Statistics show over the course of 54 days, the number of wrapped bitcoin (WBTC) hosted on the Ethereum network has decreased by 40,156. This equates to a more than 18% redemption of the circulating supply of WBTC since Nov. 27, 2022.

WBTC Remains Largest Operation in Terms of Bitcoin Custody Despite Recent Redemptions

The Bitgo-backed Wrapped Bitcoin (WBTC) project has been officially in operation since the end of January 2019 and has grown significantly since its launch. At the time of writing, it is the largest operation in terms of the number of bitcoin (BTC) custodied to back the WBTC token value.

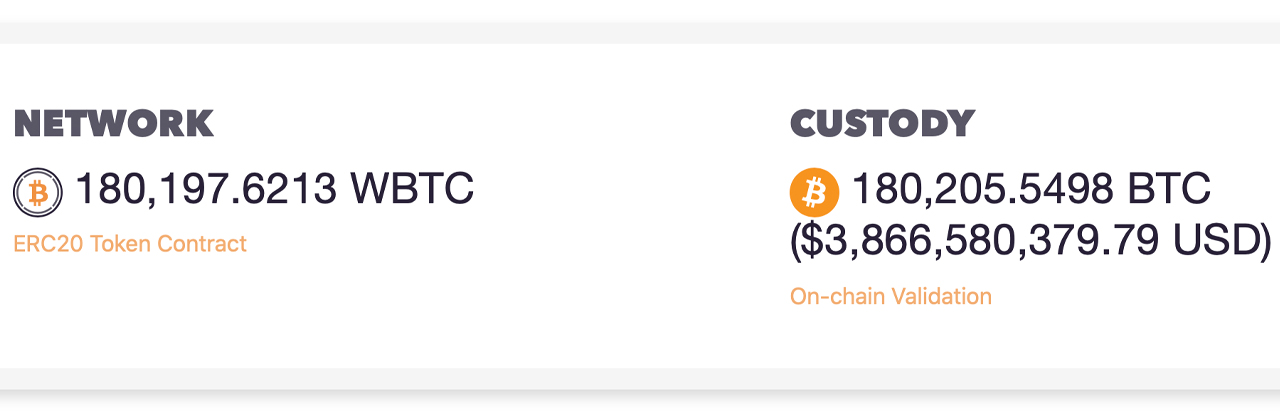

On January 20, 2023, WBTC is the 19th largest crypto asset by market capitalization, valued at $21,278 per unit. WBTC’s market valuation on Friday afternoon Eastern Time was around $3.8 billion. According to the project’s website and transparency dashboard, at 3:00 p.m. Eastern Time on Jan. 20, 2023, there were approximately 180,197 WBTC in circulation on the Ethereum chain.

The project also manages 99.89 WBTC which is hosted on the Tron blockchain network. The stash of ERC20-based WBTC tokens is substantially less than it was 54 days ago on Nov. 27, 2022, when 220,353 WBTC ($16.4K per BTC) was circulating on the Ethereum blockchain network. Ten months prior, on Feb. 26, 2022, the number of WBTC in circulation was approximately 262,662 ($39.4K per BTC).

That means over the last ten months, 31.39% of the WBTC in circulation was removed from the overall supply. More than half of that percentage, or 18.22%, of the WBTC supply was redeemed over the last 54 days, or 40,156 WBTC total, since Nov. 27, 2022.

While WBTC is the largest wrapped version of bitcoin, Lido’s staking token STETH, a derivative of Ethereum, is the largest synthetic version of a top crypto asset in terms of market capitalization. STETH, however, does operate differently than Bitgo’s management of simply holding the BTC for the given amount issued.

While there’s 180,197 WBTC in circulation today, there’s approximately 180,205 BTC backing the WBTC supply in Bitgo’s custody, according to the website’s dashboard. The supplies of wrapped or synthetic BTC tokens have followed the same trend as stablecoins, as the stablecoin economy has seen billions in redemptions over the last year.

What do you think about the WBTC project seeing an 18% redemption of the circulating supply over the last 54 days? Share your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment