Bitcoin price is up on Jan. 20, and a swift market-wide rally in crypto prices has some investors hopeful that the year-to-date high at $21,427 is a sign that BTC has bottomed.

Despite negative news regarding crypto lender Genesis, Bitcoin price continues to rise. The rise in Bitcoin price after Genesis filed for bankruptcy may mean that the news was already priced into BTC.

After continuing last week’s rally in equities markets, a cooling U.S. dollar index (DXY) and positive Federal Reserve comments post inflation data in the Consumer Price Index Report (CPI) can keep BTC above the $21,000 range.

A primary catalyst for the rally appears to be the positive CPI report released on Jan. 12 by the Bureau of Labor Statistics (BLS) which showed overall inflation for all urban consumers declining by 0.1%.

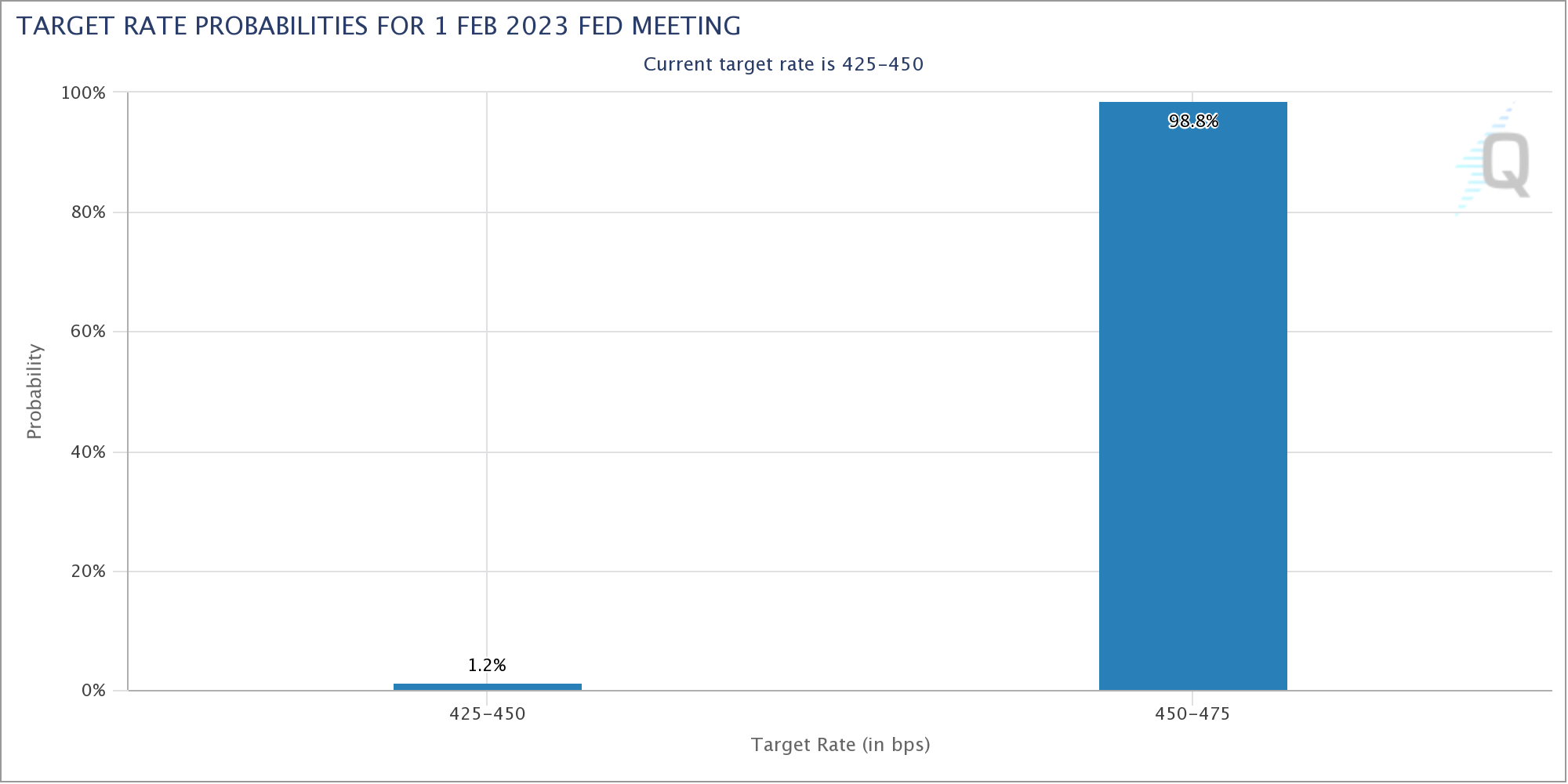

The drop in inflation was the largest since April 2020. Equities traders are also reacting by driving prices higher on the hopes that the positive data spurs less aggressive Federal Reserve interest rate hikes at the Federal Open Market Committee (FOMC) meeting on Feb. 1.

