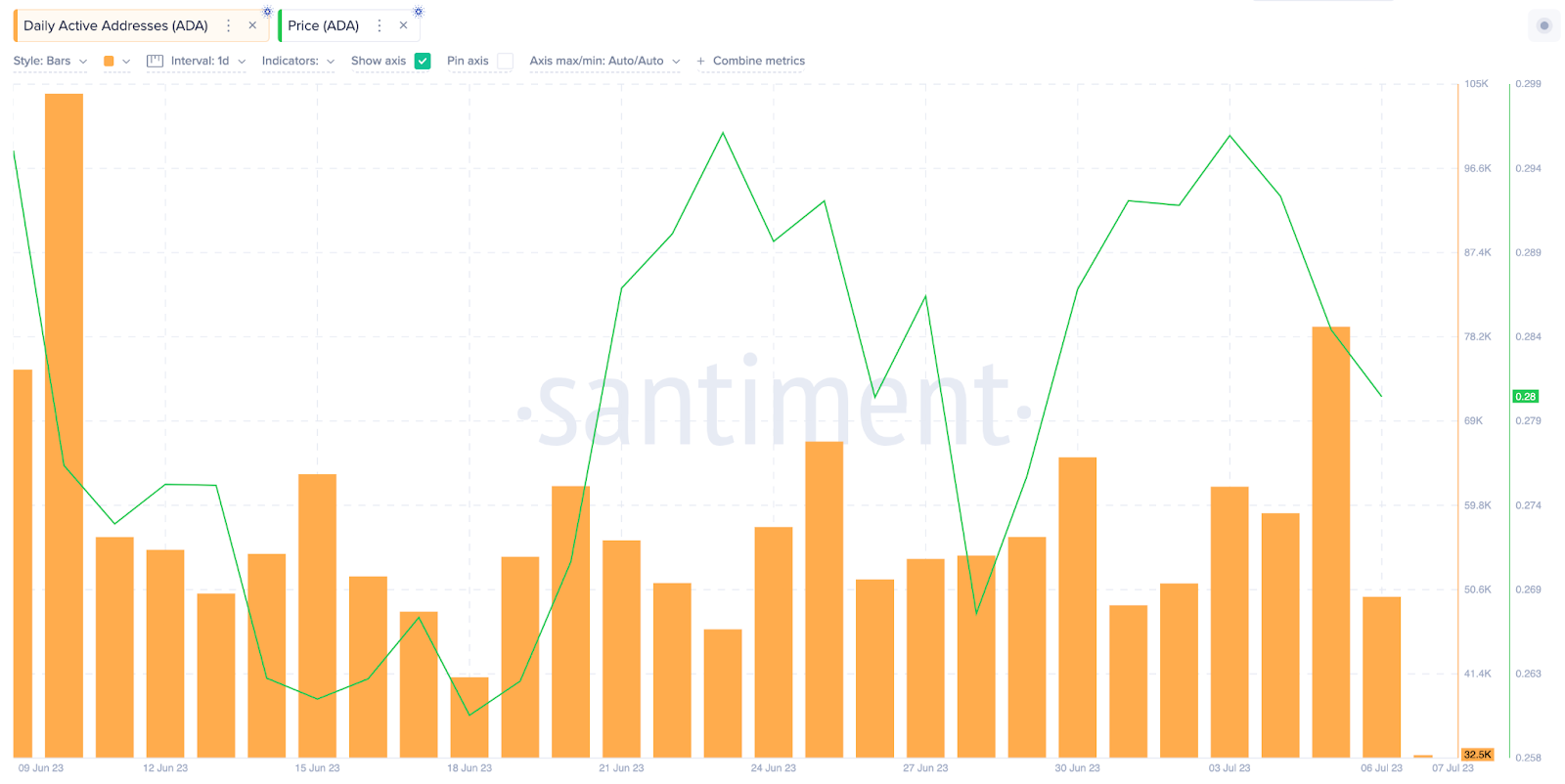

While Cardano whales have remained largely neutral, the same cannot be said of the retail network participants. Santiment’s chart below shows that the Cardano Daily Active User count has not fully recovered over the past month.

On June 10, Cardano registered 104,780 Daily Active Addresses at a recent high. At the close of July 6, only 49,854 active addresses were recorded. This represents a significant decline in excess of 52%.

The incessant downswings in the Daily Active Addresses interacting on Cardano suggest that the retail network participants are not yet fully convinced in regards to the recent regulatory squabbles.

If active users remain scarce, Cardano price action will likely remain neutral in the coming days.