The positive inflation data has already caught the attention of the United States Federal Reserve which is in charge of interest rate increases. Federal Reserve Governor Christopher Waller, hinted at where interest rates may be headed on Jan. 20:

“Based on the data in hand at this moment, there appears to be little turbulence ahead, so I currently favor a 25-basis point increase at the FOMC’s next meeting at the end of this month.”

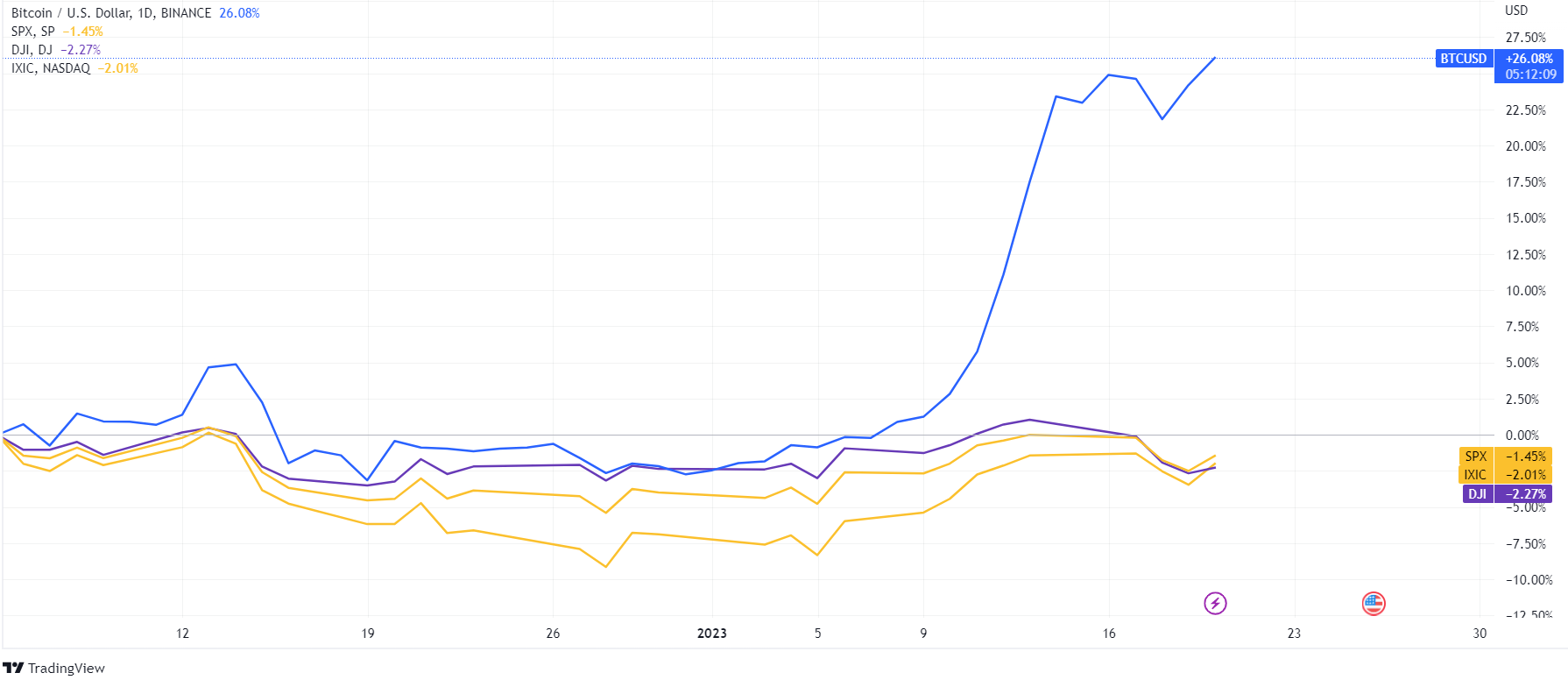

The stock market opened higher on Jan. 20, with the Dow Jones, S&P 500 and Nasdaq all posting positive numbers. As reported by Cointelegraph, Bitcoin’s price action remains closely correlated to U.S. equities and today’s rally is no exception to the trend.

Here are a few reasons why Bitcoin price is up today.

Positive CPI data leads to new year-to-date Bitcoin price highs

Since Bitcoin price rallied to a yearly high of $21,427 on Jan. 20, some analysts now see $21,000 as the new BTC price floor. Although BTC trading volume has not recovered to pre-FTX collapse levels, the $58.5 billion in Bitcoin trading posted on Jan. 15 set a new yearly high.

The CPI report showed inflation easing for the sixth straight month. One of the largest decreases in the report was the sharp drop in gasoline prices. Used and new car prices were also down. The caveat in the CPI report is that the cost of services and food remained high.

If inflation has peaked, there is the possibility of the Federal Reserve pivoting from aggressive interest rate increases. Many traders agree that if the Federal Reserve were to pivot on its current policy of quantitative tightening and interest rate hikes, BTC price could surge.

The FOMC begins meetings on Jan. 31 with a decision on interest rates expected the following day. The positive inflation data may impact the FOMC decision and boost BTC and equities higher. After the disappointing US bank Q4 2022 earnings reports the market has rebound as investors await more details on the potential Fed decision.

Longer-term data is in Bitcoin’s favor, according to market analysts

Investors’ confidence in the crypto market could also be rising due to their belief that the United States Federal Reserve could roll out smaller-sized interest rate hikes throughout 2023 due to signs from the CPI report that the Fed’s strategy is working.

In the Fed’s statement, the possibility of a policy shift remains open and tied to inflation:

“The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

According to CME Group, a derivatives marketplace with a global benchmark product that estimates interest rates, shows a high probability that increases may be lower than previously anticipated in the near future.

The graph points to a possible slowdown in the interest rate hikes. The public sentiment shows confidence that future rates may fall and investors believe that this has created the possibility for a broad crypto market recovery.

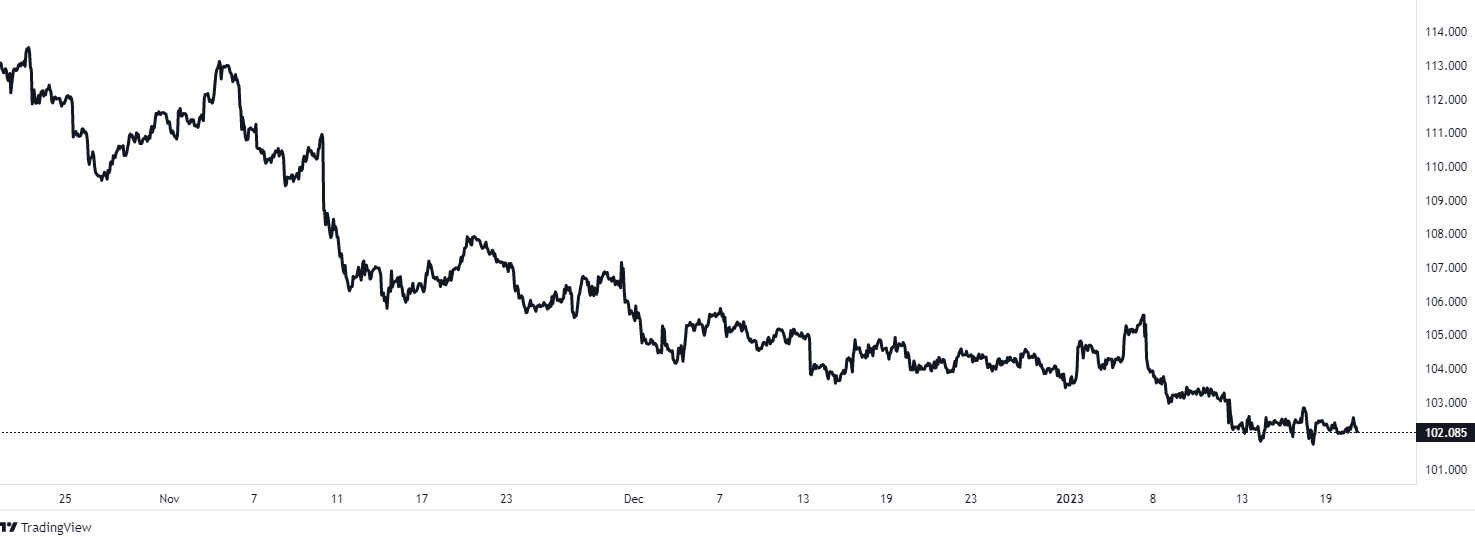

Cooling US dollar is good for Bitcoin

Another positive sign for Bitcoin price is the cooling U.S. dollar index (DXY). Historically when the DXY retracts, sentiment for risk assets like Bitcoin increases.

The S&P 500, Dow and Nasdaq provide a general overview for the economy. Currently, Bitcoin and the major stock indices share a high correlation coefficient.

Therefore if interest rates ease and the economy grows, Bitcoin could continue to rally with bullish equities markets. The better the macro climate, the better for Bitcoin price.

Related: Bitcoin crowd sentiment hit multi-month high as BTC price touches $21K

While Bitcoin price is showing some bullish momentum in the short-term after positive comments by the Fed, the larger challenges of centralized exchange insolvencies, looming crypto legislation, concerns of Binance’s reserves and potential contagion stemming from Digital Currency Group’s legal issues plus Genesis bankruptcy could place a damper on BTC’s current rally. Some analysts still believe a crash to $15,000 is possible.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Be the first to comment