ADA Price Prediction: The $0.30 Resistance is an Obstacle

Given the on-chain indicators highlighted above, ADA price will likely remain neutral and consolidate around $0.30 in the coming days.

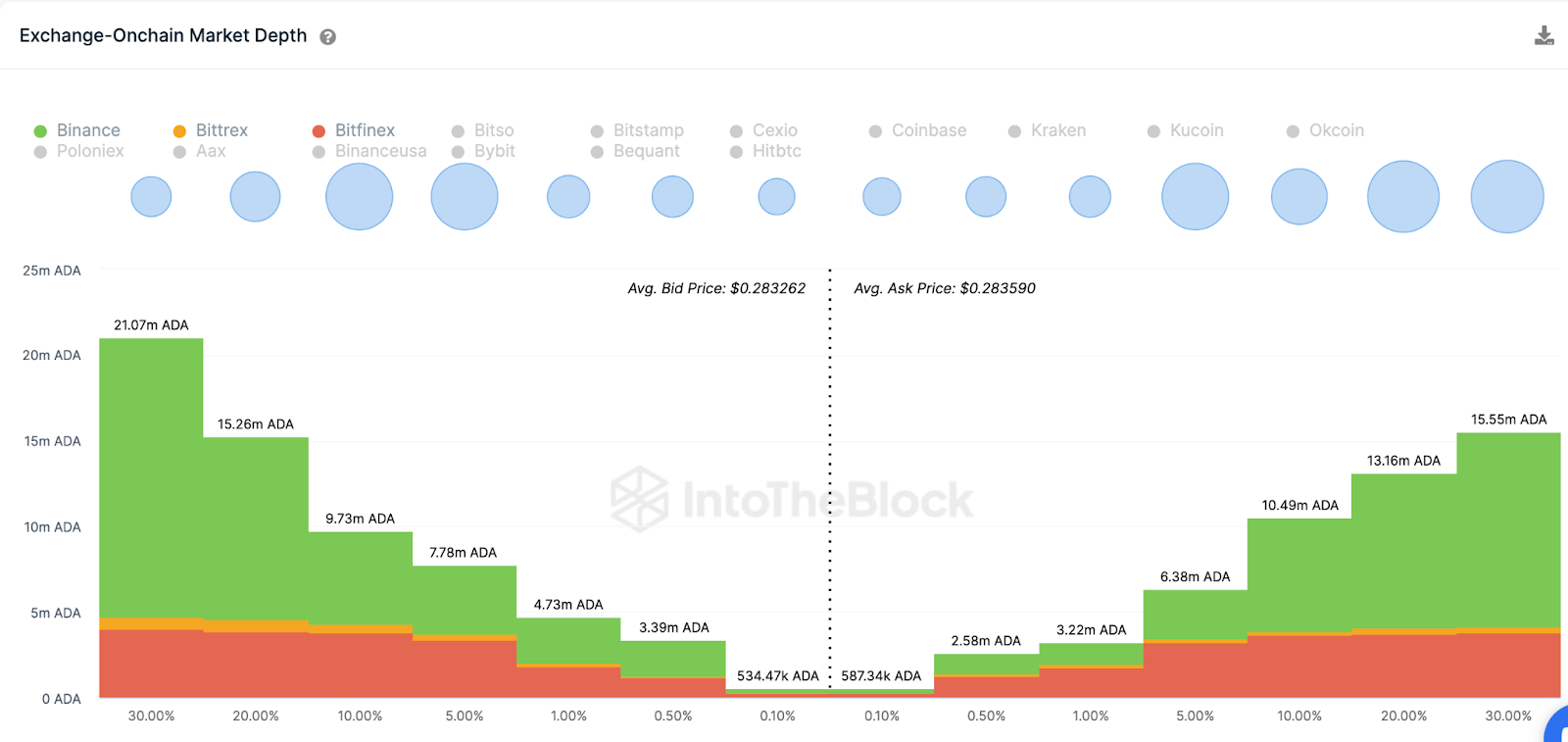

The Exchange On-Chain Market Depth shows that the 10.5 million ADA sell-wall around $0.30 could prove too tough for the bulls. But if that resistance unexpectedly caves, ADA could approach $0.32 for the first time in over a month.

On the flip side, the bears also have a chance to gain a foothold if ADA slips below $0.25. However, the massive buy-wall of 9.37 million ADA could neutralize the bullish pressure.

Nevertheless, the ADA could drop below $0.25 if that support level does not hold.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

Be the first to comment